Big Bid for the Pound

- Written by: Gary Howes

Image © Adobe Images

A strong impulse of buying through the late midweek session tee's up the British Pound at higher levels on Thursday April 14.

Pound exchange rates rose broadly in the late London session, with gains holding through New York and Asia on Thursday, suggesting the demand has held.

The flows behind the move higher in Sterling were not obvious but demand could have been prompted by a central bank or number of central banks.

The Pound to Dollar exchange rate rose by nearly a percent to trade back above 1.31 and is at 1.3180 at the time of writing, meanwhile the Pound to Euro exchange rate rose to a weekly high on Thursday at 1.2053. (Set your FX rate alert here).

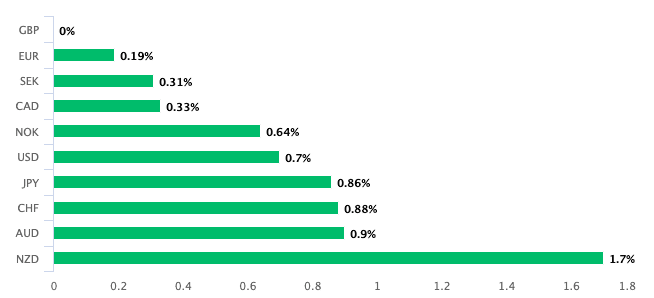

Above: GBP outperformed all peers on April 13.

It is worth considering Sterling's gains came as the all-important bond market seems to have evolved in its favour of late.

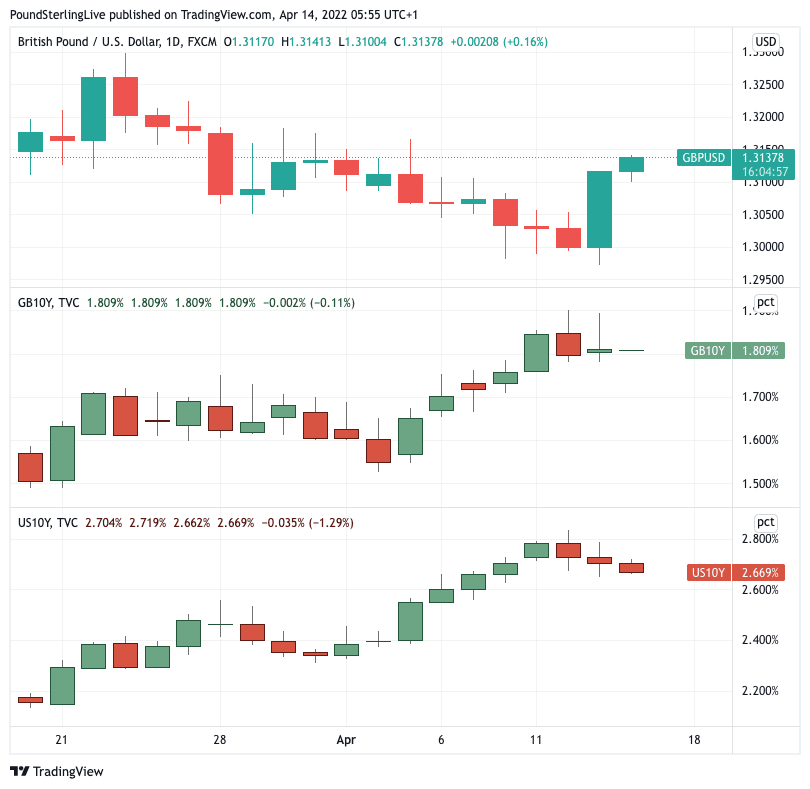

U.S. ten-year bond yields fell 0.84% yesterday while the UK's equivalent actually gained by the same amount, creating a convergence that would be expected to benefit Sterling:

Above: GBP rose (top) pane, on the day UK ten year yields held ground (middle), but U.S. yields fell (lower pane).

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The GBP-USD flexed against 1.3000 before rebounding above 1.3100," says strategist Terence Wu at OCBC in Singapore.

Germany's ten-year bond yield meanwhile fell 2.75% and this could explain some of the Euro's weakness relative to the Pound.

UK bond yields have held ground as investors price in further interest rate rises from the Bank of England in the face of surging inflation.

Inflation data for March released on April 13 shows all components of UK inflation are rising sharply, suggesting the Bank has little option but to keep raising rates.

Economists meanwhile say the U.S. economy might be witnessing peak inflation levels, which could lso mean the peak in expectations for Federal Reserve interest rate hikes is also near, as is the top in the Dollar.

"The US dollar has been slipping since NY trading yesterday as the market dials back Fed rate hike expectations on the view that CPI inflation pressures may be peaking," says Alvin Tan, Asia FX Strategist at RBC Capital Markets.

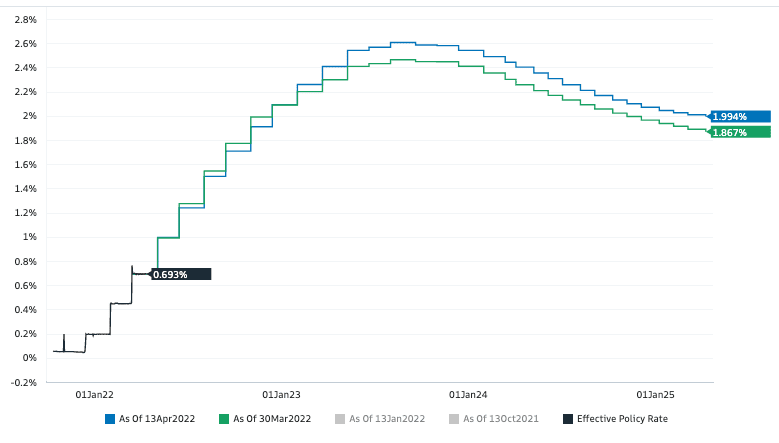

The UK's rate curve has actually risen of late as the number of interest rate hikes expected from the Bank rises; whereas we note the equivalent curve for the U.S. has not, which again implies some benefit to Sterling:

Above: The market's expectations for the future levels of Bank Rate at the Bank of England, according to OIS markets. Image courtesy of Goldman Sachs.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

This uptick in expectations for future Bank of England rate hikes could be offering the Pound support, although analysts warn surging inflation could stall the UK economy's growth in the second and third quarters, which is hardly supportive of Sterling on a multi-month basis.

Yet it is hard to discern the exact source of the demand for the Pound at this time and it is therefore difficult to call near-term direction; those readers looking to sell Sterling should consider booking in a portion of your requirement at current levels, given there is no guarantee the move can stick.

"Overall, we choose not to over-interpret the overnight USD dip, which could be an attempt to de-risk and profit-take ahead of the long weekend. The underlying fundamentals continue to favour the USD," says Wu.

Today market focus is on the European Central Bank, where investors looking for clues as to where interest rates are heading.

The market now expects the ECB to raise interest rates by at least 68 basis points in 2022 due to surging inflation, which implies at least two 25 bps hikes.

No explicit guidance is expected from the ECB, but the tone of the Bank's guidance will be crucial in determining where the Pound-Euro exchange rate moves.

"While unlikely to deliver any true policy action, the April ECB meeting could see President Lagarde giving some colour about the different policy options," says Francesco Pesole, FX Strategist at ING Bank. "We do not expect the ECB to deliver a hawkish enough statement to offset the unsupportive external environment and valuation of the euro."

If correct, the Pound-Euro rate would be expected to hold its recent gains above 1.20.