Improved Market Mood Helps Pound Sterling off Lows against Euro, Dollar

- Written by: Gary Howes

- GBP recovers some recent losses

- Stable stock markets help

- But outlook still negative

- With U.S. stocks likely to fall further

- In turn weighing on GBP

Image © Adobe Images

Pound Sterling recovers some of the big losses that followed the shock PMI release on Tuesday and is offering a brief period of respite for those looking to sell the UK currency, however analysts remain cautious on the outlook.

The Pound rose against the Euro, Dollar and other currencies as discount hunters put in bids into the Thursday session, emboldened by rising global stock markets that indicated an improved investor sentiment.

"The market mood in general is slightly more positive," says George Vessey, an analyst at Western Union Business Solutions. "Sterling being a risk-sensitive currency is benefiting from this sentiment as well."

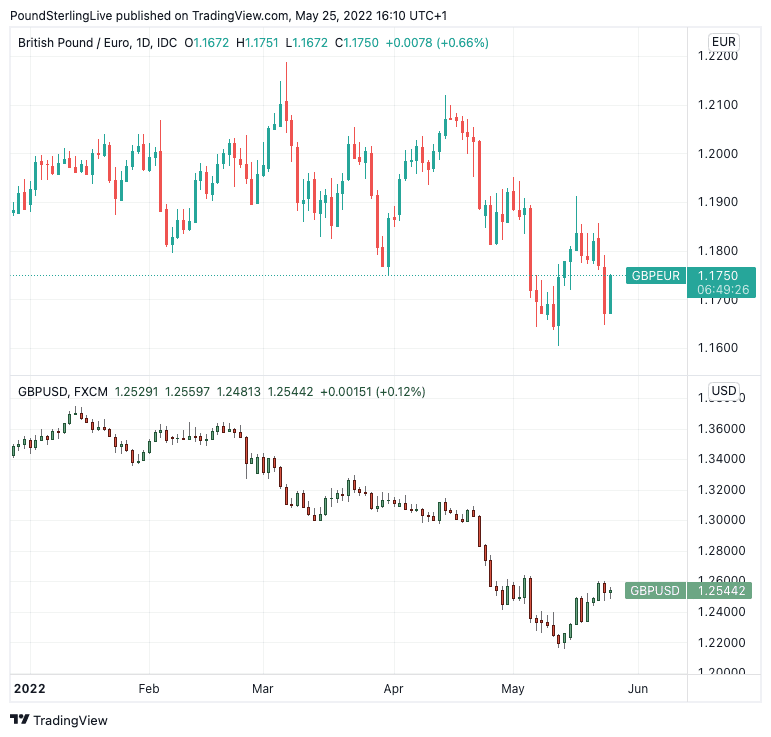

The Pound to Euro exchange rate fell a sizeable 0.83% following the release of worse than expected PMI data for May on Tuesday but has recovered back above 1.17 to quote at 1.1765 on Thursday.

The Pound to Dollar exchange rate fell 0.45% in the wake of the data but appears to be tentatively holding above 1.2567, helped in part by the release of U.S. Federal Reserve meeting minutes overnight.

"We expect GBP to recover should markets remain in a risk on mood," says Thanim Islam, Dealing Manager at Equals Money.

Above: GBP/EUR (top) and GBP/USD (bottom) are trending lower.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

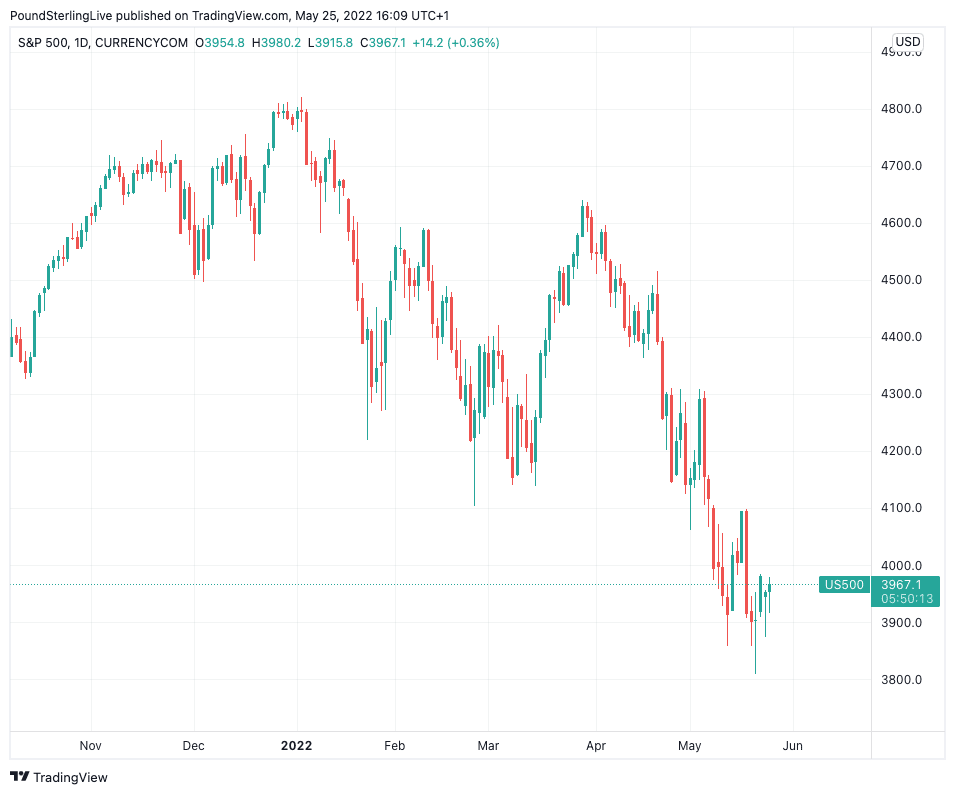

Although markets moved in Sterling's favour through the midweek session there are signs that the overall trend remains lower for stocks, which means rallies are likely to remain shallow in nature.

A broader move lower in stocks is primarily linked to the ongoing hike in interest rates at the U.S. Federal Reserve: rising interest rates means the cost of borrowing rises and there is less liquidity available to find its way into investment assets.

Stock markets traditionally struggle during rate hike cycles and a more prominent turnaround in stocks might only be possible when the end of the cycle comes into view.

Analysts at Goldman Sachs have recently put out research showing that stocks will struggle to recover until investors get a sense of when the Fed will stop raising interest rates.

"In monetary-policy-driven corrections, the market has on average tended to bottom when the Fed has shifted towards easing, regardless of whether economic activity has troughed," says economist Vickie Chang at Goldman Sachs.

Above: The bellwether S&P 500 index remains firmly in downtrend territory.

Bob Farrell, one of the pioneers of technical analysis who worked at Merrill Lynch for over 45 years, developed some compelling rules that could serve us well now.

He said bear markets have three stages: a sharp decline, followed by a reflex rebound and then a drawn-out fundamental downtrend.

Farrell is retired but his protégé at Bank of America Merrill Lynch, Stephen Suttmeier, says we are likely in the third stage of the bear market, with risks the S&P 500 moves to 3800 (20% correction) and even 3500 (27%).

"Cyclical bear markets within secular bull markets tend to mean-revert toward the rising 200-week moving average on the S&P 500, a key 2022 support near 3500," says Suttmeier.

Goldman Sachs' Chang says in order for equities to come off their recent lows and stop declining the market must become more confident that financial conditions tightening has been sufficient and that the Fed has delivered and signalled enough tightening.

Therefore the overall outlook for Sterling could well depend on the trajectory of Federal Reserve decision making in the United States.

Domestic factors also mean the outlook for the Pound remains challenging; "high inflation, a too-cautious Bank of England, and global risk aversion could see further GBP weakness," says Bilal Hafeez, Head of Research at Macro Hive.

Macro Hive expects the Bank of England to press the pause button on its interest rate hiking cycle in August to reassess slowing economic growth, depriving Sterling of support typically provided by rising central bank interest rates.

"A relatively more dovish BoE could see further weakness in GBP," says Hafeez.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Even the European Central Bank is sending more 'hawkish' signals following this week's warning from President Christine Lagarde that rates would rise in July and again in August.

"As the market reacts to Christine Lagarde's ECB Policy roadmap, it's much easier to see sterling as the weakest currency in Europe," says Kit Juckes, Head of FX Research at Société Générale.

Analysts at JP Morgan meanwhile say the UK is trapped in a stagflationary vortex that will see inflation rise sharply in the near-term and economic growth fall to "a borderline recession".

"To describe this combination of double-digit inflation and zero growth as toxic for the exchange rate would be an under-statement," says Paul Meggyesi, Head of Global FX Strategy at JP Morgan in London.

"We are making pretty deep cuts to our GBP forecasts once again this month," he adds.

JP Morgan lowers its one-year GBP/USD target from 1.31 to 1.16 with a trough predicted in the third quarter of 2022 when the pair falls to 1.14.

EUR/GBP forecasts are meanwhile raised to reflect a "negative relative cyclical outlook" for the UK.

The bank's one-year forecast is lifted to 0.88 from 0.84, the third quarter forecast is also set at 0.88. EUR/GBP at 0.88 gives a GBP/EUR exchange rate of 1.1363.

"The UK’s status as the posterchild for stagflation is imbedded in the upward revision to the EUR/GBP forecast," says Meggyesi.