Pound Reacts to Inflation Beat

- Written by: Gary Howes

Image © Pound Sterling Live

Pound sterling flickered higher after inflation data came in on the hot side. However, the currency will prove preoccupied with global events today.

UK CPI inflation rose from 3.2% y/y in November to 3.4% in December, beating expectations for 3.3%.

The beat on expectations should, all else equal, be supportive of the pound as it lowers the odds of a second interest rate cut at the Bank of England this year.

The rise was driven by a 0.4% m/m increase in prices, up from -0.2% in November.

Core CPI was unchanged at 3.2% y/y, which was slightly softer than the 3.3% expected.

Services inflation, which is closely watched by the Bank of England, rose to 4.5% from 4.4%, even if this was slightly lower than expectations.

These data mean the Bank will be cautious in considering future interest rate cuts, even as job losses start to mount.

The GBP/EUR exchange rate - which has been under pressure over recent hours owing to a deterioration in market sentiment - rose to 1.1490 from 1.1460.

The GBP/USD was relatively unchanged at 1.3435.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sterling's sanguine market reaction tells us there's nothing in the data to materially alter the Bank of England's interest rate path: There is enough concern about the jobs market to get another cut across the line by April.

However, inflation is still looking stubborn at these above-target levels. The split on the Bank's Monetary Policy Committee isn't likely to close, and this will ensure there's enough debate for the Bank to remain cautious.

"Core CPI broke a run of three consecutive months of MoM misses to the downside. A further miss could have made for an interesting MPC meeting on 5th Feb - but as it stands the market looks about right in pricing just a 5% chance of a 25bp cut," says economist Simon French at Panmure Liberum.

However, Kallum Pickering, economist at Peel Hunt, says "don’t sweat the UK inflation uptick, it won’t last."

He explains the December jump in the headline number was driven by erratic components such as tobacco duty and airfares.

"Importantly, measures of underlying price pressures offered comfort against the headline jump. Growth in core prices, which exclude energy, food, alcohol and tobacco, remained stable," he says.

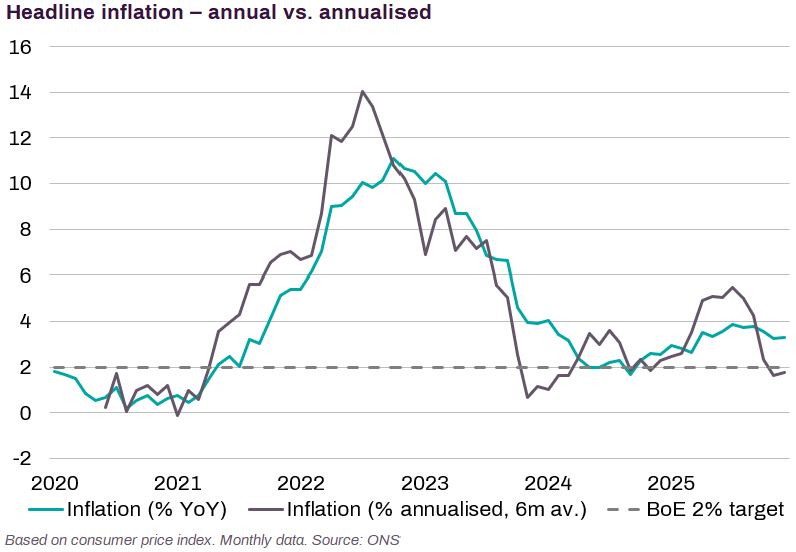

Image courtesy of Peel Hunt. It shows that on an annualised basis, inflation is back to target.

On balance, the tick higher in prices should ensure UK bond yields remain supported, which can support the pound.

From a near-term perspective, however, the currency market will take its cues from geopolitics and headlines out of Davos concerning the EU-U.S. confrontation over Greenland.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.