Pound Sterling Pales as BoE, Brexit and a Rebounding Dollar Rock the Market's Boat

- Written by: James Skinner

File Image © Pound Sterling Live, Still Courtesy of Bloomberg TV. Webpage; © Bank of England

- GBP/USD spot rate at time of writing: 13297

- Bank transfer rate (indicative guide): 1.2934-1.3028

- FX specialist providers (indicative guide): 1.3101-1.3180

- More information on FX specialist rates here

Pound Sterling was underperformer by the fading hours of the mid-week session after paling in the face of a recovering Dollar and as remarks from Brexit negotiators and Bank of England (BoE) Governor Andrew Bailey helped upend the earlier order in the currency market.

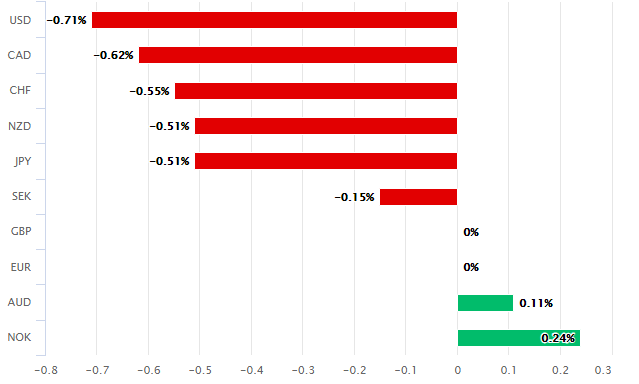

The Pound was quoted lower against all major currencies other than the Australian Dollar and Norwegian Krone Wednesday, although losses against the Euro were thin at -0.07% as the single currency suffered in sympathy with Sterling though likely for other additional reasons too.

Losses blighted British exchange rates after Governor Bailey and colleagues appeared before a parliamentary select committee where cautious words and utterances of concern about the economy followed fresh complaints from Brexit negotiators.

"The EU’s Barnier is providing another somber update on Brexit negotiations as we speak, but sterling/dollar is showing a very muted reaction," says Eric Bregar, head of FX strategy at Exchange Bank of Canada, before Bailey's appearance in parliament. "The market’s muted reaction so far suggests “yes we know that, what else is new?”

Governor Bailey told members of parliament that the recovery in consumer spending has been very fast but that it hasn't been matched by a rebound in business investment before reiterating that negative interest rates remain in the bank's toolbox but are not likely to be used any time soon.

He also warned of short-term increases in inflation, which could disadvantage British government bonds on the global market, while Monetary Policy Committee member Gertjan Vlighe told lawmakers it may take years for the economy to fully recover from coronavirus related disruption.

Above: Pound Sterling performance against major currencies on Wednesday. Source: Pound Sterling Live.

“What is clear is that the economy is going to need to be reshaped in order to recover. A sharp rise in unemployment is expected when the furlough scheme ends, while businesses will increasingly look to automation in order to plug gaps in their workforce and help control costs. As such some sectors and industries could be decimated despite consumption returning to pre-pandemic levels. It is becoming more and more obvious that the government will need to step in with more targeted fiscal support and provide more support for jobseekers," says Paul Craig, a portfolio manager at Quilter Investors.

Despite Sterling's earlier underperformance the British currency had retained a fractional lead over the ailing Euro, an indication of global factors being at play rather than the domestic, but the Pound-to-Euro rate swung to an intraday loss following remarks of the various BoE staff in parliament on Wednesday.

Nonetheless, the Pound-to-Euro rate has mostly held above 1.12 after reclaiming that level late last week and technical analysts at Commerzbank say it now targets 1.1281, but also has scope to reach 1.1390.

"EUR/GBP remains under pressure and it looks set to slide to .8864 the 9 th June low and we suspect that there is potential to reach the 200 day ma at .8779," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "GBP/USD is poised to encounter the 1.3500/15 the December 2019 high and the January 2009 low. Here we also find the 1.3522 2009- 2020 resistance line (see the monthly chart) and we would allow for this to hold the initial test/provoke failure."

Above: Pound-to-Euro rate shown at daily intervals with Fibonacci retracements of late April fall.

Wednesday's losses came amid a widespread rebound in U.S. exchange rates for which there was no shortage of competing explanations, as well as in the wake of strong gains for other majors and an outperformance by the Pound.

Investors' contempt for the Dollar has seen EUR/USD bid higher and higher in recent weeks, and so much so that gains in the single currency drew inevitable protest from a European Central Bank policymaker late Tuesday.

"This reflects the typical first stage of the central bank’s reaction to sharp movements in currencies, namely verbal intervention," says Nick Kounis, head of macroeconomic and financial market research at ABN Amro. "The rise in the euro will have a downward impact on the ECB’s inflation forecast as, if sustained, it would reduce import prices and eventually core goods prices. The ECB’s June projections assumed that the trade-weighted index would rise on average by 1.4% this year. At the moment the annual change is closing in on 4%. If the euro were to stay at the current level, it would reduce the ECB’s projections for inflation by around 0.1-0.2 percentage points over the next year. This is not a huge amount, but it is an extra disinflationary pressure at a time when inflation is moving further away from the ECB’s goal."

EUR/USD gains combined with earlier weakness in the Yen and Pound lifted the trade weighted Euro to six-year highs last month, necessitating some catch-up for Japanese and British currencies if Dollar declines were to persist.

But with Sterling and the Yen having done better against the Dollar in the last week than the Euro has, EUR/USD was then able to rise without having quite such an uplifting impact on the trade-weighted single currency.

"While GBP-USD has been racing higher in recent months, this has largely been a function of USD weakness. GBP has been an outperformer against most other currencies so far this quarter, but not by a great distance. The broad GBP trade-weighted index is at the top of the range seen over the last five months but is not racing higher," says Daragh Maher, head of U.S. FX strategy at HSBC.

Above: Pound-to-Dollar rate shown at daily intervals.