Why Selling the EUR/USD Exchange Rate is a 'High Conviction' Trade Today

The European Central Bank (ECB) could surprise investors with a more aggressive banquet of easing measures than markets are pricing into the EUR to USD exchange rate.

- Euro rates today: EUR/USD at 1.0961, EUR/GBP at 0.7723, EUR/AUD at 1.4686

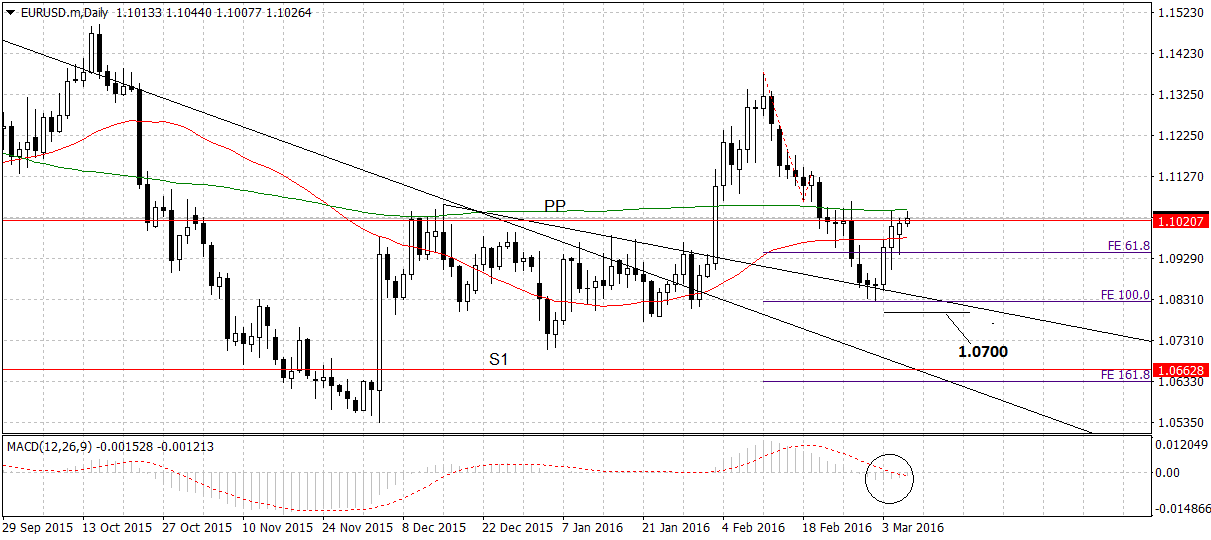

- Our initial downside target is at 1.0700

- Westpac, Citi and ING on why shorting the EUR/USD is on their 'high conviction' list

- 6 things to watch out for listed below

The euro is trading in familiar territory just 24 hours ahead of the release of the decisions made at the ECB's crunch March policy meeting.

We will be updating our coverage of the event and carrying a live stream of the press conference here.

The euro's ability to stay afloat ahead of interest rate cuts is an admission that markets are erring on the side of caution when it comes to exposure to the euro.

Traders will not want to be wrong-footed as they were in December when the ECB disappointed markets and the euro surged higher.

"The ECB’s mantra is to surprise and with positioning now decidedly leaning towards a less dovish ECB," say CitiFX, "shorting EUR is now seen as the better risk / reward play tactically."

Citi are not the only big bank who are bearish the euro, so too are ING, who expect the EUR/USD pair to fall by 1.5% after the March meeting if their base case scenario is met.

ING forecasts a deposit rate cut of 20 basis points, more agressive than the consensus from a Reuters poll that forecasts a 10 basis point cut taking the final rate to -0.4%.

Reuters consensus expects monthly purchases of at least EUR 70 billion, currently the programme makes 60bn of such purchases per month.

"Market participants seems to be more cautious now and are not as short the euro as they were before the ECB meeting," says Camilla Viland at DNB Markets, "consequently we believe that if the ECB deliver by a mix of cutting the rate, increasing its asset purchases, and clearly signal that they are prepared to do more, the euro may very well weaken tomorrow."

Westpac: Selling EUR/USD a High Conviction Trade

Joining the bears ahead of the ECB meet are Westpac whose models show a high probability of EUR/USD weakness.

"We have added an EUR/USD short, last week's two bearish signals out of three producing a sell on strength order that was filled at 1.0995, stop at 1.1110," says Westpac's Martina Song.

Westpac are wary that Draghi will struggle to leapfrog expectations but any squeeze in EUR is likely to be short-lived.

1.1050 is seen as a key level, a break above which could see EUR heading higher but Westpac see no indication from momentum that such a move will happen right now.

Pound Sterling Live Forecast: Targetting 1.07

The risk of the ECB surprising with more-stimulus-than-expected and effecting further down-side in the EUR/USD pair fits well with our marginally bearish technical forecasts.

The pair is stuck in a range between 1.0500 and 1.1500 in the medium term.

It has just moved higher in the last few days, and has reached the level of the Monthly Pivot Point at 1.1021, where it is currently situated.

The monthly pivot is a line constructed from the previous month’s High, Close, Open and Low prices, which traders use to buy and sell at, and which it is likely to provide an obstacle to further gains.

The MACD indicator in the bottom pane is below the zero-line which is a bearish signal, and indicates the pair will probably start to move lower again soon.

Confirmation of further down-side would come from a break below the 1.0800 level, to an initial target at 1.0700, and then the S1 Monthly Pivot level at 1.0663.

The ECB: 6 Things to Watch

The following pointers come courtesy of Kathy Lien, Director at BK Asset Management.

1. Size of Deposit Rate Cut - The ECB is widely expected to lower rates but anything more than 10bp reduction will trigger a knee jerk decline in EUR/USD. Also watch out for possible tiering of deposit rates

2. Extension of QE Program - In December, the ECB said they would extend their asset purchase program through March 2017. Pushing this date out by three to six months would not be a big leap

3. Adjusting the Size of QE - Increasing the amount of bonds purchased per month would be a more aggressive step. Anything from 10 to 20 billion euros would be negative for the currency (the larger the increase, the greater the decline) but if the central bank decides to leave QE purchases unchanged, expect a sharp and aggressive rally in EUR/USD.

4. New Long Term Repo Operation - If the ECB wanted to surprise the market they could also announce additional LTRO measures but they may forgo doing so if the deposit rate is reduced and QE purchases increased

5. Revisions to Staff Forecasts - We also expect the ECB to lower its inflation and growth forecasts after underlying inflation dropped to a 10 month low.

6. Mario Draghi's Guidance - The future direction of the euro hinges largely on whether the central bank plans to ease after March. If Draghi simply says the door remains open to additional easing, we don't expect a significant sell-off in the currency. Stronger rhetoric on the other hand could be very damaging for the euro.