Reversal Pattern Forming on Euro-to-Dollar Rate as U.S. Interest Rate's Tipped to Surge

© kasto, Adobe Stock

EUR/USD is looking increasingly toppy and together with expectations that US interest rates might rise even more rapidly than previously assumed reinforces a bearish bias.

Is the multi-month advance in the Euro in danger of finally fading?

The 'M' shape drawn at the highs on the chart of EUR/USD chart shown below is a potential reversal pattern called a double-top, which has bearish implications for the pair.

A break below the trigger point or 'neckline' as technicians call it, at 1.2206 (current market level is 1.2293) would almost certainly see the pair cascade lower to below the 1.2000 level.

Such a break would see the exchange rate fall to a potential target at 1.1870, which is equivalent to the height of the pattern extrapolated lower, the usual method for forecasting from double-tops.

Of course it may not make it that low, but if it breaks below the neckline then there is a high probability it will get at least as low as 1.1990, which is the golden ratio (or 0.618) of the height - the golden ratio is an ancient mathematical constant which tends to have significance in financial markets.

Until there is a break below the neckline, however, there is still a possibility the pair will eventually resume its uptrend, but such a move would require a decisive break above the current 1.2557 highs for the purposes of re-validation.

Technical analyst Robin Wilkin at Lloyds Bank eyes slightly different levels, but the message is the same - the exchange rate is in danger of further declines based on technical considerations: "prices are back to another area of support around 1.2260, which may well provide some two-way price action in the near term.

"While under 1.2355/1.2410 downside momentum remains in place and we expect an eventual break here and then the previous reaction lows at 1.2205. 1.2050-1.1850 are weekly trend supports below."

Higher US Interest Rates

From a fundamental perspective, most analysts are saying that the Dollar is now rising versus the Euro because of higher interest rates expectations in the US.

Higher interest rates attract greater foreign capital inflows which boost demand for the Dollar.

Yet of late the relationship between interest rates and USD has broken down and the Dollar has been disobeying interest rate expectations, so quite why analysts now think it has recoupled is difficult to say.

It may be that expectations have taken a step up after the release of the last Federal Reserve (Fed) meeting minutes yesterday evening, which revealed a robust optimism from the board of governors in the economic outlook, and this has 'reinvigorated' the model in some way.

Data too has revealed strongly rising core inflation and growth, further playing into the narrative of rising interest rates.

There are now those - most notably Nordea analysts Jan von Gerich and Kjetil Olsen - who expect not 3 but 4 rate hikes from the Federal Reserve in 2018 - one per quarter.

This would be a major increase from the 2 - 3 hikes the market is currently pricing in.

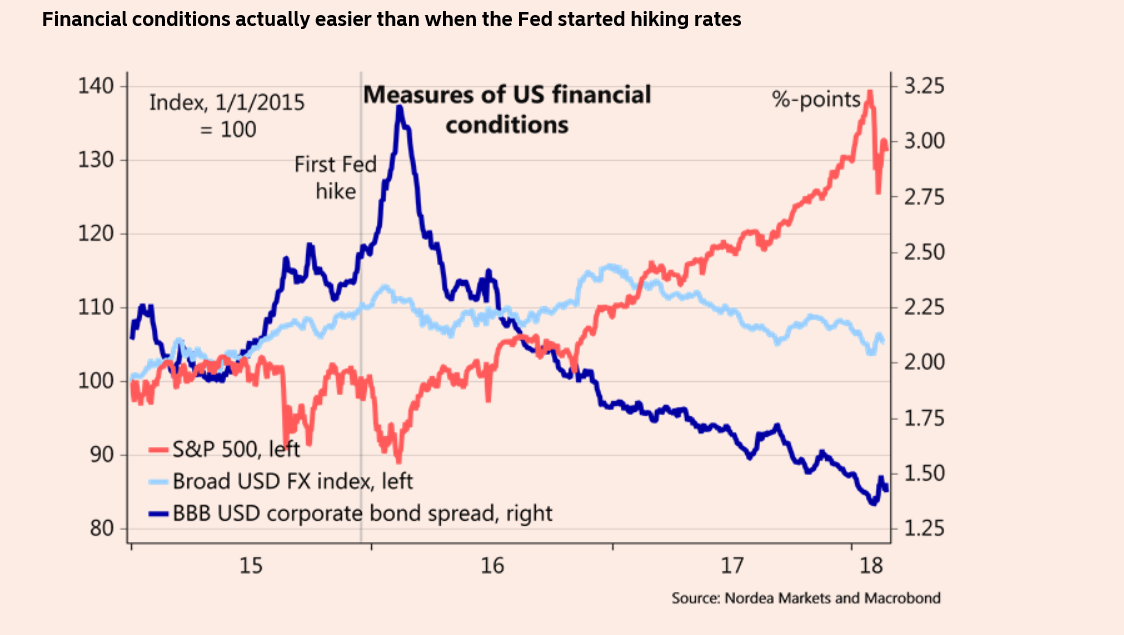

Nordea's argument isn't just that the minutes were bullish, they that real financial conditions are still relatively loose due to other economic factors.

The weaker Dollar itself, for example, is loosening monetary conditions by increasing inflation via costlier imports.

The rising stock market is also creating wealth and narrower credit spreads between government and corporate interest rates, reveal an improving credit profile for the private sector.

All these factors are essentially acting like a Fed interest rate cut, so in real terms, conditions are even looser monetarily than they were before the Fed started raising interest rates (see chart below), they argue.

This suggests the Fed will need to speed up its tightening schedule by raising interest rates more rapidly than expected - which explains Nordea's call for 4 x 0.25% rate increases in 2018.

In the case of EUR/USD, there is also the added factor that the Eurozone seems to be peaking in terms of growth rate.

Both January and February's Manufacturing and Services PMI's showed a slowdown albeit from a 12-year high, and whilst it remains to be seen whether this is the start of a deeper correction or just a blip, it may have introduced some doubt into the mind's of Euro-bulls.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.