Macron Won't Budge on Fishing

- GBP volatility elevated as EU leaders meet to discuss Brexit

- Negotiations likely to last until November

- But one prominent political commentator says chances of deal as high as 100%

- GBP upside on a trade deal said to be limited by Rabobank

Above: Emmanuel MACRON, President of France arrives at EU Council summit. Copyright: European Union.

- Market rates: GBP/EUR: 1.1040, GBP/USD: 1.2905

- Bank transfer rates: 1.0830, 1.2644

- Specialist transfer rates: 1.0940, 1.2780

- Learn more about market beating exchange rates, here

British Pound volatility extended into a key meeting of EU leaders on Thursday where ongoing Brexit trade negotiations would be discussed, with the +1.0% gains recorded against the Euro and Dollar at one stage on Wednesday giving way to losses.

The prospect of a deal in the near-term looks to be limited given the strong resistance to a deal being shown by EU fishing states that face losing the current unfettered access to UK waters they currently enjoy under a new trading arrangement.

"On no account will our fishermen be sacrificed for Brexit. We didn’t choose Brexit, the British people did. So preserving our fishermen’s access to the UK’s waters allows a good compromise," Macron told reports on his arrival at the two-day European Council summit.

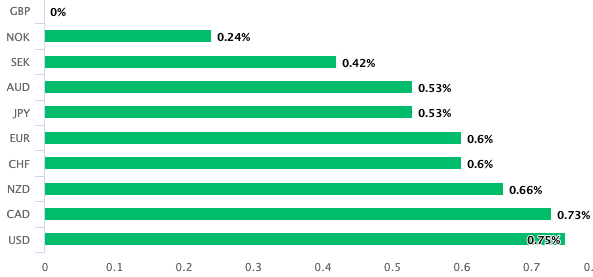

Fishing looks set to be the final hurdle for negotiators to overcome before a deal is signed, and the decline by Sterling against the Euro, Dollar and other major currencies is testament to anxieties that a deal could yet fail to materialise before the transition period ends on December 31.

"The second issue we need to have fair conditions between the UK and EU to assure us that we have a level playing field on state aid and regulations, especially socially and environmentally. Brexit should not create social or environmental 'dumping' on our border," said Macron, adding, "I want to be clear: this deal will not be made at any price. If these conditions are not met, it’s possible there won’t be a deal. We are ready for that. France is ready for that. We are in the process of finalising. ..We are ready for a no-deal."

Market analysts and political commentators are now looking to mid- to late-November for a final breakthrough.

Despite rising tensions over fishing rights the Pound-to-Euro exchange rate remains above levels it was at on Wednesday morning, suggesting the market remains cautiously optimistic a deal can be reached.

ITV's Robert Peston is not a name I would typically quote in my news reports, but the following remark appears to reflect aview being adopted by many in the foreign exchange market:

"The odds of a UK/EU free trade agreement are - in my estimation - quite close to 100%. Though I don't suppose anyone will admit to that. The outstanding issues (how often the fishing quota is renegotiated, enforcement mechanisms for state aid limits) are so conspicuously amenable to compromise, that it would be quite an achievement to muck it up."

But for those watching Sterling and expecting higher levels from here, Peston adds an element of caution: "that said, we live in an Age of Incompetence, so I guess anything is possible."

The Pound-to-Euro exchange rate rose by 1.0% at one stage on Wednesday to reach 1.11 before paring back some of those gains, at the time of writing on Thursday the pair is at 1.1074. The Pound-to-Dollar exchange rate had advanced by over a percent at one state to record a high at 1.3064 before paring the gains to quote at 1.3013 on Thursday.

If you are holding out for better rates don't hesitate to ask your FX provider if they have the relevant stop loss order to protect against downside and the relevant buy order to take advantage of upside targets when they are reached. Please learn more here.

A near-majority of institutional foreign exchange analysts and strategists expect further upside if a deal is confirmed. However, what is also nearly a consensus view is that the upside potential is relatively limited given numerous other headwinds such as rising covid-19 cases, a stalling UK economy, rising unemployment and the view that future trade with the EU will be more difficult once the UK has exited.

Jane Foley, Senior FX Strategist at Rabobank says there is "scope for a half-heated GBP recovery" to 1.1236 GBP/EUR on a 3-month view.

"Given the risk that any deal will lack the comprehensiveness that many had hoped for when Johnson was elected last December and in view of the economic struggles that are implied by the covid-19 crisis, we foresee various headwinds for the pound in the medium-term," says Foley.

Thursday sees EU leaders convene for a European Council meeting where discussions will be held to establish what compromises Chief Negotiator Michel Barnier can bring to the table in ensuing talks.

"We retain our cautiously optimistic view on GBP and think that a 'skinny' trade deal is more likely than no deal. Such an agreement, however, may only come after this week’s EU Summit, leaving scope for less-than-expected event volatility this week. In any case, we think that Sterling is likely to remain headline driven but that downside is likely to be capped because of its undervaluation," says Nikolaos Sgouropoulos, a foreign exchange strategist at Barclays.

Fisheries is looking to be a final showdown in talks as a number of EU coastal states are pushing for their access to UK waters to remain unchanged. However, negotiations over fisheries might not be a simple conversation between the EU and UK as other EU states with no exposure to UK fisheries will be expecting some concessions from their side in order to ensure trade with the EU's second-largest export market is not damaged by a 'no deal' outcome.

After all, fisheries makes up less than 1.0% of the EU economy.

"There's been some progress on Level Playing Field. There's been little to no progress unfortunately on fishing, and both sides are still far apart. EU fishermen are not going to be sold out... to get an agreement on a future relationship with the UK on trade," said Irish foreign minister Simon Coveney on Tuesday.

Ireland joins Spain and France in seeking to ensure the EU has as much access to UK fishing waters as they currently do. France is proving particularly adamant that it must retain the same levels of access to UK waters for its fishermen as part of any Brexit deal.

However, the UK argues that as an independent coastal state it should take back full control of its waters.

"President Macron has stood firm on the grounds that he would not allow French fishermen to be sacrificed, despite warning from Chief EU Brexit negotiator Barnier last week that it was not feasible that the EU keeps the same access to UK waters," says Foley.

One prominent reporter we follow, owing to his strong track record on reporting on Brexit negotiations over the past four years, says that it could be a good omen for a deal that talks are now stuck over the issue of fisheries.

"When both sides start singling out fisheries as the main obstacle then we're almost there. The expectation has always been that it'll be left to last for leaders, to provide their deal-clinching moment in the sun. Ultimately to the EU it's less important than LPF and governance," says Nick Gutteridge, freelance Brussels reporter, currently contributing to The Sun.

The UK has said it although it would regain full control over its waters it would allow access to foreign boats according to agreements that would be renegotiated annually, whether other EU countries can prise some concessions out of France and Spain will be key to the success of talks.

"Given the very tangible threat of a no-trade-deal Brexit the pound is proving to be sensitive to news headlines on the issue. Even if a deal is signed in the coming weeks, the risk that some businesses potentially in the services sector will receive scant provision coupled with the prospect that a deal may not prevent long queues at the UK’s border from January 1 suggests that Brexit related headlines are unlikely to end any time soon," says Foley.