Pound Sterling Jumps as Bank of England Surprises with Hint of November 2017 Interest Rate Rise

- FX Snapshot at time of initial publication:

- The Pound-to-Euro exchange rate is at 1.1246, up 1.19%

- The Pound-to-Dollar exchange rate is at 1.3357, up 1.11%

The British Pound has risen against most major currencies as the Bank of England warn the market is underpricing expectations for future interest rate rises and exposing the Pound as being too cheap in the process.

The Pound is easily the best-performing global currency of the day thus far having risen sharply in reaction to the latest policy update from the Bank of England.

The rise comes despite the 7-2 breakdown in the composition of the vote to keep interest rates unchanged at 0.25%.

Markets were looking for a 6-3 breakdown as a signal that the Bank was leaning towards raising rates in reaction to the recent spike in inflation.

The vote composition is in itself therefore a GBP-negative outcome and Sterling dipped on the headline.

But in the accompanying minutes, the Bank warned that the market was complacent regarding the speed at which future interest rate rises would need to be delivered.

The Pound jumped in response as currencies tend to rise into cycles of interest rate rises.

The minutes warned interest rates, "could need to be tightened by a somewhat greater extent over the forecast period than current market expectations," adding, "some withdrawal of monetary stimulus is likely to be appropriate over the coming months in order to return inflation sustainably to target".

Those readers who read our our preview piece here would have seen this coming - the Bank is looking to deal with the market's complacency on future rates to ensure long-term stability.

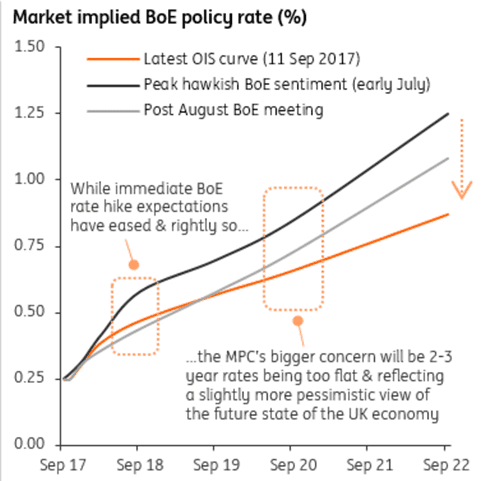

Above: Analysts at ING warned going into the event that markets were complacent about the pace of future interest rate rises.

This complacency is problematic as when the Bank does start raising rates the sudden adjustment could destabilise markets and the economy.

"After recent warnings that markets were under-priced for potential interest rate hikes, the MPC appears close to following through and tightening its policy in response to above-target inflation. Going into the meeting, UK short rate curves were very flat and the trade-weighted pound was sitting not that far off its post-referendum lows. Today’s hawkish outcome has the potential to spark upward revisions in market pricing for both,” says Timothy Graf, Head of Macro Strategy at State Street Global Markets.

State Street see the Bank's actions as effectively being 'jawboning' - they are happy to talk but are unlikely to raise rates instead deploying a "gambit of using hawkish signalling to encourage the market to dampen inflation expectations on its behalf."

But others analysts are not so sure, and believe the Bank might just act to shore up the credibility of its communication and the prospects of an interest rate rise coming as soon as November have grown.

"As widely expected the Bank of England left its bank rate and stock of bonds unchanged. But the majority of the committee saw a withdrawal of stimulus appropriate in the coming months," says Andreas Wallström at Noredea Markets.

Nordea warn that an interest rate rise could come as soon as November.

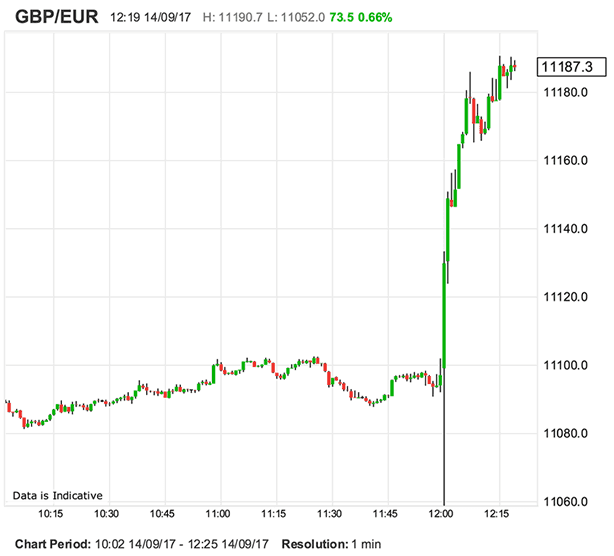

Above: Feel the burn; pitty the traders who have been stopped out of the market but the immediate plunge on news of the 7-2 vote composition and the subsequent rally when all the information was taken in.

The team at Capital Economics have responded to the outcome of today's event saying the tone of the minutes supports their "long-held view that market expectations had gone way too far in expecting rates to remain on hold until 2019."

Recall, it is Capital Economics who are forecasting a decent recovery in Sterling into 2018 on the view that markets have been far too complacent on the viability of the pervasive negative stance towards the UK economy, Bank of England policy and Sterling.

"If the economy continues to hold up, and there are clearer signs that wage growth is building, then the first hike could some somewhat earlier than we had previously envisaged, possibly as soon as the next meeting in November alongside the Inflation Report," says Paul Hollingsworth, UK Economist at Capital Economics.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Outlook for the Pound: More Constructive

Concerning the currency's outlook, this week's surge firms the shift into a more positive footing for Sterling against most pairs.

We would look for the market to follow through with the move and perhaps puts a floor under recent weakness.

Ah, the parity call on EUR/GBP - wondering if these are the same people who called for parity on EUR/USD? Asking for a friend.

— Michael Hewson ???????? (@mhewson_CMC) August 15, 2017

ING Bank believe that should the Pound-to-Euro exchange rate sustain levels above 1.11, then the likelihood of parity being achived is greatly reduced. 1.11 has long-been a key support level for Sterling below which it rarely spends time on a long-term basis.

TD Securities believe the outcome that was delivered by the Bank should see the GBP/USD exchange rate rally to 1.3370 and the GBP/EUR exchange rate fall to 1.12.

All of these above targets have been hit at the time of writing; we could however see gains pared back over subsequent hours.

"While a rate hike may still not be imminent, it nonetheless suggests that the BoE has made a hawkish pivot and that monetary policy risks are much more fluid than before. As such, the backdrop for GBP is starting to become a little more constructive though investors need to be nimble as Brexit risks remain," says Richard Kelly, Head of Global Strategy at TD Securities.

"The Pound has bounced upwards on this news, hitting $1.33 against US Dollar and €1.12 against the Euro – and still moving on up… Now’s a good time to make the most of this sudden Sterling strength,” says Denzil Rickerby, Corporate FX Dealer at Halo Financial.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.