Short NZD v USD is Top Trade Going into NFPs: ING

- Written by: Gary Howes

Analysts at ING say they now think the conditions for a data-led USD correction are ripe. ING’s Viral Patel writes:

More recent USD weakness has exceeded fundamentals; the stars are aligned for a data-led correction.

With financial conditions arguably less of a concern and markets barely pricing in a rate hike for 2016, we think USD price action is “fair game” now and will be a function of forthcoming US data.

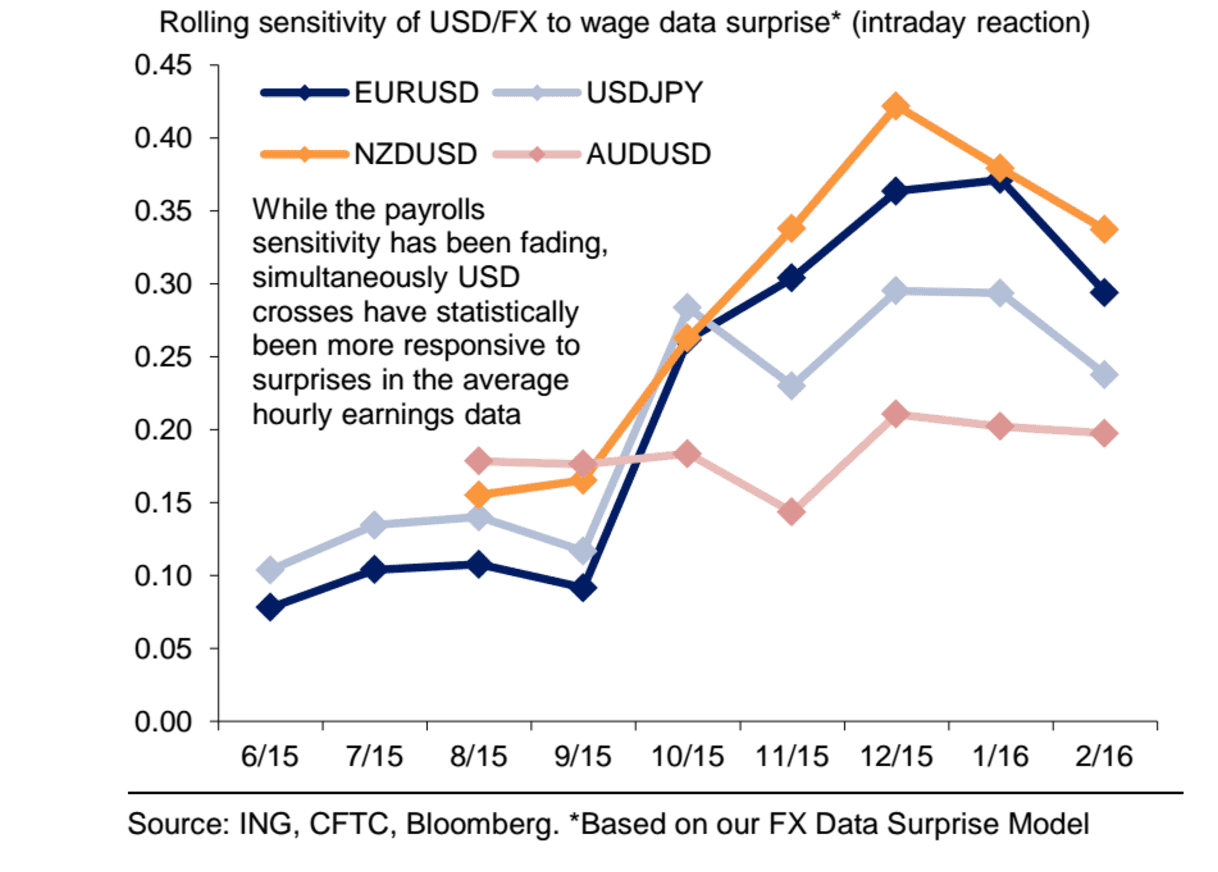

Indeed, we note that USD crosses are beginning to:

(i) exhibit a greater sensitivity to US data surprises and

(ii) re-couple with changes in rate differentials; both of which suggest that a repeat of March (where markets largely ignored a sequence of strong US data prints) is unlikely.

With long dollar positioning much lighter (spec markets are now net short USD vs. major FX), we think the conditions for a data-led USD correction are ripe.

A solid jobs report would set the tone for a USD revival in May.

Short NZD/USD is our top-pick for those wanting to position for an upside surprise in US wages.

Risks of a positive wage inflation surprise points to USD upside against more rate-sensitive currencies such as EUR, JPY and NZD.

While short GBP/USD should also be considered under this outcome, our preference is to buy a 2-day NZD put/USD call, strike 0.6870 (spot ref 0.6902), costing 0.34% of notional.

What ING are Forecasting

Payrolls to come in a tad softer than expectations (ING: +190k; consensus: +200k).

While some indicators continue to signal a robust hiring backdrop, the softer ADP print suggests that there are some (albeit marginal) downside risks to jobs growth in April.

Upward bias in the unemployment rate still in place (ING: 5.0%; consensus: 4.9%). The discrepancy between payrolls and the household survey (from which the u/e rate is derived) is still evident, while the very strong labour force growth is unlikely to endure. A slight correction in both components may put some upward pressure on the u/e rate.

Robust underlying wage pressures should result in decent headline wage growth (ING: 2.4% YoY; consensus 2.4%).

We note that the headline AHE measure has been hovering at the lower end of a range of US wage indicators, with the Atlanta Fed’s wage growth tracker continuing to tick higher (on a moving average basis).

Thus, we think the odds of a positive wage growth surprise are slightly higher this month.