Euro-Dollar Rate Back On Dry Land As USD Rush Fades

- Written by: James Skinner

- EUR/USD levitates after finding support at 1.2050

- As USD demand fades & gravity weighs on yields

- Tepid risk appetite hints of only slow EUR recovery

Image © Adobe Images

- EUR/USD reference rates at publication:

- Spot: 1.2069

- Bank transfers (indicative guide): 1.1647-1.1730

- Money transfer specialist rates (indicative): 1.1960-1.1985

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Euro-to-Dollar exchange rate recovery from its latest declines could be a slow burning affair if instability in global markets prevents investors from letting go of the greenback, although the single currency had already stepped foot back onto dry land Thursday after finding support around 1.2050.

Europe’s unified unit arrested its earlier decline and reversed higher from around 1.2050 on Thursday, a level at which it has found both support and resistance on a number of occasions in the recent past, although a short distance further below the Euro benefits from even stronger underpinnings.

“The post US CPI uptick in UST yields prompted UST-Bund spreads [difference between bond yields] to rebound back above 180bp. EUR bulls need renewed spread compression in order to encourage a rebound back towards 1.2125,” says Jeremy Stretch, head of G10 FX strategy at CIBC Capital Markets.

Stretch says, "EUR bulls may need to be patient," for any meaningful recovery by the Euro due to public holidays in Switzerland, Germany and France on Thursday and a resulting dearth of economic newsflow from the European continent, although developments in global bond markets were pointing toward such recovery being likely.

Above: Euro-Dollar rate shown at daily intervals alongside AUD/USD.

Government bond markets drew a supportive bid across the globe on Thursday following heavy falls during the prior session, which lifted yields sharply, although U.S. bonds appeared to draw more enthusiastic demand when their yields declined further and faster than those in Europe.

“A failure of long-term US yields to keep pace with the rise in their European counterparts will strengthen the layers of support below 1.20 in EURUSD and 1.40 in GBPUSD,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

The bid for U.S. bonds came concurrent with demand for the Euro and in the wake of U.S. producer prices data, which measures changes in the cost of goods and services sold by manufacturers and other companies.

That confirmed on Thursday that American inflation pressures are rising and significantly more than has so-far been expected by economists, with producer prices rising at more than twice the rate anticipated by consensus for last month.

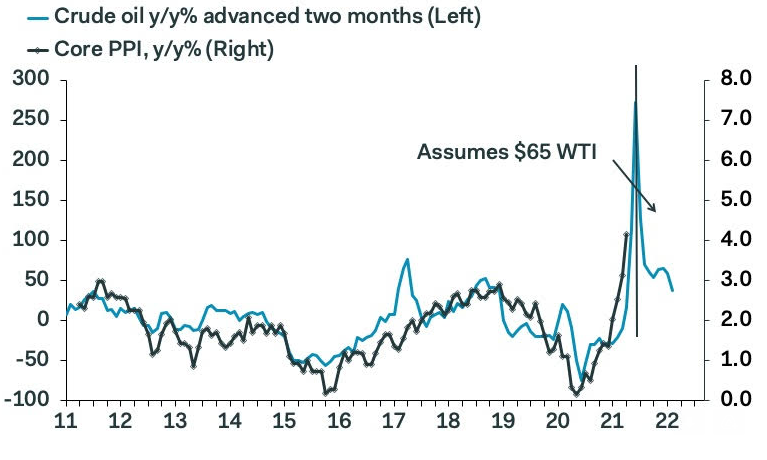

Above: Pantheon Macroeconomics graph showing U.S. produce price changes alongside oil price.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

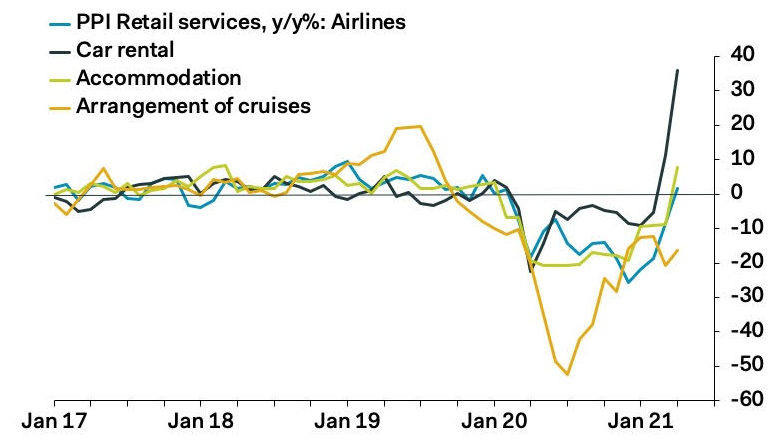

“The PPI was driven higher by outsized increases in a broad array of goods and services prices, with components as diverse as steel scrap (up 18.4%) and airline fares (up 6.9%) recording big gains,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

The overall 0.6% increase in production costs was still lower than the full 1% seen in March and so indicates that U.S. inflation may already have been on the cusp of a retreat last month, which is the same period in which the official measure of actual consumer price inflation reached its highest since 2008.

This is notable for the currency market and Euro-to-Dollar exchange rate because it supports the Federal Reserve (Fed) when the bank argues that recent and pending increases in official measures of inflation are merely “transitory,” and so is bearish for the greenback and a bullish development for Europe’s single currency.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The key question will be what happens once the oil hit begins to fade" Pantheon’s Shepherdson says.

“Will rising margins as the economy reopens then keep PPI inflation at a faster pace, alongside other inflation measures? That, in turn, would raise the risk of a sustained rise in inflation expectations, which the Fed could not tolerate indefinitely.”

U.S. consumer price inflation rose by 4.2% during the 12 months to April, up from 2.6% previously and more than twice the 2% target of the Federal Reserve (Fed), leading some investors to worry that the Fed could abandon its new policy strategy in favour of interest rate rises that come sooner than it has so-far guided for.

Above: Pantheon Macroeconomics graph showing contributions to U.S. produce price changes.

Those fears incited widespread demand for the Dollar on Wednesday and early on Thursday, which sent the Euro tumbling, although the figures in question had been predisposed to steep increases from the get-go and investors appeared to overlook that U.S. policymakers are actually seeking to have price growth rise above the Fed’s target for long enough so that overall inflation then averages the 2% target over an unspecified period of time.

“The FOMC made it crystal clear they will look through temporary inflation overshoots. In fact, the FOMC seeks to achieve inflation (as measured by the PCE deflator) that averages 2% over time. The PCE deflator has averaged less than 2% for over a quarter of a century,” says Elias Haddad, a senior FX strategist at Commonwealth Bank of Australia.

“We recommend investors use USD relief rallies to initiate or add to short USD positions,” he adds.