EUR/USD to See New Lows in 2019 says Barclays

- Written by: James Skinner

© Pound Sterling Live

- EUR/USD rate will fall to new lows in 2019 says Barclays.

- As the ECB outlook darkens and the USD still reigns supreme.

- But Societe Generale says a recovery to 2018 highs is in sight.

The Euro-to-Dollar exchange rate will fall to new lows next year, according to the latest forecasts from Barclays, as the European Central Bank (ECB) outlook darkens, political risks linger and the greenback remains top-dog in currency markets.

The Dollar will remain dominant next year, Barclays says in its 2019 outlook, as the Federal Reserve (Fed) goes on raising its interest rate and unease over the U.S.-China trade relationship continues to support the safe-haven greenback.

Fed policymakers will be raising their interest rate at the same times as the ECB comes around to the realisation that Europe's inflation outlook is not nearly as robust as the central bank's forecasts have led markets to believe.

That will renew and reinforce the them of growth and monetary policy divergence that has been behind the 9% upward swing in the Dollar index since April 2018, keeping the Euro on its back foot.

"We think markets have overreacted to the subtle change in recent Fed rhetoric and still envision gradual, quarterly Fed rate hikes. In contrast, we think risks to the EUR are still skewed to the downside," says Marvin Barth, head of currency strategy at Barclays.

Barth and the Barclays team says Italian politics and a recent turn for the worse in European economic data mean risks to the single currency outlook are still slanted to the downside.

All of this means core inflation, which refers to the consumer price pressures left over after energy and food items are removed from the goods basket, will remain low for a while yet.

Core Eurozone inflation fell from 1.1% to 1% in October. That is exactly the level it was at in January 2018 and is only 10 basis points, or 0.1%, above the level it was at in January 2017.

As a result, the European Central Bank has not made any real progress toward its inflation target, in underlying terms at least, over the last two years.

Yet the bank continues to claim inflation is making a sustainable return to the target of "close to but below 2%", which will enable it to begin lifting interest rates once "through the summer of 2019".

"Core EA inflation remains low and will likely be lowered in the ECB’s projections, implying only very gradual normalization in monetary policy," says Barth. "A potential no-deal Brexit adds further downside risks to our EUR view, given the UK’s deep integration into the EU economy and supply chains."

Above: EUR/USD (red & blue) and 2-year U.S.-German 'yield spread'.

The EUR/USD rate was down -0.13% at 1.1340 Tuesday and has now fallen -5.2% for 2018, while the EUR/GBP rate was -0.28% lower at 0.9015 but has risen 2% in 2018.

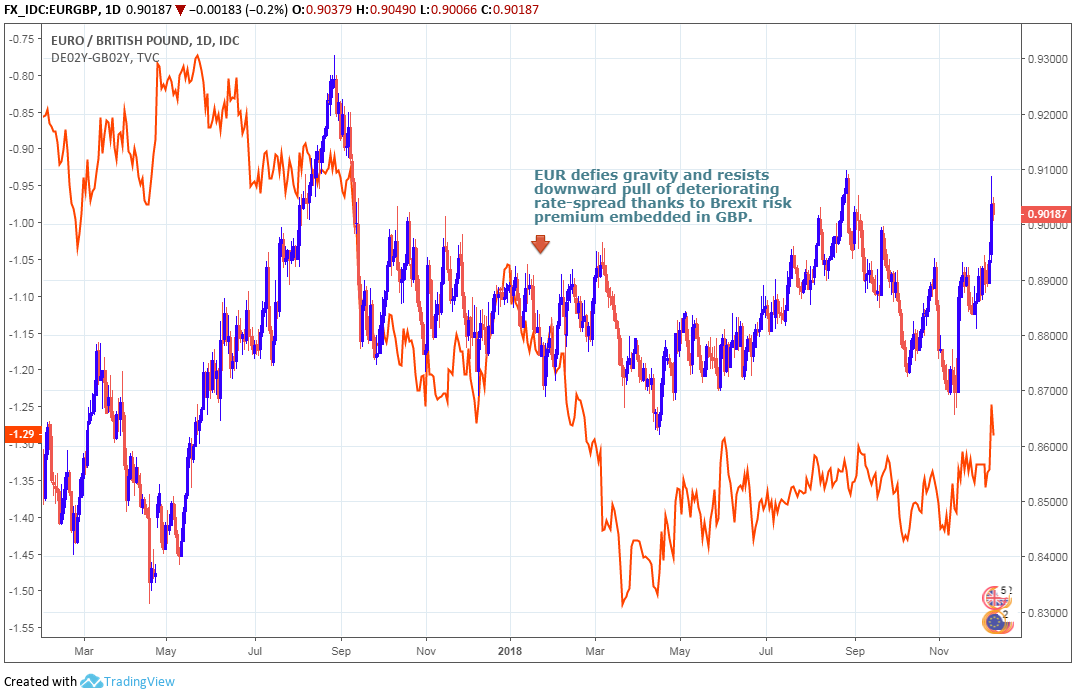

Above: EUR/GBP (red & blue) alongside 2-year German-UK 'yield spread'.

Barth says the ECB will next year be forced to cut its forecasts for inflation, and take a more gradual path toward a normal interest rate structure.

This, and the strong U.S. Dollar, are forecast to push the Euro-to-Dollar rate down to 1.12 in the first-quarter of 2019 and to keep it there throughout the coming year. Others have different views though.

"Weak growth, an easy ECB policy that is still crowding investors out of European assets, concerns about the impact of Brexit and of US import tariffs, not to mention nagging concerns about the durability of the whole project, have undermined the euro," says Kit Juckes, chief FX strategist at Societe Generale.

Juckes says things can hardly get much worse for the Euro given the boom-to-bust swing the EUR/USD rate has undergone in 2018 and the litany of headwinds that have clobbered the currency.

However, he flags the direction of China's Renmimbi and a still-present risk that President Donald Trump imposes tariffs on cars imported into the U.S. from Europe as significant threats to the currency next year.

"These are real enough threats, along with the ongoing Brexit uncertainty and spat over the Italian budget, to make diving in to buy the euro at the start of 2019 a risky idea. However, by mid-year we expect the economy to be back on a sounder footing," Juckes writes, in Societe Generale's 2019 outlook.

Juckes and the Societe Generale team acknowledge the risks that still threaten the Euro and despite these, project a gradual recovery for the Euro-to-Dollar rate in the second half of 2019. The reason behind this outlook that differs so much from that of the team at Barclays is because of house view on the Dollar.

Societe Generale forecasts the Dollar will decline next year as the economy slows, markets get their first glimpse of the likely end point for the Federal Reserve rate hiking cycle and as investors begin to focus increasingly on U.S. fiscal vulnerabilities such as the 'twin deficits'.

Juckes says the EUR/USD could fall to 1.13 in the first-quarter of 2019, but that it will then rise to 1.15 and 1.22 over subsequent quarters, before ending the year around 1.25. Only time will tell whether it's Barclays or Societe General that is on the money.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here