Ramsden Steadies Pound Sterling by Signalling a Readiness to Raise Interest Rates

Image © Bank of England

The British Pound heads into the final session of the week on foreign exchange markets looking more solid, considering the notable fluctuations suffered over the past 24 hours prompted by developments on the Brexit front.

Market analysts are crediting the words of Bank of England Monetary Policy Committee Member David Ramsden for the improved situation.

Sterling is currently being bucked by Brexit on one hand, and expectations for Bank of England monetary policy on the other.

The fluctuations witnessed in the currency over the past 24 hours were a response to the cabinet squabbles concerning the question of the Irish border and a customs backstop plan - all readers need to know is that the issue has been settled and after falling Sterling also settled. A more detailed view is offered here.

Readers also need to keep in mind that Sterling is now more attuned to Brexit headlines, having ignored them for much of 2018. Therefore, much could change on Brexit headlines which might pop up over the course of today and coming days.

But at least on the Bank of England front, there have been some supportive developments for Sterling.

In an address to the Barclays Inflation Conference in London, Ramsden says he believes the UK economy to be improving, and markets have taken his views as potentially signifying a GBP-supportive rate hike will come from Threadneedle Street in August.

"Positive comments on the UK economy from BoE’s Dave Ramsden, however, saw the GBP erase most of the earlier losses. He said that the early signs are that the UK economy is bouncing back in the second quarter and a period of "unusually subdued" wage growth is coming to an end," says Quek Ser Leang at UOB.

At the time of writing the Pound-to-Euro exchange rate has overturned previous losses to be quoted at 1.1391 which places it more-or-less in the middle of its longer-term range. The Pound-to-Dollar exchange rate is holding onto its weekly gain at 1.3416 having been as low a low as 1.3294 this week.

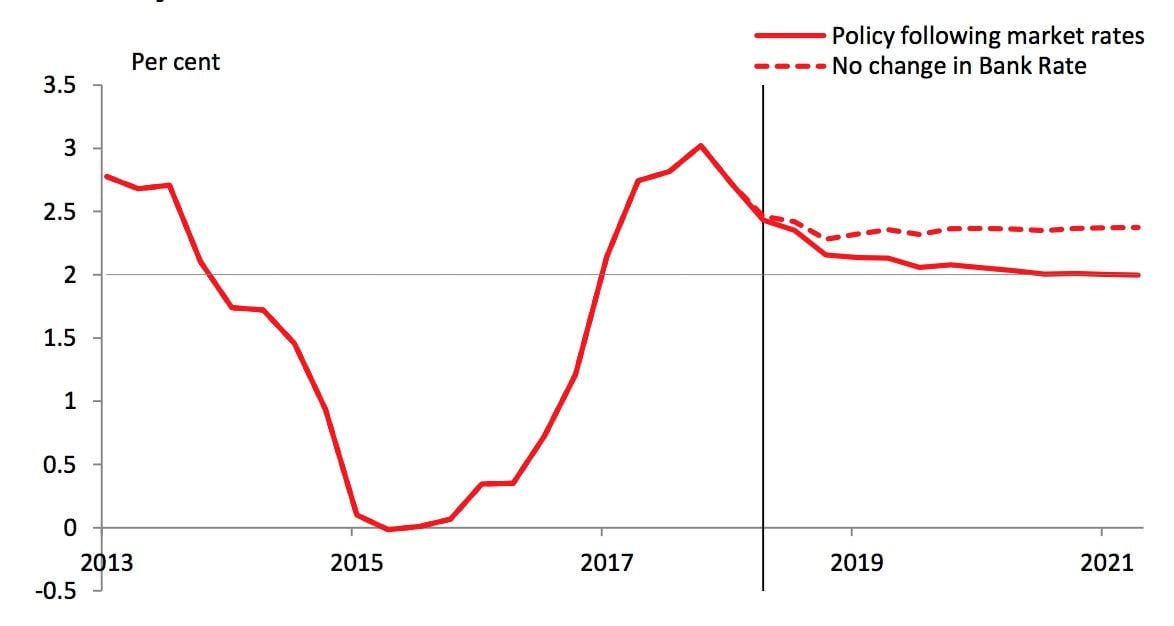

Ramsden expressed concerns that UK inflation might hover around 2.4% through to 2021 should there be no change in interest rates at the Bank of England.

"This does not seem a desirable outcome," says Ramsden, who indicates that he has now signed up to the MPC's collective judgment that “were the economy to develop broadly in line with the May Inflation Report projections, an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to its target at a conventional horizon”.

In short, Ramsden will offer his vote to raise interest rates in the near future which is significant considering he has occupied the more 'dovish' end of the MPC spectrum.

"Ramsden's views seem in line with the consensus on the MPC, suggesting he has become less dovish since voting against raising Bank Rate in November 2017," says Samuel Tombs, an economist with Pantheon Macroeconomics.

Should upcoming UK economic data point to an ongoing recovery, we would expect the Bank to raise rates in August. This should protect Sterling from any excessive downside relating to Brexit we believe.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.