Pound Sterling on the Charge against Euro & Dollar after CBI Data Beats Expectations

- CBI data shows surge in business optimism

- Likelihood of BoE rate cut fade

- Sterling tracks falling odds and goes higher

- But Friday's data remains key for Jan. rate cut

Image © freepeoplea, Adobe Stock.

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

The British Pound has moved higher following the release of data out midweek that showed optimism amongst British businesses picked up sharply in the month of January, providing further evidence that January 30 might be too soon for the Bank of England to cut interest rates.

According to the latest CBI Industrial Trends Total Orders only marginally improved to -22 vs the -28 previously. The figure was however better than the -25 analysts had expected.

However, it is the Business Optimism element of the survey that appears to have caught the attention of currency traders. This forward-looking component of the survey swung positive and read at +23 vs. -44 previously.

This is a significant uptick in optimism and reflects the optimism reported in the Deloitte CFO survey which reported an "unprecedented rise in business sentiment" following the General Election in December.

The data hints that the economy could be due to pickup in coming months and when combined with Tuesday's better than expected labour market statistics suggests the Bank of England has little reason to deliver an interest rate cut at their January 30 meeting.

Sterling struggled in the first half of January as various Bank of England policy setters signalled they were standing ready to cut interest rates owing to a slowdown in the UK economy recorded in 2019.

Expectations for a rate cut rose sharply to above 70% according to money markets and the Pound fell in sympathy.

However, Tuesday's labour market data and Wednesday's CBI numbers have seen these expectations fall back towards 50%, the Pound has understandably risen in response.

"Sterling is trading alot higher again. The correlation with BoE rate cut expectations is very much back in play. Better than expected employment data & CB trend survey this morning shifting the chances of a cut from around 70 % to near 50 %. Sterling is meanwhile is up 100 points in a market that will indicate a cut back on longs soon I suggest," says Neil Jones, head of institutional currency sales at Mizuho Bank.

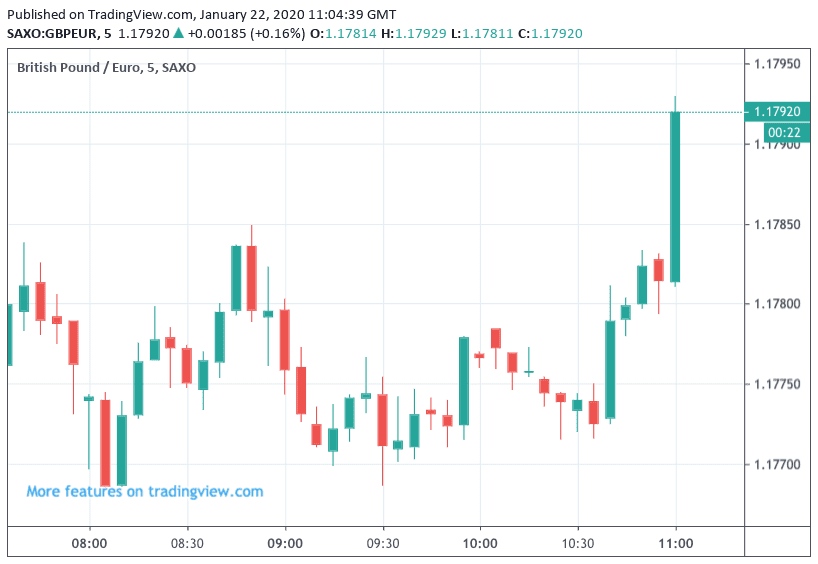

The Pound-to-Euro exchange rate is quoted at 1.1800, its highest level since January 09.

The Pound-to-Dollar exchange rate is quoted at 1.3090.

"GBP/USD is up near 1.3090. The UK CBI business sentiment survey increased in the three‑month to January to the highest level since April 2014. The details show improvement in capital expenditure plans, employment, new orders and export optimism. More upbeat UK business sentiment and tight labour market condition have reduced the probability of a Bank of England interest rate cut next week," says Elias Haddad, FX Strategist with CBA.

All eyes now turn to the release of the flash PMI survey on Friday, which will give a comprehensive overview of the UK's performance in the post-election period. The Bank of England's Monetary Policy Committee - who are tasked with setting interest rates - have indicated they could well base their final decision on the outcome of the survey. MPC member Gertjan Vlieghe mentioned in a speech earlier in the month that should the survey fail to show a significant improvement he would vote for a rate cut.

"Sterling popped to two-week highs as the odds of a local rate cut next week slipped below 50% from as high as 70% in recent days," says Joe Manimbo, analyst at Western Union. "Watch those Friday numbers on U.K. manufacturing and services growth which will be the next to influence the fluid rate debate."

If the data smashes expectations, expect the Pound to move sharply higher as the market moves to swiftly cut out expectations for an interest rate cut at the Bank of England on January 30.

A disappointing result will almost certainly ensure the Bank cuts interest rates and could add a heavier feel to Sterling over the short-term.

"This Friday’s UK PMI has a higher than usual level of market attention on it," says Jordan Rochester, FX strategist with Nomura. "Given it will likely move the needle on whether the BOE will cut this month or not (market now prices 66% chance) we’ve been digging into all the potential leading indicators that suggest a potential positive surprise on Friday."

Analysis by Nomura on the pricing in the options markets - that in turn give an insight into the volatility that can be expected in Sterling on the day - confirm that markets are giving the release a great deal more attention than is typically reserved for PMI data releases.

"FX volatility markets assign a 4 vol add on in GBP/USD, which is high for a UK PMI where the standard level would be just 0.3. Implied overnight is therefore ~11 vols so requires a 0.5% move in GBP/USD on Friday to breakeven," says Rochester.

In short, markets are of the opinion that the data will provide enough fireworks to trigger a move in the region of at least half a percent.

"We remain long GBP/USD with a 1.34/1.36 call spread (5 March expiry) with lot resting on Fridays PMI and next week’s BOE to set that mini trend higher in motion," says Rochester.