Bets for more Euro Strength Surge: Latest IMM Data Suggests GBP/EUR Exchange Rate to Struggle

- Written by: Gary Howes

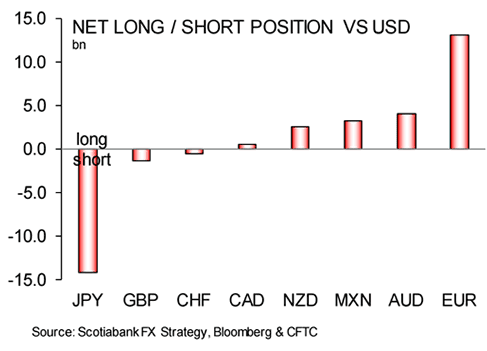

Pound Sterling continues to look vulnerable to further losses against the Euro suggests the latest snapshot into how traders are betting on the foreign exchange market.

Insights into the sentiment amongst currency traders are provided in the weekly snapshot of foreign exchange market positioning provided by the U.S. Commodity Futures Trading Commission.

The most recent data shows positive sentiment towards the Euro continues to build with latest market positioning data - a snapshot of how traders are betting on currency markets.

The Euro is far and away the currency everyone is betting on to deliver further gains and this suggests GBP/EUR is likely to remain under pressure for some time.

"EUR bulls are in control driving a $1.2bn w/w build in the net long to $13.2bn—a fresh multi-year high," says Shaun Osborne, a strategist with Bank of Nova Scotia. "In terms of details, gross longs are at a fresh record (200K contracts) and gross shorts are at the narrower end of their multi-year range."

There is meanwhile a net positioning against Pound Sterling with the market positioned against the currency; this data is instructive in suggesting where the momentum on the Pound to Euro exchange rate lies.

The positive sentiment towards the Euro comes as markets prepare for the European Central Bank to soon announce how it plans to exit its stimulus policy aimed at growing the Eurozone’s economy.

This stimulus has for a long period kept the Euro at artificially low levels, and now that the ECB is looking to exit the stimulus programme a journey higher to fairer levels is underway.

What's more, at their July policy meeting the ECB indicated that they were not concerned about the rising value of the Euro which could work against their objectives of supporting the Eurozone economy. Many saw this as a sign the ECB would not look to stand in the way of the Euro's rise.

“The ongoing rise in the exchange rate must be due to a shift in expectations for unconventional monetary policy,” says John Higgins at Capital Economics.

Higgins notes that the ECB is in no rush to exit its programme of supporting the economy and this should provide some reassurance to those watching weaker Eurozone states that could suffer were the ECB to suddenly cut the stimulus cord.

“A “go-slow” approach would reduce the risk of the central bank derailing the economic recovery, which would help to explain why peripheral EGBs have fared better than Bunds and why the euro has also risen,” says Higgins.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

What Next? UK GDP Dominates Near-Term Outlook

Sterling remains under long-term pressure against the Euro which shows little sign of easing at this stage.

However, against the US Dollar, it would appear some decent support is building and the multi-year lows below 1.20 appear unlikely to be tested again.

The next few days will see little by way of economic news releases to drive short-term movements in Sterling save for the release of second-quarter GDP data from the ONS.

UK economic growth has cooled sharply in 2017 with the first-quarter registering barely any growth.

However, there are signs that the economic pulse has picked up somewhat in the second-quarter.

“2017Q2 GDP is likely to improve slightly on last quarter's weak print, but we do see risks that it could come in softer than consensus, especially as car registrations fell 25% q/q on tax changes. Net trade likely provided a boost after dragging on Q1 growth,” note TD Securities.

Economists are forecasting quarterly GDP growth of 0.3%, up from the previous quarter’s 0.2% growth.

This leaves us with an annualised reading of 1.7%.

The data is released at 09:30 on Wednesday, July 26.

With sentiment already so negative on Sterling we wouldn't expect a massive sell-off on any disappointment. Rather, we would say risks to the upside are elevated; i.e any positive release could see a sizeable jump.

We would however expect strength to be short-lived unless a positive shift in sentiment surrounding the Brexit debate occurs.