Pound-Rupee Bias Still Bearish Longer-Term, Range Seen Holding Near-Term

Image © Adobe Stock

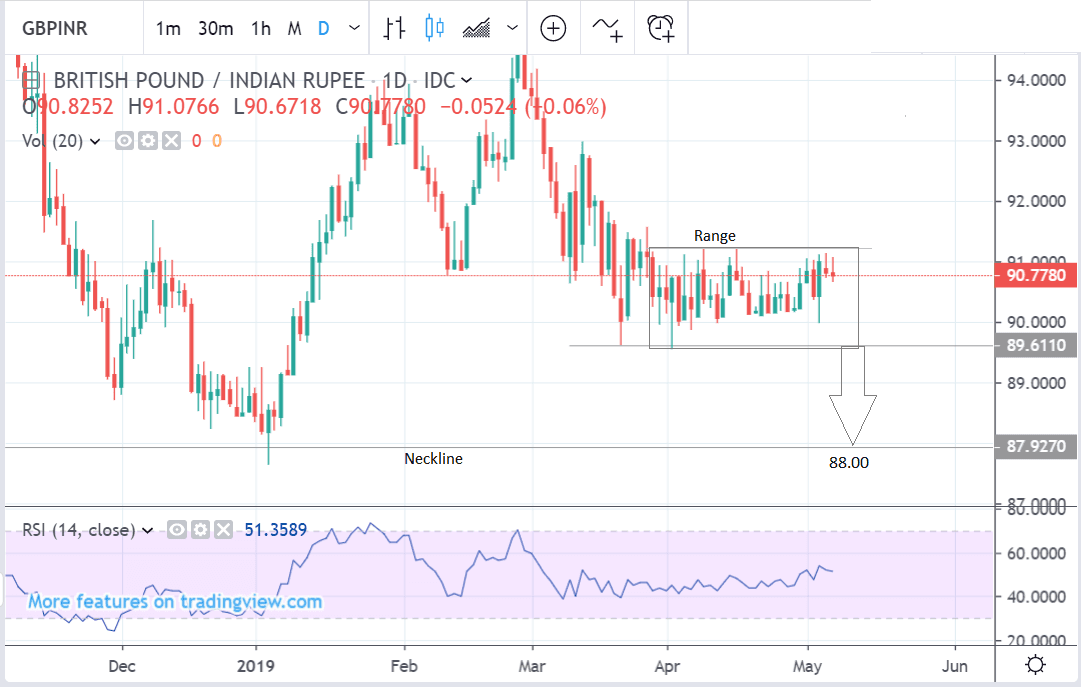

- GBP/INR still trading in narrow range short-term

- Break below 88.00 ‘neckline’ key to extension lower

- Cross-party Brexit talks to dominate Sterling; Oil prices the Rupee

The Pound-to-Rupee exchange rate is trading at 90.59 at the time of writing, down almost half a percent from the previous week.

The technical outlook is neutral in the short-term and bearish in the medium-term, conditional on a break below 88.00.

The pair is still range trading on the daily chart - but ranging within a broader downtrend. Given how long the pair has been going sideways there is a heightened risk of a high volatility breakout when the exchange rate finally exits its range.

Before the pair started going sideways it declined during March and this suggests a marginal bias to more downside once the range has finished; more weakness is favoured, therefore.

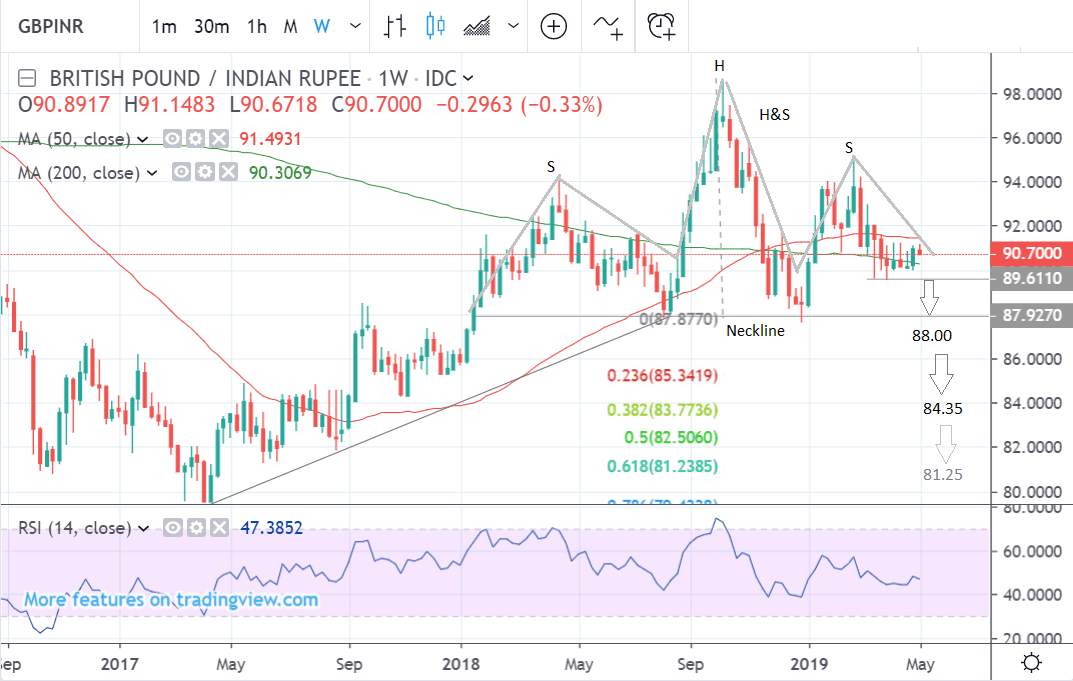

From a technical perspective, the bearish outlook is supported by a large head and shoulders (H&S) reversal pattern on the weekly chart.

The H&S is composed of three peaks, the central one of which is ‘the head’ (in the middle) with two slightly lower peaks either side: ‘the shoulders’. The neckline connects the intervening trough lows and is used as a confirmation level. If the exchange rate breaks below the neckline it confirms more downside.

The neckline on GBP/INR is at around 87.75-88.00. It could give the go-ahead for a deeper decline down to a target at roughly 84.25, at the level of the 200-month MA, a key support level for the pair. There is a possibility of a further decline to another target that is even lower at 81.25, which is based on a percentage of the height of the pattern extrapolated lower.

The exchange rate has not yet reached the neckline, and is currently being supported by the 200-week MA. This would first have to be broken before expecting more downside.

A clear break below the 89.60 March 21 lows, however, would confirm clearance and open the way down to the next target at 88.00. A break below that would then provide the go-ahead for deeper declines.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement