EUR/USD Forecasts Slashed at Morgan Stanley amid Growth and Trade Fears

- Written by: James Skinner

© Grecaud Paul, Adobe Stock

- EUR sits at one-week low after GDP boost as trade risks weigh.

- ING eyes 1.1260 as a range-top, as Morgan Stanley cuts forecasts.

- J.P. Morgan likes EUR higher, but contingent on economic recovery.

The Euro was languishing at a one-week low Wednesday after official figures confirming a pickup in the economy during the first-quarter failed to inspire a bid for the single currency, with the data coming as major banks continue to downgrade their EUR/USD forecasts.

Eurozone GDP growth was confirmed on Wednesday at 0.4% for the first-quarter, with the expansion having been aided by a solid pickup in the German economy at the start of the New Year. German GDP growth rose to 0.4% during the quarter, up from 0% at the end of 2018.

GDP growth picked up in Germany, Italy, Hungary, Bulgaria, Poland, Romania and Slovakia during the recent quarter, Eurostat's second estimate of GDP growth shows, although the most notable improvement is that in Germany given the size of the economy.

"The German economy came off to a pleasantly good start in 2019. After narrowly avoiding a technical recession in H2 2018," says Florian Hense, an economist at Berenberg Bank. "After a subdued Q2 (0.2% qoq), chances are that German growth can pick up on a more sustained basis throughout H2 (0.4% on average). Amid recently escalating trade tensions the downside risks loom large, though."

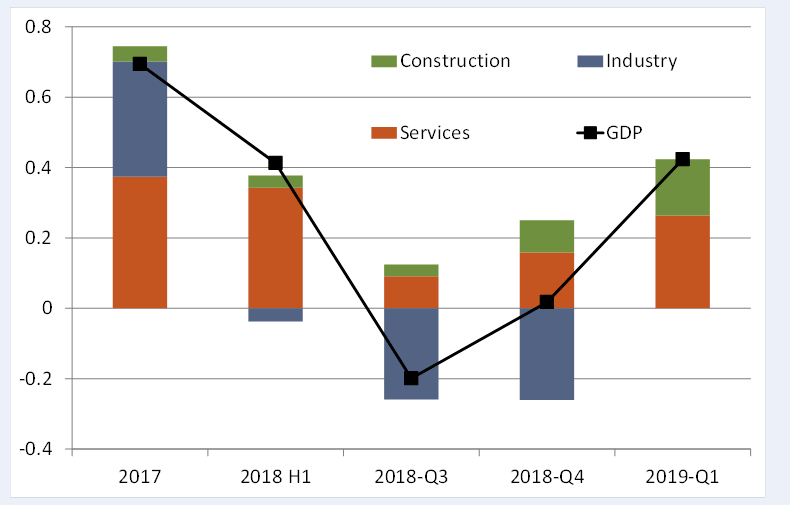

Above: Contributions to German quarterly GDP growth. Source: Berenberg.

Markets had feared a German recession late last year after growth turned negative in the third quarter of 2018 and the economy was left unchanged, with 0% growth, in the final quarter.

The U.S.-China trade war, fears over Brexit and new EU rules impacting production at car manufacturers were behind the slump, which came mainly from the industrial sector. The domestic side of the economy held up well.

"The European Commission slashed its German 2019 GDP growth forecasts from 1.1% y/y to 0.5% y/y. The year on year GDP growth forecasts of 0.5% is built on the following quarterly profile: Q1: 0.2% q/q, Q2: 0.1% q/q, Q3: 0.3% q/q, Q4: 0.4% q/q. Our economists believe these forecasts are too pessimistic," remarks Sue Trinh, Asia head of FX strategy at RBC Capital Markets.

All of this matters for the Euro because of what it might mean for European Central Bank (ECB) interest rate policy. The ECB needs much faster economic growth if it is to have any hope of seeing the wage and inflation pressures that are necessary for it to lift its interest rate.

The ECB abandoned in March earlier guidance that had suggested it could lift interest rates in Autumn this year, and now says that Eurozone borrowing costs will remain at their crisis levels "at least through the end of 2019".

Above: Euro-to-Dollar rate shown at 4-hour intervals.

"If the weak recovery in the Eurozone, renewed global trade tensions and flattening yield curves were not already bad enough for the Euro, it now has to contend with renewed populism out of Italy. Deputy PM Salvini said yesterday that he’s ready to break EU fiscal rules to get unemployment lower," says Chris Turner, head of FX strategy at ING Group. "1.1250/60 may well prove the top of the range for EUR/USD."

The Euro was unchanged at 1.1203 against the Dollar following the GDP report, but is down -2.29% for 2019, while EUR/GBP rate was down -0.02% at 0.8678.

Above: Euro-to-Dollar rate shown at weekly intervals.

Europe's single currency could now be slower to recover previous losses to the Dollar, according to Morgan Stanley and J.P. Morgan, given the fresh economic risks posed by President Donald Trump's latest offensive in the so-called trade war with China.

"Renewed US-China trade tensions not only translates to renewed global downside risks that are constructive the USD, but have specific read-through to other US trade policy initiatives," says Daniel Hui, a strategist at J.P. Morgan. "First is Section 232 auto tariffs, for which the nominal deadline for a decision by Trump is May 18th...Presumably, in light recent events and Trump's own rhetoric, the probability of a near-term auto tariff announcement, over a pass or a delay, has come up materially."

President Donald Trump has until the end of Friday to decide whether he will impose tariffs on cars imported into the U.S., which would impact the Eurozone and Japan if the proposed levies go ahead. This would be another economic headache for Germany and Europe, coming on top of the threat posed by the latest moves against China.

The White House has lifted from 10% to 25% the tariff levied on around $200 bn of annual imports from China and set the ball rolling on a process that could see a 25% tariff imposed on China's remaining $300 bn of exports to the U.S.

China has since retaliated by lifting to 25% the tariff levied from around $60 bn of annual imports from the U.S., and rhetoric from both the U.S. and Chinese governments toward one another is turning increasingly hostile, stoking fears of a protracted trade conflict.

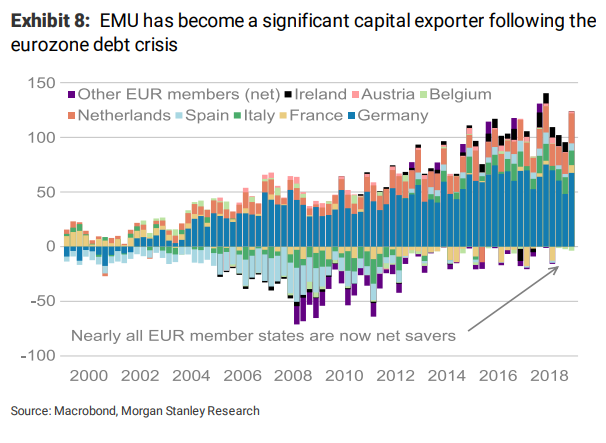

Above: Eurozone imports and exports of financial capital. Source: Morgan Stanley.

"Higher yields and better equity returns have prompted both foreign and domestic accounts to pivot their portfolios abroad. Meanwhile, EUR has become increasingly used as a funding currency, given its low yields and muted growth prospects," says Hans Redeker, head of FX strategy at Morgan Stanley. "Short-term protectionist risks may give EURUSD one final leg lower to 1.10, but we forecast a meaningful rebound from there, rising to 1.16 by year-end."

Redeker says the Chinese government is likely to continue attempting to stimulate its economy in 2019 and that this will be positive for the growth outlook in Europe. It was only after U.S.-China tariffs were implented in the third-quarter of 2018 that German and Eurozone growth really began to weaken.

Meanwhile, the U.S. economy is seen slowing later in 2019 while stock markets are also projected to weaken as a strong Dollar becomes an increasing headwind for earnings growth. The greenback has been supported by flows into the U.S. stock market in recent quarters so a reversal could hurt the currency.

Redeker and the Morgan Stanley team slashed their forecasts for EUR/USD in their mid-year outlook last week, knocking the year-end projection down from 1.25 to just 1.16 after a disappointing start to the year for the single currency. They're looking for the Euro to reach only 1.13 by the end of September.

"We expect a shallow medium term revival in the euro, but to little more than the forward rate on a one year horizon, predicated on the key assumption that the region’s economy is capable of delivering sustained growth close to 1.5% through 2H," says J.P. Morgan's Hui. "The precise timing and location of the inflexion point in EUR will hinge on the ability or otherwise of the region’s economy to get out of first gear."

Hui also forecasts the Euro-to-Dollar rate will end the 2019 year at 1.16, after climbing to 1.14 by the end of September. Those forecasts are unchanged from one-month ago, although the bank has lifted its projection for the Dollar index and now expects it to hit 97.80 in June before declining to 94.80 at year-end.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement