Euro to Rise vs. U.S. Dollar Short-Term but Outlook Uncertain from October: Nordea

- Liquidity dynamics favour the Euro in the short-term

- U.S. debt ceiling impasse is raising USD liquidity

- Euro liquidity to rise in October if ECB restarts QE

The Euro will probably rise against the U.S. Dollar in Q3 but its rise will be short-lived and it could fall towards year-end and into 2020 say analysts at Nordea Bank.

The Nordic bank’s forecast relies heavily on an analysis of U.S. Dollar and Euro liquidity levels and the outlook for these has changed considerably over recent months.

Previously the bank had been outright bullish the Euro vs the Dollar as liquidity in the Eurozone had been expected to remain relatively constant whilst in the U.S. it had been expected to rise, due to the reaction of the U.S. authorities to the next debt-ceiling crisis.

Now, however, the bank has changed its view and it sees the initial thesis only relevant till the end of Q3. After that, the Euro is liable to weaken versus the U.S. Dollar as Euro liquidity rises after October 2019, and U.S. liquidity falls.

The main driver of this change in liquidity is the European Central Bank (ECB) which is expected to increase monetary easing after October 2019.

Since this will probably encompass a resumption of quantitative easing (QE) which involves the ECB buying up government and corporate debt in order to boost lending, it will also result in a surge in liquidity and a weaker Euro.

“From a bilateral liquidity perspective, such a QE program would still point to near-term upside in EUR/USD owing to USD liquidity effects, but in comparison to a no QE-scenario the uptrend won’t last into 2020,” says Martin Enlund, chief analyst at Nordea Bank.

The ECB started a new cycle of easing in March by extending their TLTRO programme, which offers Eurozone banks access to cheap credit.

Now it is rumoured to be considering even more impactful measures to boost growth such as quantitative easing (QE) and if it goes ahead it will accelerate liquidity levels in the Eurozone, and have a detrimental effect on the Euro.

Not all analysts believe that the ECB will opt for QE. UBS wealth management, for example, does not see the political will on the ECB’s governing council for more QE and expects a 20 basis point rate cut instead.

Nordea Bank and Bloomberg, however, both expect QE of 40 and 45bn Euros a month respectively, with Bloomberg seeing the governing council potentially relaxing their criteria for inclusion.

The argument for QE over an interest rate cut is that it would be ‘kinder’ to Eurozone banks.

A major share of bank profits come from interest earned on loans. If base rates are low, however, banks make less interest on their loans, reducing their profitability.

Given the Eurozone banking sector is already considered weak and undercapitalised the ECB may be averse to making things worse with another cut in interest rates.

Bank lending is also the predominant vehicle for funding in the Eurozone so such a move might be self-defeating.

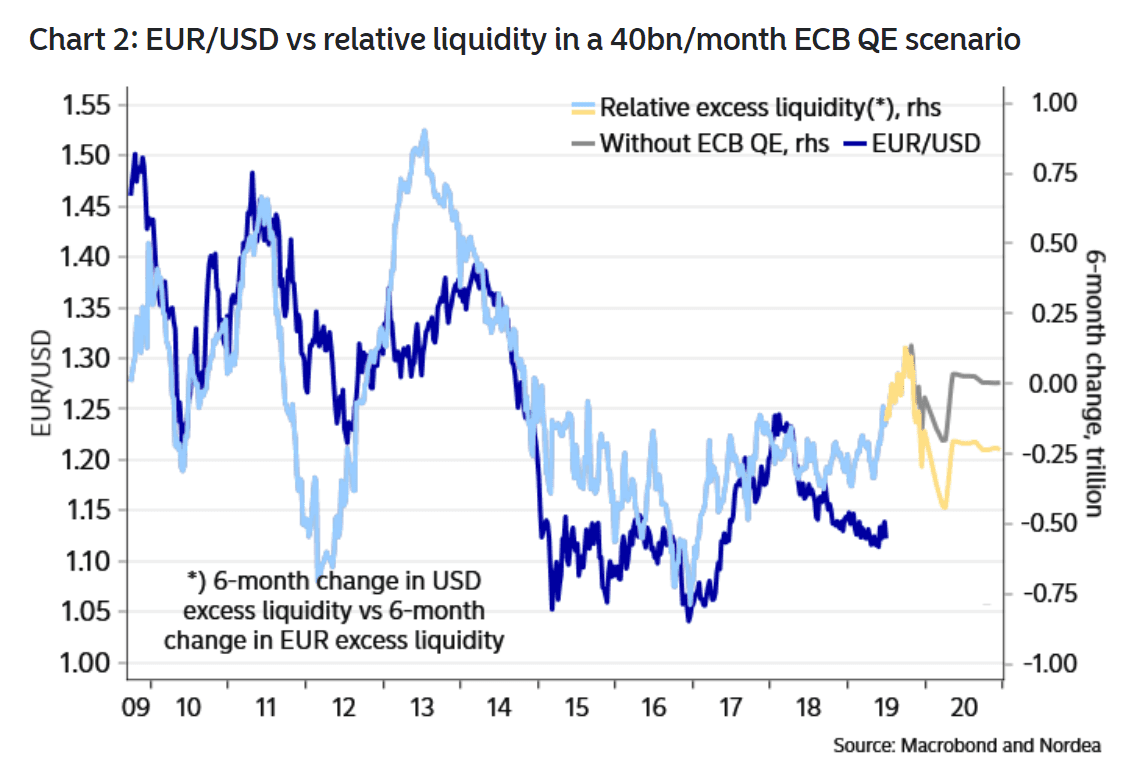

Nordea expects the ECB to introduce a QE scheme of 40bn of asset purchases a month. The chart below shows Nordea’s projections of liquidity in both a scenario in which the ECB resurrected QE at a level of 40bn Euros and one in which they did not.

As can be seen from the chart EUR/USD exchange rate tracks Euro and U.S. Dollar liquidity quite closely.

U.S. Dollar liquidity is linked to the U.S. debt ceiling which was once again touched in March 2019. Since then the U.S. Treasury has been using extraordinary measures such as drawing down its GCA account - a fund earmarked for national emergencies - and pumping the 350bn it had in there to keep the government afloat. This has driven up liquidity over the last 4 months and partly explains the Euro’s mysterious resilience versus the Dollar.

“The U.S. debt ceiling deadline will cause the US Treasury to draw down its GCA account with the Fed, pushing more USD liquidity into the private banking sector,” says Enlund.

The Treasury is expected to have emptied out its GCA account by mid-October, although according to a report in the LA Times this has been moved forward to mid-September.

After that, the U.S. government will either run out of money and shut down with the potential that the U.S. risks defaulting on its debt obligations, with extremely negative consequences for the U.S. Dollar.

Or if Congress grants an extension to the debt ceiling and avoids a government shutdown, the USD liquidity tide will reverse as the Treasury will start to refill its emptied out GCA account, which it likes to keep at around $350bn.

This will reduce liquidity in U.S. economy and lift the U.S. Dollar, just when the Euro is weakening from QE.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement