Pound Boosted by Rare Brexit Win, Dollar Weakness is Key FX Market Concern

- Pound-to-Euro exchange rate today: 1 GBP = 1.1272 EUR, high = 1.1280, low = 1.1257

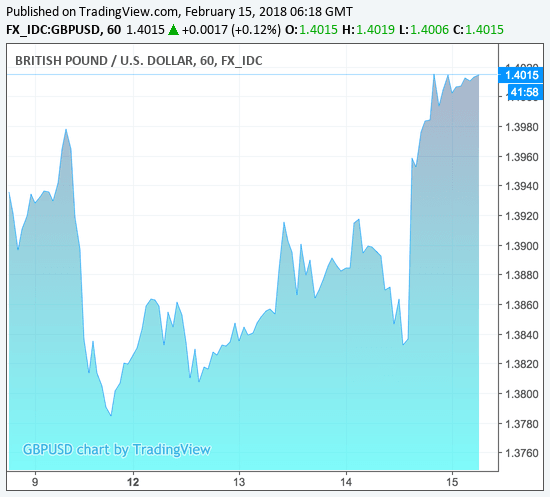

- Pound-to-Dollar exchange rate today: 1 GBP = 1.4128 USD, high = 1.4144, low = 1.4098

Above: Chief EU Brexit negotiator Michel Barnier and European Council President Donald Tusk (C) European Council

Sterling is firm on news the European Union has dropped a draft negotiating clause that antagonised British counterparts ensuring the prospect of a transitional deal being reached remains likely.

Brexit headlines and global market dynamics continue to dominate Pound Sterling exchange rate movements ahead of the weekend.

Sterling is once again trading back above 1.41 against the US Dollar following a broad-based dip in the US Dollar which has in been put down to a swing in market sentiment that favours risk assets and growing fears that stagflation looms in the United States - something we look at in a little more detail lower down in this piece.

However, positive Pound-specific developments are also notable, with news emerging that European Union negotiators have dropped a 'punishment clause' from their guidelines pertaining to the transitional Brexit period that is currently under negotiation.

A footnote published by the European Commission last week suggested that the UK would lose access to elements of the European single market if it broke EU rules during the transition period.

The news antagonised various elements of the British Government and commentators while also providing fresh angst to the British Pound as traders bet the development helped raise the prospect of the two sides failing to agree on a transitional deal.

In a rare win for the UK, it appears EU officials have now promised new wording that makes reference to the EU's standard infringement procedures.

This is undeniably good news for Sterling as it moves the process forward and will likely entice further concession from the UK. "We stay in favour of buying GBP dips. Even though Brexit related uncertainty remains intact, more supported central bank rate expectations should prove the GBP’s predominant driver," says foreign exchange analyst Manuel Oliveri at Crédit Agricole.

Indeed, we heard yesterday from the UK's Foreign Secretary Borish Johnson that the UK would likely abide by EU rules during a transitional period which suggests a broad-based unity in what has been at times a fractious Cabinet for agreeing a transitional period as soon as possible.

Johnson's speech to the Policy Exchange think-tank is the first in a series of speeches due from the Government as they aim to set out their position as we move through the next stages of Brexit negotiations. We urge readers to keep abreast these developments as any surprises from ministers could shake the Pound, either higher or lower.

The reaching of a transitional deal is the single most important issue for the Pound in 2018 we believe as it will govern the outlook for the UK and EU relationship for the next two years and will almost certainly ensure the Brexit process runs smoothly.

The news should prove supportive for the Pound-to-Euro exchange rate which is likely to hold ground in the middle of a long-term range centred around the 1.1350 level.

"A choppy holding pattern effectively persists either side of 1.1350 with market attention focused elsewhere for the most part," says Trevor Charsley, an analyst with currency brokers AFEX.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

The Dollar's Woes Remain Dominant Theme in Global FX Markets

However, the Pound could find itself a passenger to global developments over coming days, if recent price action is anything to go by.

It has been a spectacular, if confusing, period of play for the Pound against the US Dollar as traders chop and change what they deem to be the overarching theme in global financial markets right now.

The Pound-to-Dollar exchange rate, which had been trading at 1.3895 prior to the release of US inflation data, fell to lows of 1.3800 following the release. Yet, as we head into the European open, the Pound-Dollar exchange rate is now back above 1.40!

According to the Bureau of Labour Statistics, January inflation data showed headline inflation rose by 2.1% compared to the same time in 2017, which was higher than the 1.9% analysts had forecast.

The result was all the more surprising because of the high oil prices in January a year ago which was seen as difficult to beat this January. Following the result, the Dollar rose against the Pound and Euro as higher inflation raised expectations of a quickening in interest rate rises from the Federal Reserve, the body tasked with managing inflation.

Higher interest rates, in turn, are a driver of the Dollar as they attract greater flows of foreign capital drawn by the prospect of higher returns. The Dollar's initial reaction to go higher was therefore textbook in nature. So why then the sudden reversal of fortunes?

Emmanuel Ng, a foreign exchange analyst with OCBC Bank in Singapore tells us that the broader market narrative is important in considering the Dollar reaction: "despite warmer than expected US Jan CPI readings (headline and core), the dollar wiped out against the majors on Wednesday despite an earlier blip higher. With investors instead focusing on risk appetite dynamics, the DXY eventually crashed and slipped below 89.00 to an 88.94 low."

The DXY is the Dollar index - a measure of broadbased Dollar strength based on its performance against a basket of currencies.

"A sharp bounce in global equities (including EM equities) and commodities plus firmer UST and most other core government bond curves we think may have continued to power positive risk appetite mechanics, continuing to put the greenback at a disadvantage," says Ng, adding:

"GBP/USD managed to surface above 1.4000 in the face of broad Dollar bearishness on Wednesday. Despite slightly capped short term implied valuations, a supported range may continue to prevail with key support expected into 1.3900."

However, there could be more sinister reasons behind the Dollar's ongoing woes with a number of analysts starting to argue that the US economy is entering the end of a cyclical upturn and a slowdown lies ahead.

"The spectre of stagflation is haunting the markets. US industrial production was revised down sharply for December and actually fell in January, contrary to expectations, as did capacity untilization," says analyst Marshall Gittler at ACLS Global.

Meanwhile, following Wednesday’s higher-than-expected CPI data, Thursday’s PPI also beat expectations, while the prices paid indices for the two Fed indices out yesterday – Empire State and Philadelphia Fed – both jumped.

"So we have output stagnating or even falling, while inflation accelerates," says Gittler. "This mix can be deadly for the markets ... sell USD sentiment seems to be the order of the day."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.