Euro Set to Rise Again say Crédit Agricole

The Euro is set to resume its uptrend after temporarily trading lower due to political risk factors say's Crédit Agricole's Head of G10 FX Strategy, Valentin Marinov.

The single-currency temporarily weakened after German elections, which saw an increase in the anti-EU vote, and then again after the Catalan referendum, but Marinov reckons these factors are expected to dissipate and the Euro recover as a result.

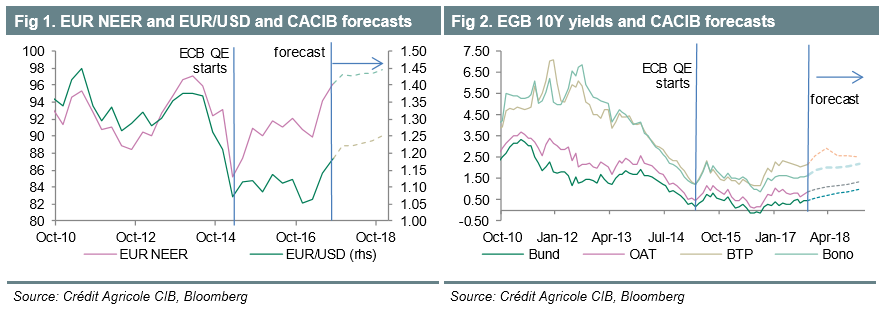

The European Central Bank (ECB) is meanwhile expected to announce the reduction of monetary stimulus at its October policy meeting, a move which will almost underpin Eurozone bond yields in turn attracting foreign investor capital giving the single currency a boost.

All, in all these factors, keep Crédit Agricole 'long' on the Euro says Marinov.

Catalonia Steps Back from the Brink

The Catalan's have stepped back from the 'brink' by not declaring independence unilaterally, and the most probable result will be regional elections in 2018.

"All in all, we expect that the ‘Catalan independence drama’ would lose its intensity from here. Growing prospects of a snap election in Catalonia in early 2018 could turn into a drawn-out process with relatively limited FX and EGB (European Government Bond) market impact in the near-term," says Marinov.

The waning significance of the crisis means investors can now concentrate on improving economic fundamentals and ECB policy which are both positive for the Euro.

Italy into the Breach?

The Euro's calendar is however not completely devoid of political risk.

Italy is set to hold a general election in early 2018 (March-May) and many fear the impact of the emergence of an anti-EU vote there.

Yet although the single currency may take a hit in the run-up to the elections, Marinov does not see an "existential threat" to the Euro.

"While a potential victory for the anti-establishment parties will be an upset for the EUR-bulls, we doubt that it will pose an existential threat to the single currency. In particular, we note that it would be close to impossible for the likes of M5S to push for a binding referendum on EUR," he says.

Crédit Agricole's base case is for a coalition of major parties including the current reigning Democratic Party to reign; an outcome which would be a relatively benign for the single currency.

Marinov notes how investors appear to be comfortable with the risks associated with an Italian election based on options valuations, which are often an accurate method of determine sentiment in relation to high risk events.

"This could be an indication of market perception that risks around the event are quite modest or a reflection of market expectation that EUR/USD could go higher heading into next year (we forecast EUR/USD at 1.22 in Q118)," says Marinov.

The downside to this complacency is that the market will be unprepared for a negative outcome and may fall steeply as a result.

ECB Stimulus - and its Reduction

A key driver for a higher Euro is likely to be the stimulus reduction plan of the ECB, which is expected to be implemented in 2018, although it is exected to be announced either at the next meeting in October or in November.

Crédit Agricole's base case is for the ECB to strike a trade-off between wanting to keep financial conditions accommodative so as not so spoil the fragile recovery but to reduce asset purchases due to the increasing scarcity of available bonds.

This should result in a programme with a longer timeframe of 12 months but at a lower monthly level of only 20bn.

Crédit Agricole thinks the market will react positively in the short-term from an FX perspective by focusing on the lower monthly level of purchases.

"Investors may downplay the significance of any long-term extension to the programme and focus on the sharply lower monthly purchases instead. This much could push EGB yields and EUR higher," says Marinov.

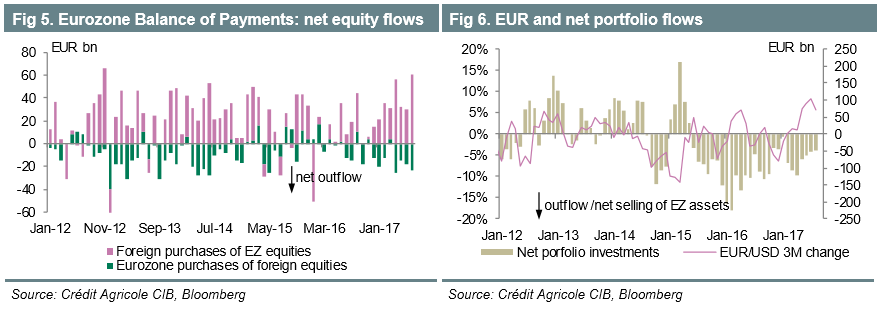

In the longer-term, the Euro is set to gain even more of a boost from a repatriation of assets back into the Eurozone from an unwinding of Euro-funded 'carry'.

"This may grow into an important development in 2018, which, when combined with the still ongoing equity inflows into the region, could push the Eurozone net portfolio flows back into positive territory and propel EUR higher still over time," says Marinov.