Euro-Dollar Lifted by Shifting Political Winds but Growth Worries and ECB Weigh on Outlook

- Written by: James Skinner

Image © Adobe Images

- EUR boosted as Italian coalition helps lift sentiment and USD weakens.

- But Italian result alone doesn't solve ECB's problems, or alter outlook.

- UBS downgrades EUR growth forecasts, eyes ECB 'bazooka' in Sept.

- Others also look for ECB action this month, steer clear of the EUR.

The Euro was on it front foot Wednesday as the Dollar weakened and investors celebrated a decision by one of Italy's anti-establishment parties to enter coalition with its antithesis, averting the need for a general election, but analyst commentary suggests the outlook for the single currency remains bleak.

Members of Italy's anti-establishment Five Star Movement (M5S) have voted by a margin of four-to-one in favour of a governmental coalition with the Democratic Party (PD), it's political antithesis that supported installing the unelected and technocratic government of Mario Monti at the height of the debt crisis and that eventually became a stalwart of the painful EU-mandated austerity process.

The decision came after former Deputy Prime Minister and League leader Matteo Salvini sought to cash-in a large polling lead by forcing an early general election, which opened a window of opportunity for the negotiations that produced this week's paradoxical and incongruous alliance. Salvini, the anti-establishment renegade who stoked controversy with his migration policies and rhetoric toward the EU while leading the only then-elected party to oppose the Monti government in 2011, has now been ousted.

"Conte’s first government was the 66th in 73 years. Apart from a joint desire to avoid new elections and to keep League leader Matteo Salvini out of government, there is little love lost between the new partners. The upstart 5Stars have been the bane of the established PD for the past six years. Conte’s ability to broker compromises between the parties will be even more crucial than it was for his previous coalition," says Florian Hense, an economist at Berenberg. "The coalition faces a big challenge right away."

Above: Euro-to-Dollar rate shown at hourly intervals, alongside EUR/GBP rate.

The PD's fall from grace, and the election victories of M5S and The League in March 2018 that drove their ascent to high office, resulted from widespread discontent with austerity policies that had roots in Brussels. And delivering against Brussels' debt and spending targets will be the first big task of the coalition, which faces an October deadline for submitting its budget to the EU Commission for approval.

"Mr. Macron is blowing out the budget in France, the socialist government in Spain is once again postponing its budgetary “consolidation”, and even Germany is having to contemplate fiscal stimulus to counter a collapse in its key manufacturing sector. The formal rules in the EU’s fiscal compact won’t be changed anytime soon, but in practice the shift towards a more active fiscal policy now is underway," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

A coalition means Italy avoids another election for the time being, and circumvents a repeat of the clashes and war of words seen in October 2018 when Salvini's government submitted for approval from Brussels, a budget that made a mockery of the previous government's commitment to the rules. The next budget is due in October.

However, few analysts and economic pundits see the government enduring for long enough to provide markets with anything more than a moment of respite from battles over the budget and other policies. And the rub the for the Euro is that even if the government does endure, it won't be enough to disperse the storm clouds gathering overhead because it makes little difference to weakness of Eurozone growth and inflation that's expected to push the European Central Bank (ECB) into action this month.

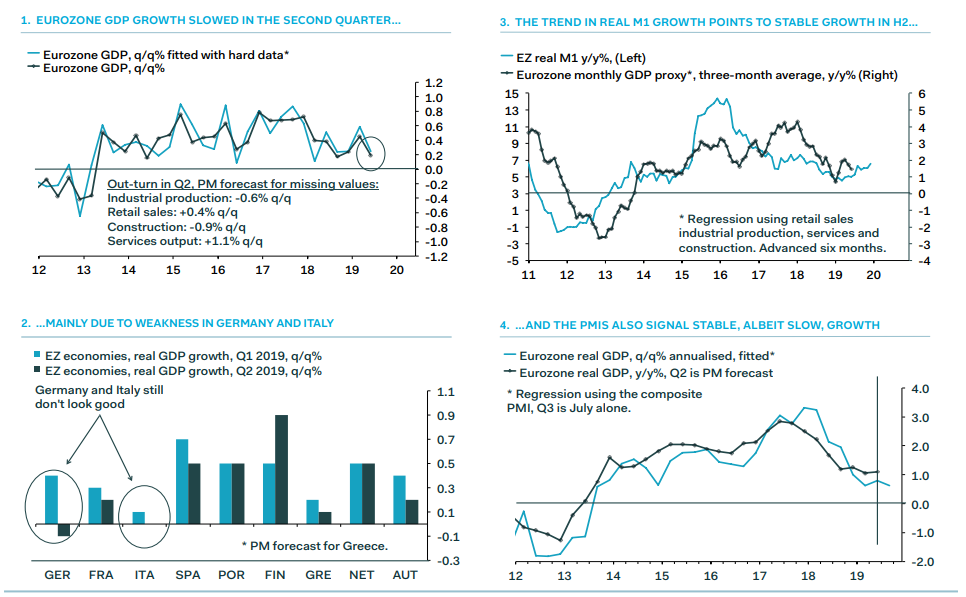

Above: Pantheon Macroeconomics slide showing Eurozone and member growth rates.

"The floorboards at 1.10 have broken in anticipation of the ECB's meeting next week. Here, we expect large-scale easing: -20bp in depo cuts and €40bn/month in QE. While the break lower in EURUSD came at month-end (making it hard to separate the signal from the noise), we are in agreement with the move," says Mazen Issa, a strategist at TD Securities.

The European Central Bank is widely expected to fire a 'bazooka' of some form at the financial markets on September 12 in an effort to lift inflation by stimulating the economy with lower borrowings. Markets expect the bank to cut at least one of its interest rates as a minimum in order to do this, but many also increasingly forecast the ECB will restart the quantitative easing program that it only just wound up back in December 2018.

A QE program see the bank buy European government and corporate bonds, as well as potentially other assets, forcing down yields (borrowing costs) in the process. Such a program would be billed as enhancing or otherwise quickening the transmission of lower borrowing costs into the real economy. However, the adverse side for the Euro is that such moves will mean investor returns from owning the single currency will fall even further, leading some of them to sell it.

"Today, we cut our Eurozone GDP growth forecast for 2020 by 0.3pp to 0.7%, which puts us well below the 1.2% consensus (dated 12 August). We maintain our 2019 projection of 1.1%," says Reinhard Cluse, an economist at UBS, in a note to clients Wednesday. "The Eurozone economy has suffered major damage as a result of weaker trade and the concern over rising protectionism...We highlight that a no -deal Brexit and US auto tariffs are not part of our new base-case scenario."

For all of the “geniuses” out there, many who have been in other administrations and “taken to the cleaners” by China, that want me to get together with the EU and others to go after China Trade practices remember, the EU & all treat us VERY unfairly on Trade also. Will change!

— Donald J. Trump (@realDonaldTrump) September 3, 2019

The Eurozone economy has been badly wounded by President Donald Trump's trade war with China, especially the German economy, even though it's not yet been targeted directly with anything more than tariffs on ome metals exports. The German and Eurozone economies are sensitive to developments in China because of their significant exports to the world's second largest economy, which is now expected to weaken even further in the months ahead.

President Trump went ahead Sunday with a new 15% tariff on $112 bn of goods imported from China each year, although there's still a further $190 bn worth of tariffs scheduled to take effect on December 15. After that point, all of China's exports to the U.S. will have been tariffed. But Trump's trade gripes don't end in China, but rather extend all the way to the very heart of the European Union.

The White House has already ordered a 25% tariff be imposed on cars exported to the US from the EU only implementation of those levies was delayed in the middle of May, for a period of 180 days pending the outcome of talks, talks which might not be going as well as they need to be. Trump wants the EU to cut its tariffs on imports of American cars and he's also demanding access to the French and European agricultural market for American farmers, which is a politically contentious move in some parts.

Above: Euro-to-Dollar rate shown at daily intervals, alongside EUR/GBP rate.

"In light of subdued data, the escalation in US-Chinese trade tensions, and signals from the ECB and its senior policy makers, we expect the ECB to deliver a comprehensive easing package on 12 September that will – contrary to our earlier call – also include new asset purchases," UBS' Cluse says.

Changes in interest rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

Eurozone core inflation, which is the measurement of price pressures most preferred central bankers, has not been above 1.4% in all of the time since the debt crisis and has recently fallen below the 1% level. The ECB is obliged to ensure inflation averages "close to, but below 2%" over the medium term, which normally refers to a period of around two-to-three years ahead, but this task is being made more difficult to deliver by slowing Eurozone growth that's sapping inflation pressures from the economy.

Eurozone GDP growth is forecast by the European Commission to come in at just 1.2% for 2019, while private sector forecasters like UBS' Cluse tip it even lower than that. This kind of economic growth is below what the ECB's calls 'potential growth' and estimates to be around 1.25%, which means the economy is not currently growing fast enough to generate any inflation pressures at all. And all this is without U.S. tariffs on EU cars or a 'no deal' Brexit, both of which are now in prospect for the months ahead.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement