The Euro-Dollar Week Ahead Forecast: Charts and Emerging Market Price Action Both Point Higher

- Written by: James Skinner

- Charts point higher in EUR supportive risk environment.

- Cratering CNY stocks may spook global markets Monday.

- While EUR to benefit from contagion of coronavirus fears.

- EUR to be lifted further by virus fallout in emerging markets.

- Coronavirus uncertainty could sideline traders, lift volatility.

- Market to mull eventual policy response from China et al.

Image © Adobe Images

- EUR/USD Spot rate: 1.1095, up 0.62% last week

- Indicative bank rates for transfers: 1.0707-1.0784

- Transfer specialist indicative rates: 1.0929-1.0995 >> Find Out More About This Rate

The Euro rose sharply on Friday amid a big crash and bang in emerging market currencies, although the charts suggest further gains are in store for the new week while continued coronavirus-related fallout in the developing world could also continue to lift Europe's unified unit.

Europe's single currency lagged major rivals throughout much of last week but was boosted sharply on Friday by large declines in currencies like the South African Rand, which more than offset the largely negative newsflow that emerged from the Eurozone during the final session of the week.

"EUR/USD showed some mild signs of life on Friday, rising to the upper half of the 1.10-1.11 range. The move was mostly triggered by the drop in equity markets, which benefited the EUR due to its funding characteristics," says Chris Turner, head of strategy at ING. "More news about the spread and dead toll of the Coronavirus will come during the weekend and the risk is that we may see another leg lower in equities as markets re-open on Monday."

Turner says more declines in global stocks markets could lift the Euro-to-Dollar rate again, and might ultimately provide an opportunity for it to move above 1.11.

Both the global market fundamentals and technical studies of the charts are pointing higher at the beginning of a week where the opening trading session will be dominated by the Chinese stock market reaction to last week's developments. Chinese investors have been away for New Year celebrations since January 23 but are expected to return to their desks in at least some capacity from Sunday evening London time.

The Peoples' Bank of China (PBOC) said at the weekend it will inject 1.2 trillion Yuan (£130 billion) of cash into the financial system via reverse-repurchase operations in a bid to ease any 'liquidity' or cash shortages, although such stimulus doesn't automatically reach beyond the financial sector.

Above: Euro-to-Dollar rate at 4-hour intervals.

The Euro has largely traded between 1.10 and 1.12 since early October, frustrating investors and traders due to the lack of volatility in the exchange rate. And the threat of a breakout to the downside had appeared to be growing until late last week when investor fears over the possible global economic impact, not to mention human cost, of the coronavirus escalated and emerging market currencies came under pressure.

"Rallies will need to regain the previous uptrend, which is now likely to act as resistance, which is located at 1.1088. A move above here will refocus attention on the tough band of resistance overhead at 1.1175-1.1240 – namely the 55 week ma, the 2019-2020 down channel and the recent high. This guards the 200 week ma at 1.1356, which continues to represent a critical break point medium term," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Jones has advocated that clients buy the Euro-to-Dollar rate at 1.1013, with a stop-loss around the 1.0950 level, which is comfortably below a crucial level of support that underpins the market around 1.0981.

She says the Euro is in the process of establishing a technical "base" on the charts following a post-April 2018 sell-off.

"The euro has posted an encouraging rebound from as low as 1.0992 on Wednesday (lowest since late November) as the 1.10 mark acted to limit the common currency’s steady decline since mid-January," says Juan Manuel Herrera, a strategist at Scotiabank. "Downside price action will be supported by its intraday low of 1.1019 and subsequently by the 1.1010 mark."

Above: Euro-to-Dollar rate at daily intervals.

The Euro: What to Watch

The Euro lagged major rivals throughout last week but was boosted sharply on Friday by a big crash and bang in emerging market currencies, which is something that could go on lifting the single currency in the week ahead.

Last week's newsflow from Europe was largely negative for the currency and especially so on Friday when the Euro made solid gains over the U.S. Dollar that helped constrain the upside in the Pound-to-Euro rate. GDP data from Italy, France and for the broader Eurozone all made for dire reading although that didn't stop the Euro from rising into the weekend, a move that was likely the result of a fierce sell-off in riskier emerging market currencies.

"Macroeconomic fundamental news has taken a back-seat and that might continue next week depending on how the coronavirus risk evolves in the coming days. With large parts of China effectively paralysed this will have global growth consequences, mainly for Asia and Europe," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

Above: Euro-to-Dollar rate at 4-hour intervals alongside Dollar-Rand rate (orange).

The Euro has become a popular 'funding currency' in recent years, which means it gets borrowed and sold in order to fund bets on higher-yielding emerging markets during the good times, and then bought back during the bad times when those emerging markets are under stress and investors are taking money off the table. Such a function tends to see the Euro-to-Dollar rate benefit temporarily during emerging market weakness.

That likely explains Friday's upward move, which could continue in the new week if China's Yuan weakens and its stock markets plummet overnight as many now expect will happen. However, the Eurozone is arguably the most exposed to an economic slowdown in China once the world's second largest economy's immediate neighbours are taken into account.

"We have decided to revise our CNY calls for Q1 and Q2 to reflect lower domestic and global growth, appetite by officials to sustain a weaker currency given its growing importance in the countercyclical programme, and reduced risk appetite. These are highly susceptible to revision given the progression of the coronavirus and the longevity of containment policies," warns Simon Harvey, an analyst at Monex Europe.

Coronavirus is the only story that matters for currencies and other markets this week, but especially the Euro.

The Dollar: What to Watch

The Dollar was the best performing major currency on an intraday basis Friday after climbing steadily through week as concerns about the spread of coronavirus lifted safe-haven assets and crushed risky assets, which is a trend that could continue in the days ahead.

January's non-farm payrolls will be released at 13:30 Friday and expectations for jobs and wage growth would normally dominate trading leading up to the event, although this week is likely to see the agenda set by coronovirus developments and policymaker statements in relation to it.

Markets are looking for 160k jobs to have been created last month and hourly wage growth of 0.3% month-on-month, although the only story that'll matter at least initially is the coronavirus, Chinese efforts to contain it and investor perceptions of the likely implications for economies and markets the world over.

The Dollar benefits more often than not during times of crisis and the spread of a new coronavirus inside and outside of China now threatens to turn the February month into exactly that, a time of crisis. The new pneumonia-like disease has spread from Hubei province to all 30 other provinces within China, leading to panic among parts of the domestic population, self-isolation and panic buying of some important goods such as respiratory masks.

Investors will be preoccupied Monday with the scale of losses seen in China's stock markets overnight as trading resumes following a week-long New Year holiday in which the number of officially declared infections rose from 4,515 at midnight on January 27 to 14,380 by midnight on February 01.

The number of "severe cases" has risen from 917 on January 27 to 2,110 while the number of declared fatalities has risen from 106 to 304. There are now 19,544 suspected cases, up from 6,973

Above: 10-year major economy bond yields shown at hourly intervals. Yields falling as risk-aversion rises.

Proxies for Chinese assets have pointed to between a 6% and 10% fall in equity benchmarks. A meaningfully larger fall could spook investors the world over.

This can only mean a stronger Dollar, Japanese Yen, Swiss Franc and Euro while potentially placing all other currencies at risk of losses to those majors. And that would be especially the case if price action in China's stock market does expose a gap between the situation as it's been disclosed by the government, and Chinese peoples' perceptions of it.

Already the expectation is for a severe hit to Chinese GDP in the first quarter, with a lesser impact on global growth.

City forecasters have so-far focused on assessing the impact the virus might have on Chinese and global growth this quarter, with a view to quantifying the likely implications for currencies and other asset prices. But governments and central banks could be forced into action a long time before first-quarter economic data ever reaches the market, with implications for exchange rates.

Some companies and households could face an acute shortage of cash-at-bank at the other end of a multi-week lay-up, or period of quarantine, which might necessitate a joint response from the government and central bank. And in the meantime, exchange rate volatility could increase if trading volumes fall due to uncertainty about the spread and overall implications of coronavirus.

The Peoples' Bank of China (PBOC) said at the weekend it will inject 1.2 trillion yuan (£130 billion) of cash into the financial system via reverse-repurchase operations in a bid to ease any 'liquidity' or cash shortages, although such stimulus doesn't automatically reach beyond the financial sector.

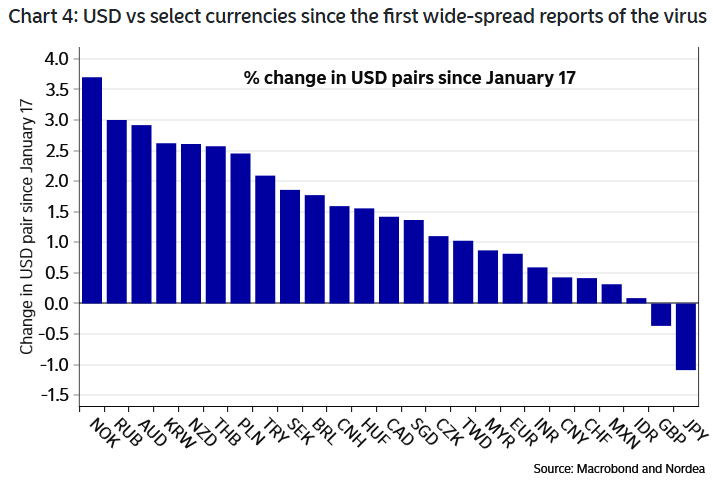

"The virus scare will (rationally) make market participants care less about “older” data," says Martin Enlund, chief FX strategist at Nordea Markets. "We fully understand if investors wish to stay away from more “virus-sensitive” currencies for now. This would include Asian currencies as travel bans and the like will weigh on activity in the region, and commodity currencies given how important China is for global demand."