Rupee's Greatest Risk in 2018 is From Rising Oil Prices

The Rupee is vulnerable to a continued rise in global oil prices given the country's dependence on oil imports, and that and a slide in growth could be a double whammy for INR in 2018.

Rising oil prices could start to become a drag on the Rupee if they continue higher in 2018, says DBS Economics.

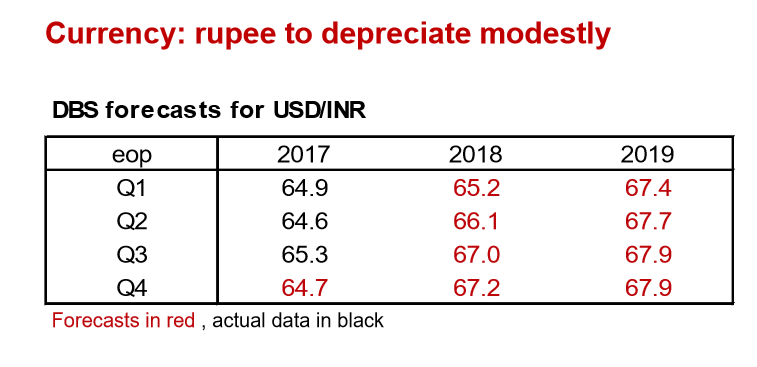

The Rupee is to "depreciate modestly" if oil prices rise further, according to a recent note from the firm.

Crude oil accounts for more than a third of India's gross imports alone, so changes in its price directly impact on the balance of trade and thereby on the broader 'current account', which is the gross balance of money going in and out of a country - from all activities - including trade, investments, remittances and transfers.

The current account is a major long-term driver of the exchange rate and imbalances in it usually begin to find redress through an appreciation or depreciation of the currency.

Put another way a current account surplus - or an excess of money entering a country tends to push up demand for a currency and it appreciates; and vice versa for a deficit.

In India's case, the fear is that the higher cost of oil will increase the current account deficit, thereby weighing on the Rupee.

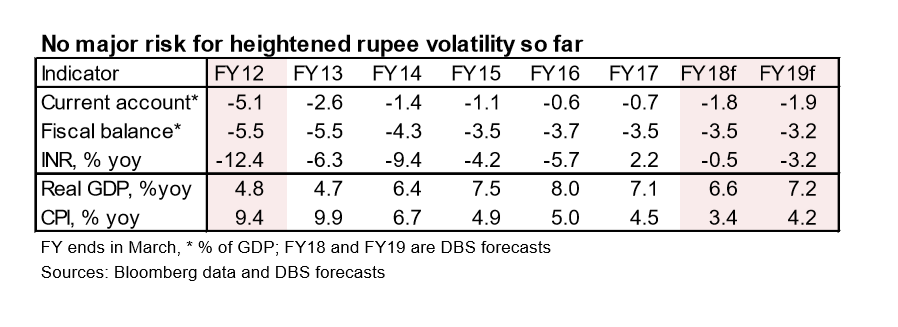

"We will, however, pencil in more depreciation (of INR) if the fiscal and current account deficits exceed their pain thresholds, currently perceived to be 3.5% and 2% of GDP, respectively," says DBS Economist for Eurozone and India Radhika Rao.

However, despite DBS forecasting that the current account deficit will widen to -1.8% in 2018, it is currently far from that wide at only -0.7% and so still no-where near the 'danger zone' for the Rupee.

Indeed the currency has actually gained by 2.2% in 2017.

Crude Sensitivity

Despite the fact, that the current account deficit remains relatively narrow it is highly susceptible to relatively small changes in the price of oil, according to DBS's Rao.

"Oil prices will be closely watched, given its potential to elevate India’s crude imports and pressure the trade deficit," says Rao.

She adds, "Our analysis shows that for every 10% increase in crude prices, the current account," deficit widens by 40bps (or 0.4%)."

Other Factors

Oil is not the only driver of the Rupee, however, and other factors are also likely to come into play - for example, the fact that the Indian Rupee is thought to be generally overvalued, and thus more likely to fall in one additional variable.

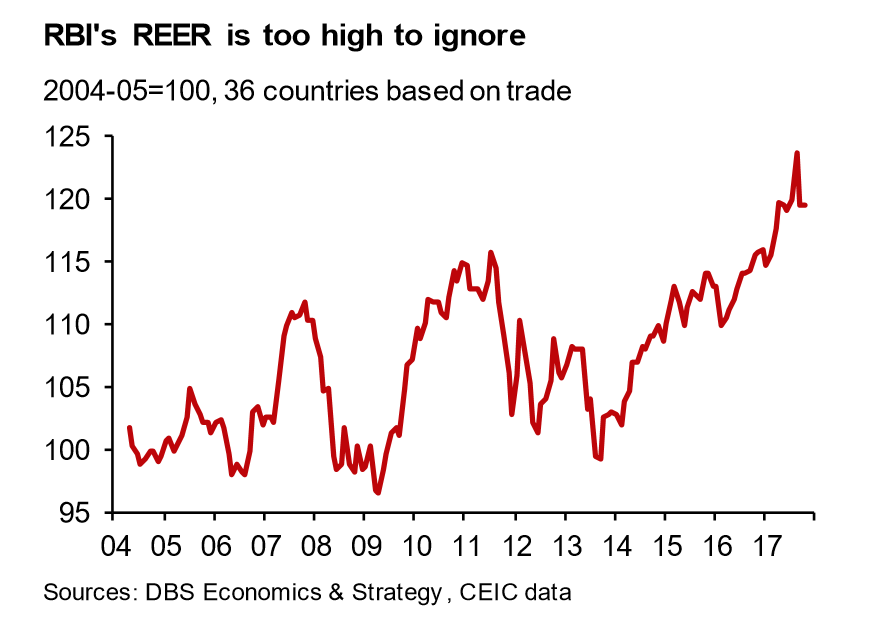

The REER, or Real Effective Exchange Rate - which is a measure of the Rupee against a trade-weighted basket of other currencies looks overbought in the chart below:

The overvaluation is also reflected in the difference between US and Indian 10-year government bond yield differentials which provide an alternative 'fair-valuation' for the currency, and are currently well above the USD/INR exchange rate when they ought to be more in tandem, thus reflecting the Rupee's excessive strength.

Reserve Bank

Another factor is comparative central bank policies in India and other countries, as these shape currency valuations too.

Indian inflation is expected to fall from 4.5% to 3.4% in 2018 and although the Reserve Bank of India (RBI) is not expected to lower interest rates to combat the slow-down (it will still be in its target range) it will almost certainly not raise interest rates.

Interest rates tend to be a major driver of currencies with higher rates drawing more foreign capital with the promise of higher returns.

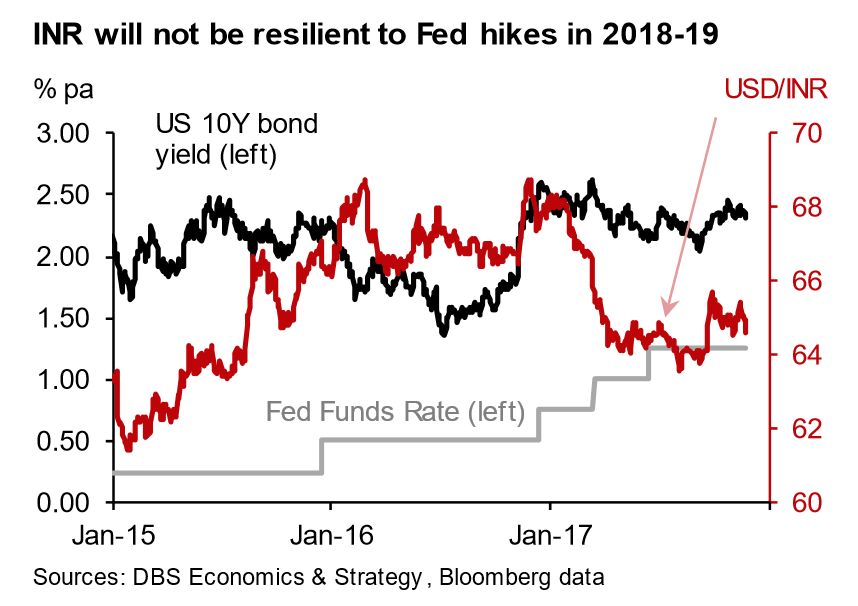

In the US and many other countries interest rates are expected to rise in 2018 as global growth picks up, and in comparison to the RBI's neutral policy, the more aggressive hiking in other jurisdictions, especially the US, is likely to lead to those currencies outperforming the Rupee.

"The Indian rupee will no longer be resilient to US interest rate hikes in the coming two years compared to 2016-17. We expect the INR to depreciate towards 67 and 68 against the USD in 2018 and 2019, respectively," says Rao.

Economic Growth

Growth is expected to slip to 6.6% in 2018 from 7.1% in 2017, and this combined with increased government spending could lead to a widening of the budget deficit, also known as the fiscal deficit, which is the difference between what the government earns in revenue and what it spends.

The reason this is important to the Rupee is that it is a good barometer of economic health, and the more healthy an economy is, the more likely investors are to transfer their money there, purchase assets from there or lend to that country.

The reason why the Rupee has risen in 2017 is probably due to the fact that the government has actually done quite a good job of reducing its fiscal deficit from -5.0% to -3.5%, by increasing revenues, modernising the economy and reigning in spending, and it was recently rewarded for its efforts by a credit rating upgrade from Moody's.

This is an extremely positive development for the Rupee, but several economists now also see dark clouds on the horizon.

"The government has been on a fiscal consolidation path since FY12/13; the deficit was lowered from over 5% of GDP to 3.5% of GDP in FY17. Plans to trim it to 3.2% this year will be challenging due to weak non-tax revenues, high oil prices, and the need for government spending support," says Rao.

She is not the only one.

A recent note from RBC Capital Markets Head of Asia FX Strategy Sue Trinh makes a similar point, with similarly negative consequences for the Rupee:

"Consolidation has seen the budget deficit narrow from 6.1% of GDP in 2012 to 3.5%. But there is now a real possibility that India misses its target of 3.2% in 2017/18 and 3% in 2018/19 due to farm loan waivers by some States, potential stimulus measures by the Central Government ahead of 2019 elections such as the bank recapitalisation plan and rising oil prices."

Geopolitical Risk

One final negative driver for the Rupee in 2018 could be geopolitical risk.

Problems in the middle east could impact on the price of oil and also the large amount of remittances from Indian workers based in the Gulf States.

"With regards to geopolitical risks next year, an escalation in tensions in the Middle East will be negative for the currency. Apart from higher oil prices, the region is the top source of the country’s remittances. As for North Korea, any military conflict with the US will pummel Asian equities and currencies including the INR."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.