Euro-Dollar Rate Advances on U.S. Inflation Disappointment

- Written by: Gary Howes

Image © Adobe Images

- EUR/USD reference rates at publication:

- Spot: 1.1845

- Bank transfers (indicative guide): 1.1430-1.1513

- Money transfer specialist rates (indicative): 1.1740-1.1790

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

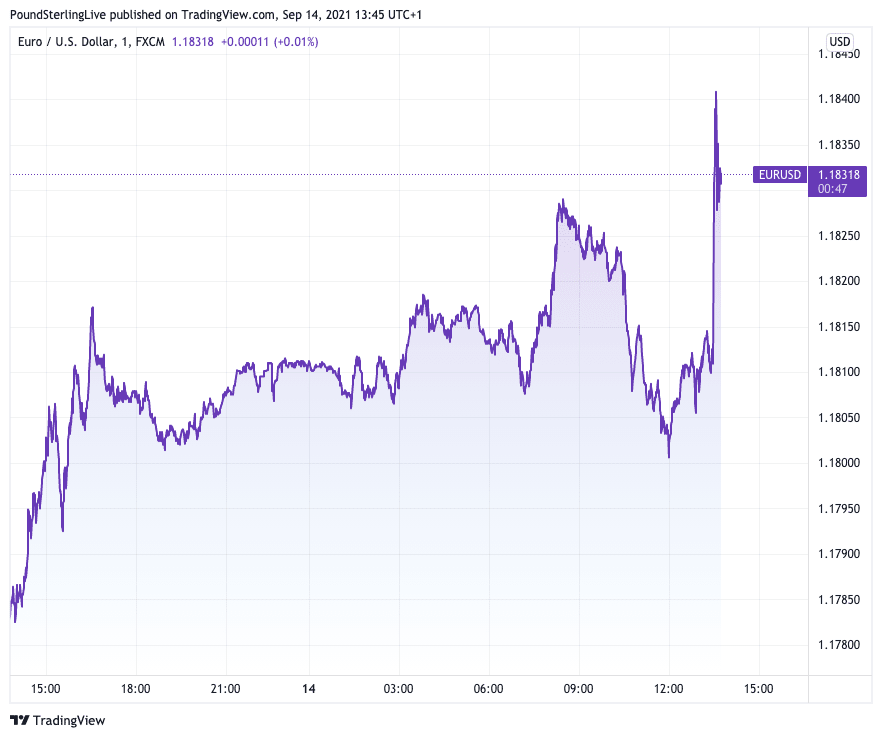

The Euro-to-Dollar exchange rate rose following the release of U.S. inflation data that came in below investor expectations and provided further evidence a spike in Covid cases was hitting U.S. economic activity.

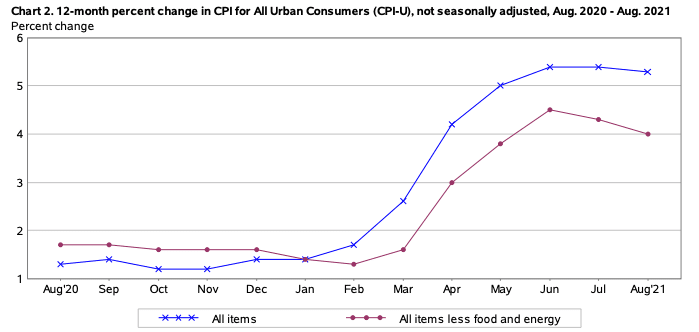

CPI inflation rose 0.3% month-on-month in August, which was below the consensus expectation for 0.4% and the previous month's 0.5%.

However the more important measure of price change from a markets perspective - core CPI inflation - rose just 0.1% month-on-month in August, missing expectations for 0.3%.

July's core reading was higher at 0.3%, suggesting peak inflation might have passed.

The data will push expectations for the Federal Reserve's first interest rate hike further into the future, a dynamic that eases demand for the Dollar.

The Dollar fell in the wake of the data: the Euro-to-Dollar exchange rate (EUR/USD) spiked to a high of 1.1840 in the immediate aftermath of the data release.

The Pound-Dollar rate meanwhile rose by a third of a percent to quote at 1.3885.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Monthly price increases may be cooling, but the annual rate of inflation remains red hot for now," says Andrew Grantham, Senior Economist at CIBC Capital Markets.

Annual CPI stood at 5.3% in August, which actually met investor expectations, even if it was a few basis points below July's reading of 5.4%.

But annual Core CPI read at 4.0% in August, a miss on the expected 4.2% and lower than the previous month's 4.3%.

CIBC Capital Markets note rising Covid-19 counts in the U.S. to potentially have played a part in the softer readings, observing a negative impact on demand in some services.

Indeed, hotel and air fare prices both declined in August, the latter by a sharp 9%.

"There will be a temporary lull in inflation this fall/winter, before a recovery in demand and some continued supply disruptions see monthly price increases accelerate again in early/mid 2022," says Grantham.

Image: Bureau of Labor Statistics.

"The core consensus always looked too high, but the extra downside surprise to us is the 9.1% plunge in airline fares as passenger numbers dropped in the face of the Covid Delta wave; we expected a smaller decline," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

Used car prices - which have been a major driver of inflation in 2021 - fell 1.5%, the first decline since February and Pantheon Macroeconomics reckon this likely the start of a sustained drop in this component.

"We expect modest core CPI prints over the next few months," says Shepherdson.

"The big story for next year will be the extent to which stronger productivity growth offsets faster wage growth, thereby preventing the reopening CPI spike morphing into sustained inflation. We are optimistic," he adds.