Budget 2021 Brings Potential Risks for Pound Sterling as Rally against Euro and Dollar Stalls

Image © HM Treasury, Gov.uk

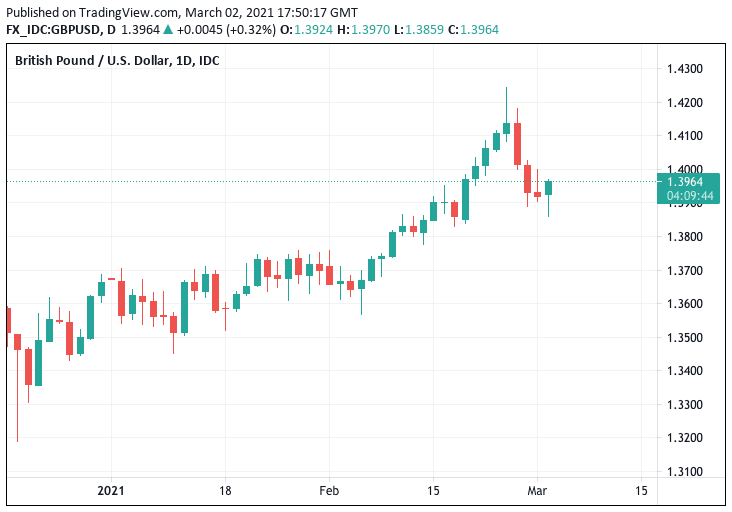

- Market rates at publication: GBP/EUR: 1.1565 | GBP/USD: 1.3969

- Bank transfer rates: 1.1338 | 1.3678

- Specialist transfer rates: 1.1498 | 1.3871

- More about bank-beating exchange rates, here

- Set an exchange rate alert, here

The near-term highlight for the British Pound over coming hours is the 2021 budget, due to be revealed by Chancellor of the Exchequer Rishi Sunak on Wednesday.

Sunak is widely tipped to extend support for businesses and individuals until covid-19 restrictions are to be eased in full, but the positive fiscal signal could be tainted by tax rises which act as a headwind to the recovery not only of the economy but the currency.

Sunak has signalled a need to keep the budget under control and of the need for "tough decisions" to do so, but given his party's numerous manifesto commitments on taxing and spending there are relatively few areas where the government can turn to raise additional revenue.

UK businesses - which are currently operating in a contracting economy - have been identified as being where the burden of paying for the pandemic should fall.

"Talk of tax increases is likely unnerving GBP investors too as a shift in fiscal strategy too soon could create an unnecessary headwind for the recovery," says George Vessey, a foreign exchange analyst at Western Union Business Solutions.

Above: GBP's rally has faded heading into Budget 2021

For the Pound a bullish scenario would see the government continue to provide generous support to the economy to reinforce the recovery, a downside scenario is an overly zealous attempt to balance the book that ultimately stifles growth.

Roger Bootle - founder of Capital Economics - says the biggest risk of hiking corporation taxes is that it hits business confidence. It is business confidence that will drive the recovery and ensure jobs are not only saved but created over coming months and years.

It is estimated that three million small and micro businesses have received no direct government support, and they are identified as being particularly at risk of corporation tax rises.

"There is pressure to reveal the plans for how all this support will be paid for, and there is speculation for a potential pathway to increase corporation tax form 19% to perhaps 25%. There is significant resistance to these moves both from Tories and Keir Starmer, as they are seen as short term in their outlook, and may drive business owners overseas, particularly if CGT is raised eventually," says Joe Tuckey, Analyst at Argentex.

The Pound might struggle should the Chancellor deliver a contractionary budget that is remembered for tax hikes.

Foreign exchange strategists at TD Securities warn that withdrawing fiscal support prematurely could prove problematic for Sterling.

"While the UK's fiscal support measures will be extended, it is also clear those days are numbered. We want to see how strong that messaging is today, as fiscal retrenchment would mark a significant divergence from other major G10 economies — the US in particular," says Mark McCormick, a strategist with TD Securities.

"The combination of very loose monetary policy and tighter fiscal settings tends to be a toxic one for a currency. Especially, we would argue, if that currency is doing so on its own. This could expose GBP," he adds.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"On balance, we expect the Budget to be expansionary, leading to a significant increase in spending for FY 2021, although below the level in FY 2020," says Anna Titareva, Economist at UBS.

Ahead of the budget speech Pound Sterling is seen trying to refind its upside impetus as the 2021 rally against the Dollar, Euro and other major currencies stalls.

The Pound-to-Euro exchange rate is back down to 1.1550 having been as high as 1.17 in the previous week, the Pound-to-Dollar exchange rate is back down to 1.3949 having been as high as 1.4243 last Wednesday.

The total size of the governments fiscal response to the pandemic for 2020 is estimated at £284.6BN, or 12.9% of GDP.

According to analysis from UBS, this is the largest in Europe.

An additional £55BN worth of spending, or 2.5% of GDP, is committed for 2021.

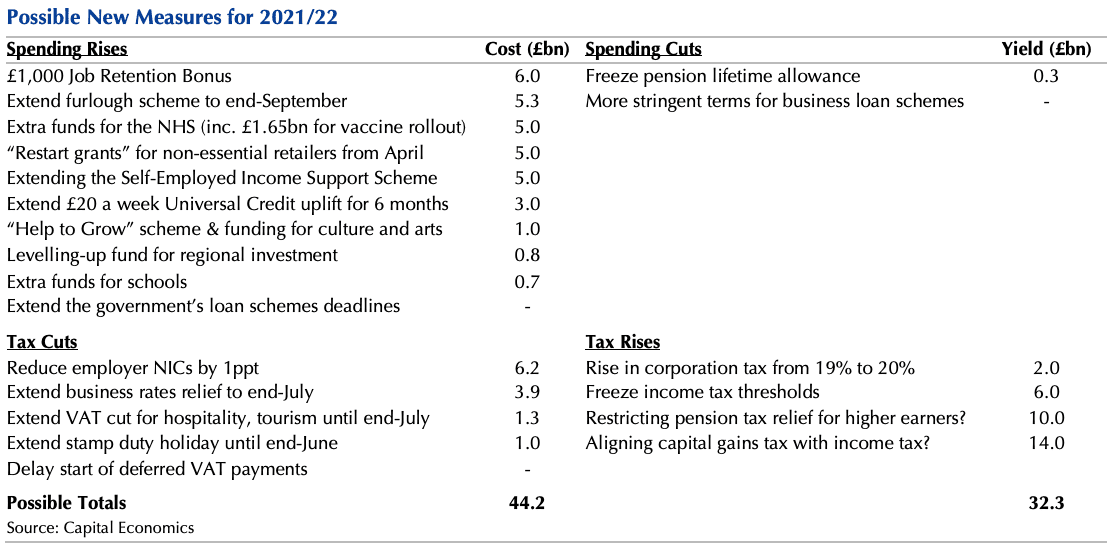

Above image courtesy of Capital Economics

It appears likely that the Budget will include an extension of the furlough scheme by at least two months with a gradual phasing out thereafter, as well as six-month business rate and three-month stamp duty holiday extensions.

"There is likely to be plenty of support measures to help businesses and employment recover as the economy comes out of lockdown over the coming months," says Derek Halpenny, Head of Research EMEA at MUFG. "Overall, we suspect the budget to reinforce expectations of stronger growth in the UK relative to the euro-zone."

MUFG say they have raised their Pound-to-Euro exchange rate forecast profile and now see the pair at 1.1765 by the end of June and 1.15 by the end of the year.

Stephen Gallo, European Head of FX Strategy at BMO Capital Markets sees "moderate, though not huge, event risk for the GBP" from the Budget.

Gallo believes it will probably be an 'assist' & 'rebuild' Budget, which will act as a bridge between now and reopening, while also laying out plans for higher levels of government fixed investment through mid-2024, which is roughly the scheduled time remaining in the current parliament.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"But in light of the recent back-up in longer-term yields, the balancing act between fiscal expansion on the one hand, and prudence on the other, is arguably more difficult to achieve, leaving scope for volatility in asset prices," says Gallo.

The budget comes at a time of rising yields paid on government bonds around the world, meaning that the cost of borrowing is starting to rise from recent record-lows. Sunak will feel that tax rises send a message to markets that the government is serious about ensuring the companies finances remain sustainable and therefore that investor capital spent on UK government bonds will ultimately be repaid.

By doing so the risk profile of these bonds is consistent with low interest payments.

BMO Capital's 'base case' for this week is that this balancing act will succeed, with the final outcome after Wednesday's Budget being fairly neutral for the GBP, and particularly for Pound-Euro.

Gallo says markets might react to the OBR's forecasts for real growth and net borrowing.

In November, the OBR saw real GDP expanding 5.5% in 2021 and 6.6% in 2022, with public sector net borrowing pegged at £164bn in FY21/22, and £105bn in FY22/23.

Net borrowing for the 2020/2021 financial was last expected to be close to £400BN.

"We see upside risks to all three of those borrowing estimates, but the crux of the issue for yields and the GBP boils down to how credible Sunak's pledges to boost investment are, alongside his arithmetic for putting the public finances back under control," says Gallo.

"Even with the first real indications of fiscal consolidation measures likely to come this week, this should still turn out to be a 'growth-friendly' Budget," he adds.

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

Simon Harvey, Senior FX Market Analyst at Monex Europe says he does not anticipate any consolidation plans to be outlined in March's budget, despite recent media reports around potential tax hikes.

"The most striking takeaway from the budget may be the government's optimism around its current reopening plans, however. With fiscal support measures being tied to specific dates, markets will crosscheck Sunak's plans with Johnson's roadmap to gauge how long the government really anticipates economically restrictive measures to remain in place," says Harvey.

The UK government has laid out a staggered plan to reopen the economy, starting with the return of schools on March 08 and the full dumping of restrictions by June 21.

Foreign exchange strategists at Barclays say they do not expect the budget announcement to bring any major changes to the government’s near-term fiscal stance. The government will likely extend its pandemic support for longer and may also announce a higher corporation tax.

"This, however, should not have significant impact on GBP, in our view," says a client note from the bank.