British Pound Exchange Rate Outlook and Predictions

- Last Updated: 07 April 2014

Updated: The British Pound (GBP) is stable as we move into the second week of April. Selling on global equity markets has seen some relief being enjoyed against the commodity dollars. Meanwhile, we continue to see consolidation vs the Euro and US dollar.

This period of consolidation will inevitably give the sterling bulls hope that the 2014 rally can ultimately reassert itself.

For the latest, see our live coverage section. For the archived material you clicked for, please scroll down.

The below rates are live and updated:

- £ vs Euro:1.1519

- £ vs Dollar:1.3612

- £ vs Australian Dollar:1.9405

- £ vs Canadian Dollar:1.8616

- £ vs New Zealand Dollar:2.2624

- £ vs Rand:21.8354

Follow Tuesday's live coverage as markets digest a slew of inflation numbers, will the March slump experienced by the UK unit end?

15:58: Sterling stuck ahead of tomorrow's important data

"Sterling is currently stuck in a ~50 bps range, with the top of the range being paid after better-than-forecast French manufacturing PMI data (51.9 vs. 49.8), but then it slid nearly half a cent on worse-than-forecast German manufacturing PMI data (53.8 vs. 54.7). Traders will be paying attention to the U.K.’s consumer price index (CPI) report on Tuesday morning, retail sales on Thursday, and current account data on Friday." - Jean-Pierre Doré at Western Union.

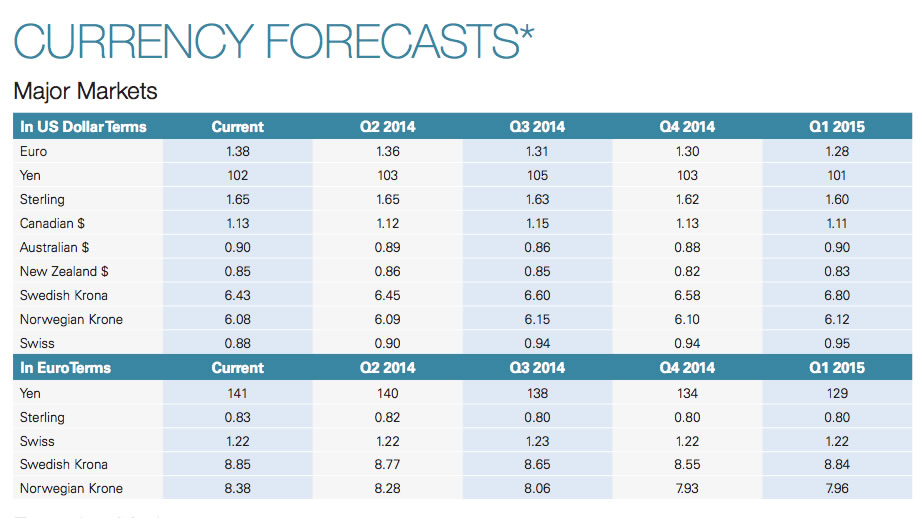

15:15: Currency forecasts 2014-15 from BBH

Brown Brothers Harriman have released these currency forecasts today:

15:00: GBP-CAD rally stalls

One of the surest trends in global FX since October 2013 is the rally against the Canadian dollar. It appears however that the rally has run its course. Shaun Osborne at TD Securities says:

"GBPCAD’s rally has stalled. We don’t think it will take a lot (gains through 1.8645/50) to get the rally going again but the opportunity to press higher may have been lost for now as the recent consolidation phase grinds towards the apex of the wedge formation in place since January.

"The dynamism that a break out might have achieved had it occurred before now risks being lost as the cross essentially looks poised to settle into a 1.80/1.86 range. We remain bullish on the GBPCAD outlook from a medium-term point of view."

14:18: £ tracking moves in EUR-USD

More from Lee:

More from Lee:

"Cable has been mostly following the price action in EUR/USD today with no economic data out of the UK .

"Traders are staying on the sidelines ahead of the UK CPI release tomorrow Key technical support seen 1.6450-60 (trendline supp); a close below would be a serious sign of a top on the higher timeframe charts, paving the way for a 1.6340/50 test and eventually 1.6250 (February low).

"On the order book, light bids ahead of 1.6450; stops building belowTo the topside, offers at 1.6520 + selling interest from ACBs 1.6535-40."

14:15: Ready to jump back into the market?

An interesting strategy pointer from Sean Lee at FXWW:

"GBP/AUD triggered stops below 1.8100 this morning but then jumped and cable tested the 61.8% retracement of the 1.6250/1.6825 rally at 1.6470.

"We are not too far away from the latter level still and cable bulls might be interested by the risk-reward on offer at current levels near 1.6485."

14:05: Lloyds say potential for £ gains remain

Lloyds Bank strike a relatively positive tone on sterling today:

Lloyds Bank strike a relatively positive tone on sterling today:

"There is plenty of UK data this week, with February CPI and retail sales on Tuesday and Thursday the highlights, but nothing of any significance today. GBP has been on the back foot for the last couple of weeks, falling against both the USD and the EUR is spite of still relatively strong UK data, and while GBP was off its lows against the EUR on Friday, this relative GBP weakness has undermined sentiment for now.

"The best explanation rationale for GBP declines is probably simply an unwinding of excessive positioning, but the fact that both the US and Eurozone produced better current account data in the last week highlights this as a weakness in the UK, and this Thursday’s data will consequently be of more than usual interest. Even so, the cyclical indicators still support relative UK outperformance, and suggest potential for GBP gains against the EUR and CHF if market risk appetite improves and the UK data continues to suggest that UK rates will keep pace with the US."

The GBP-EUR has moved higher to 1.1963 in the wake of the data miss.

13:39: Decent near term resistance

"We look for the 1.380-1.385 and 1.650-1.650 ranges in EURUSD and GBPUSD to act as decent near-term resistance in each pair, until more US data are out of the way. In EURUSD, 1.375 will become more important to watch as month-end/quarter-end approach." - Stephen Gallo at BMO Capital.

11:54: Euro strength and capital inflows

One of the key drivers of Euro strength has been capital inflows into the Eurozone. But, according to George Saravelos at Deutsche Bank the assumption that capital flows will always be supportive is flawed:

"Foreign equity inflows into the Euro-area have been extremely strong, almost half a trillion euros since the start of 2012! But at least the January portfolio flow data released last Friday should give some food for thought.

"Non-bank foreigners liquidated the largest amount of European equities in more than two years, the first month of sales since Draghi's "whatever it takes" speech. In contrast, Europeans continued investing offshore, turning net equity flows negative.

"So there may be evidence that foreign appetite for Euroland equities is saturating. Taken together with the euro's increasing attractiveness as a funding currency given the ongoing re-pricing of US rates, we would argue the euro flow picture is not as supportive as the popular narrative suggests."

The GBP-EUR has moved higher to 1.1963 in the wake of the data miss.

11:30: Advances vs EUR, but can GBP follow through?

The GBP-EUR is testing 1.2 following on from today's Eurozone PMI miss. But, can the move be extended. Looking at the momentum the EUR enjoys this is a hard ask, as noted by a weekly forecast from ICN Financial:

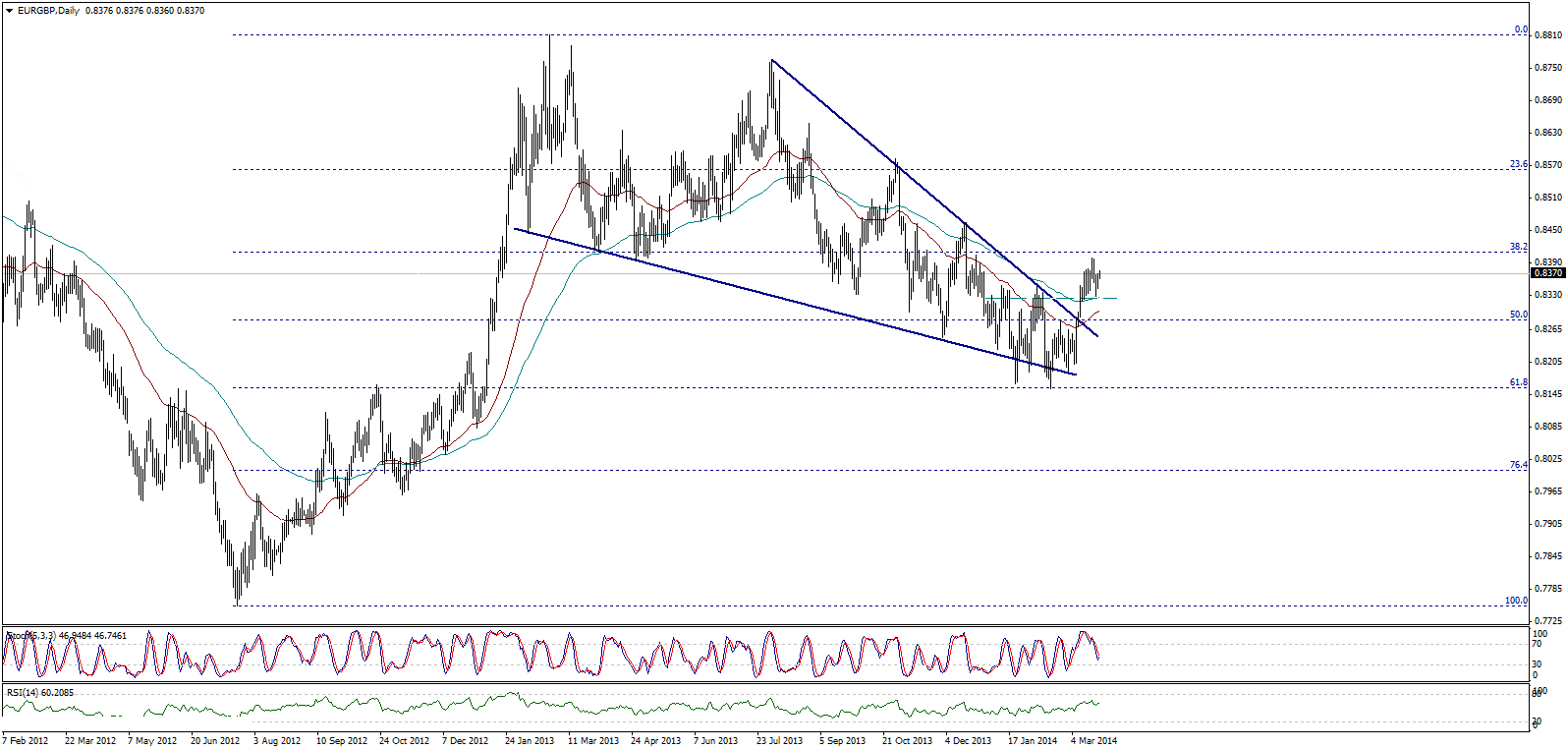

"The outlook is positive for EURGBP above 0.8285 and the intraday risk-limit is below 0.8160

"The pair is trading with slight positivity after retesting 0.8325 areas last week. The pair now is moving toward the resistance to be breached at 0.8410, the key for the extension of the upside move toward 0.8500 then 0.8560. Stochastic is attempting to crossover positively to support the upside move that remains valid with stability above 0.8325 and 0.8285."

10:05: RBS see potential for further USD losses

The Cable may yet enjoy a fresh rally according to RBS. In a weekly currency note analyst David Simmons says:

The Cable may yet enjoy a fresh rally according to RBS. In a weekly currency note analyst David Simmons says:

"The discussion over first tightening timing became nosier with that Yellen "six months" reference. But most up for grabs, and for repricing, is what markets think the Fed will do after that first tightening eventually comes. Rate expectations for 2016 are hence the critical (bearish, rates higher) theatre. We are unconvinced that USD has yet bottomed against other Majors and we still like EUR/USD and Cable higher."

09:58: £ remains under pressure

"GBPUSD extends weakness to 1.6460, Nov-Mar uptrend bottom. A break below should reinforce GBP-sales. EURGBP consolidates strength below 0.83915 / 0.84000 (fibo resistance / optionality). Trend momentum lost pace yet remains comfortably positive. Next key level is placed at 0.84209 (200 dam)." - Swissquote Bank.

09:00 Eurozone PMI data misses the mark, GPB-EUR edges higher

Eurozone Markit Services PMI (Mar): 52.4, analysts had expected 52.6.

Eurozone Markit PMI Composite (Mar): 53.2 vs 53.3 expected.

The GBP-EUR has moved higher to 1.1963 in the wake of the data miss.

08:25: Sterling exchange rates in early morning

The sterling dollar exchange rate is 0.08 pct higher at 1.6501.

The sterling euro is 0.09 pct down at 1.1945.

Against the Australian dollar (AUD) is 0.08 pct lower at 1.8137.

Against the New Zealand dollar (NZD) is 0.12 pct higher at 1.9343.

The GBP vs Canadian dollar (CAD) is 0.25 pct higher at 1.8555.

(PS. All rates are mid-market. Your bank / currency provider will deviate on this rate to derive profit. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering up to 5% more currency. Please learn more here).

08:20: Cable to remain 'sluggish'

The morning viewpoint from UniCredit Bank is thus:

"Given the USD strength, cable is likely to remain on a sluggish tone mostly close to 1.65 for now in anticipation of new UK data later in the week (CPI and retail sales). EUR-GBP is expected to remain locked above 0.8350."

08:00: Short the pound dollar exchange rate

OCBC Bank have suggested the GBP is at risk of further declines vs the USD. In today's currency outlook note the bank's Emmanuel Ng says:

OCBC Bank have suggested the GBP is at risk of further declines vs the USD. In today's currency outlook note the bank's Emmanuel Ng says:

"With the GBP losing its data-driven luster in recent sessions and implied long GBP positioning at elevated levels, the pound may be relatively more susceptible to any near term episodes of broad-based dollar strength. We look to a tactical short GBP-USD (spot ref: 1.6490) targeting 1.6230, with a stop placed at 1.6625."

The outlook for FX this week:

"This week, investors may continue to try to parse for additional hints from Fed speak, and the verdict is still out there on whether the most recent episode of USD strength may persist. ECB rhetoric may also potentially sway the EUR, with the ECB’s Draghi due to speak on Tuesday. On Saturday, the ECB’s Liikanen noting that the possibility of lower interest rates “still exists”." - Emmanuel Ng at OCBC.