Pound-Dollar Rate Lifts Sterling into Top Spot as Brexit Hopes Rise with Turnover at Downing Street

- Written by: James Skinner

Image © Stephen Darlington, accessed Flikr, reproduced under CC licensing

- GBP/USD spot rate at time of writing: 1.3184

- Bank transfer rate (indicative guide): 1.2822-1.2914

- FX specialist providers (indicative guide): 1.2985-1.3064

- More information on FX specialist rates here

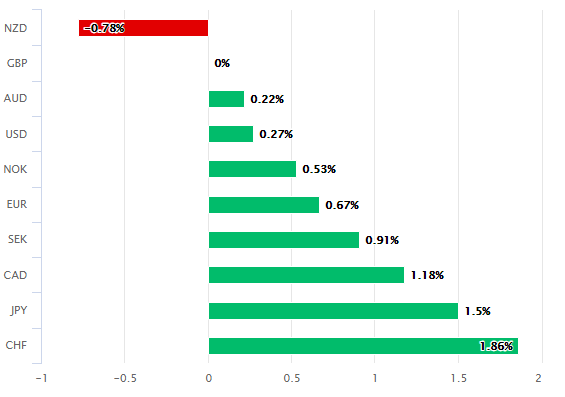

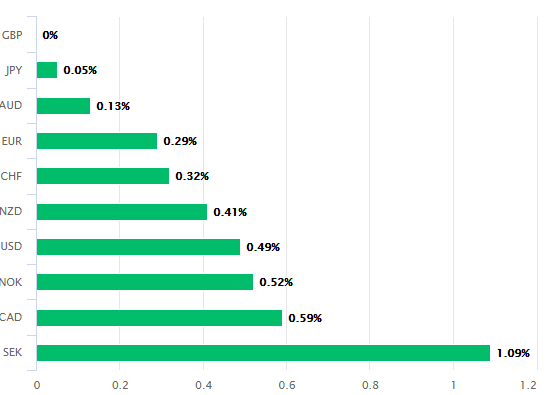

The Pound-Dollar rate led Sterling to the top spot among major currencies Friday and into second place for the weekoverall amid a strong performance from stock markets as well as possible signs that Downing Street could be on the verge of making concessions in the Brexit trade talks.

Pound Sterling was the best performing major currency on Friday having overtaken the Australian Dollar when it emerged that Prime Minister Boris Johnson's closest aide Dominic Cummings has departed Downing Street following what was widely billed as a power struggle.

It was previously reported that Cummings would remain in post until year-end and depart thereafter, in what some analysts interpreted as a positive omen for the Brexit talks. But the influential adviser was photographed leaving Downing Street through the front door on Friday while carrying a box of belongings.

Leading Brexit campaigners including Nigel Farage expressed concern on Friday about what the departure could mean for the Brexit trade negotiations, which are at a crucial stage with just weeks to go before the latest self-imposed deadline while familiar significant differences remain between the two sides.

Above: Pound Sterling's performance on Friday.

Above: Pound Sterling's performance this week.

GBP/USD added further to the session's gains, lifting the Pound into the top spot among major currencies for the day and into second place for the week, although this performance also played out against a backdrop of further gains for stock markets that Sterling has a positive correlation with.

It is well documented that I have never liked Dominic Cummings but he has backed Brexit.

— Nigel Farage (@Nigel_Farage) November 13, 2020

Seeing him leave Number 10 carrying a cardboard box tells me a Brexit sell-out is close. pic.twitter.com/Ysli7ZLCLY

"The S&P advanced modestly further this week after strong gains last week. Continued favourable risk sentiment was less evident in the FX markets however with the US dollar reversing some of last week’s losses, mainly versus the low-yielding CHF and JPY," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "G10 currencies have become more tightly linked to the performance of equity markets."

Cummings' departure and Sterling's gains came after Brexit negotiators adjourned trade talks for the weekend after another week spent deadlocked over "familiary differences," but with just days to go before a mid-November self-imposed deadline for a deal to be done.

Above: GBP/USD at 15-minute intervals with S&P 500 (black line, left axis), Brent crude oil futures (blue line, left axis).

"We believe one factor possibly helping support the pound in the midst of the bad economic news is the hope that PM Johnson is about to move first at a key moment in UK-EU trade negotiations. The departure of Lee Cain from Downing Street to be followed by Dominic Cummings and possibly David Frost has lifted speculation that the Vote Leave faction has lost influence," says MUFG's Halpenny. "GBP appears reasonably valued based on our fair-value model and recent historic moves. But any strength following a deal is unlikely to be sustained given the relative hit from COVID and the prospects of trade disruptions following a deal."

The EU Leaders Summit on 16 November has been billed by both sides as a last minute deadline for a deal to be done in time for it to be ratified before the end of the transition period on December 31, although some analysts say an agreement could actually be struck as late as the European Council Meeting scheduled for 10-11 December, which is followed by the final plenary session of the European Parliament just days later.

Nonetheless, and in the absence of confirmation that something is in the pipeline, this week's gains could leave the Pound susceptible to declines over the coming days especially if for one reason or another the stock markets are unable to hold onto this week's increases.

"We remain cautiously optimistic and hope for a trade deal, which would underpin the GBP across the board. That said, there is also a nonnegligible risk that only a partial Brexit deal could be possible at this stage, with the deadline for the more contentious issues extended to 2021. In turn, the week ahead could be a very volatile one," says David Forrester, a strategist at Credit Agricole CIB. "Further out, the outlook could remains modestly constructive provided that the BoE’s threat of negative rates does not escalate in 2021."

Above: Pound-to-Dollar rate at daily intervals alongside Pound-to-Euro rate (black line, left axis).