Euro to Pound Exchange Rate: EUR/GBP at Key Reversal Stage, Tipped to go Lower Medium-Term

- Written by: Gary Howes

- 1 EUR to GBP = 0.8559

- 1 EUR to USD = 1.0675

We consider the Euro's outlook against Pound Sterling drawing on the views of leading names in the technical analysis industry.

From a technical perspective we are starting to fancy the Pound's chances from here.

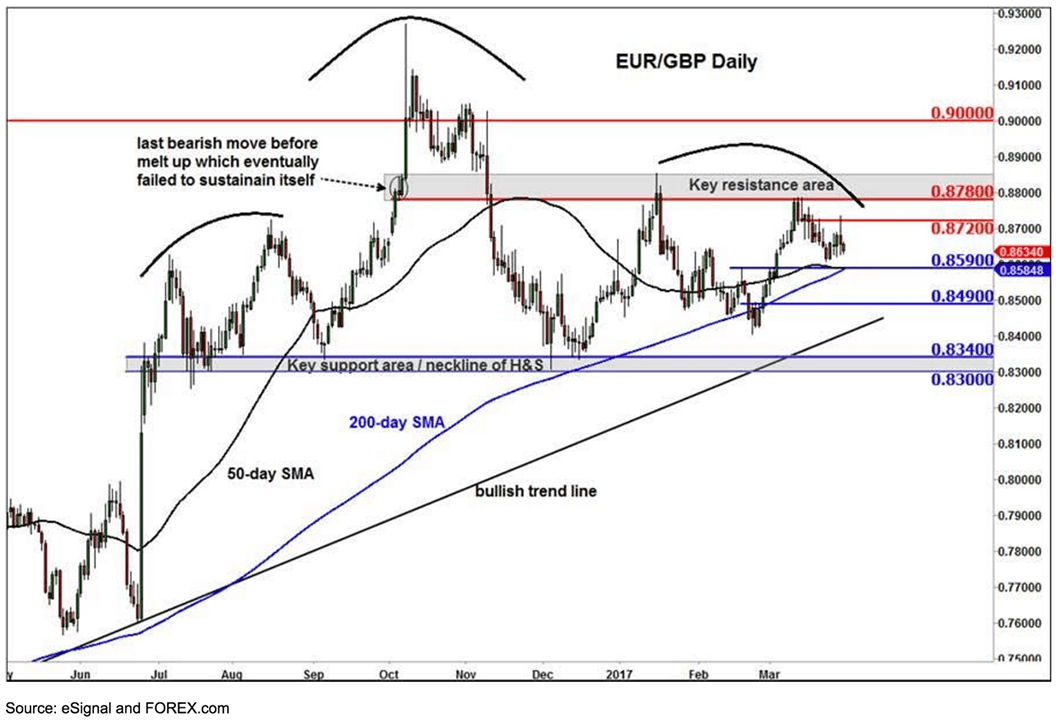

Indeed, fresh analysis suggests the Euro to Pound exchange rate may be in the process of forming a complex Head and Shoulders reversal formation, potentially pointing to a significant change in tide.

This is essentially a formation whereby a trend reverses.

“The cross has now failed twice to break the key resistance zone above the 0.8780 area, the second attempt resulting in a lower high. So it could be forming the right shoulder here,” says Forex.com’s Razaqzada.

But the analyst notes the cross still remains well above the neckline and key support area of 0.8300-8340 and also above the still-rising 200-day moving average (0.8585/90), which objectively tells us that the long-term trend is still bullish.

However will it now head decisively lower?

“To have any chance of doing that, it will first need to break below short-term support levels at 0.8590 and 0.8490, levels which were formerly resistance,” says Razaqzada.

Elsewhere, Richard Perry, a technical analyst with Hantec Markets has designated EUR/GBP as his 'chart of the day'.

Perry asks whether Sterling has finally started to engage a short-covering rally?

"With record short positions on sterling building up in recent the risk is for a short-covering rally in the wake of removing the uncertainty of Article 50. Euro/Sterling had a key move to the downside yesterday which broke the pair to a four week low and seemingly sets the pair free for further downside," says Perry.

A short-covering rally is the process whereby a one-sided bet is reversed and market participants are forced out of the market. With betting against the Pound being so popular and reversal in the trend can set off a chain event of traders closing these bets as their stop-losses are triggered.

Perry notes the following indicators coming from EUR/GBP:

- The market has been consolidating around the old £0.8650 pivot in recent days, but two sharp bear candles is starting to drive some direction.

- The RSI is confirming the near term break down with MACD lines corrective within a ranging phase and the Stochastics negatively configured for the near to medium term.

- The hourly chart shows a near term break below £0.8602 and this now means that there is a band of resistance on the hourly chart initially between £0.8602/£0.8615 with the Marabuzo line (centre line retracement) of yesterday’s session is at £0.8610.

"Rallies are now a chance to sell and also anything between £0.8600/£0.8650 to acts as a near term sell zone. Key resistance for downside bias towards the February low at £0.8400 comes in at £0.8735," says Perry.

Longer-term, analysts at Lloyds Bank say it is unclear if the declines from last October’s highs are corrective, or part of a more complex topping process.

"A break of 0.8300-0.8250 key support would suggest a meaningful top developed, with 0.80-0.78 next support. But, while over, we cannot rule out an eventual re-test of the ‘flash crash’ highs and potentially the 2009 highs at 0.9802," say Lloyds in a briefing to clients.

Elsewhere, David Sneddon at Credit Suisse notes that Thursday’s sharp fall removes key support in the form of the 55-day average and the 50% retracement level at 0.8601/.8591.

The breakdown has also seen the 200-day average at 0.8586 brushed aside, and Sneddon now turns his attention tto the 61.8% retracement level at 0.8550/44.

“We would allow for a bounce here, but beneath would open up a further sell-off to the lower of the range to 0.8495 ahead of the range lows at 0.8435/01,” says Sneddon.

Political Risks Shift

After the non-event that was the triggering of Article 50 eyes are turning elsewhere for the next ‘big thing’ on foreign exchange markets.

Because the media-currency complex loves politics as an explainer of foreign exchange market moves it makes sense that France should start to fall under increased scrutiny.

The popularity of National Front leader Marine Le Pen has markets and commentators fretting that should she win France will be heading for the European Union's exit door.

“The focus is slowly turning away from Brexit to a potential Frexit with upcoming French elections in April,” says Fawad Razaqzada, an analyst with brokers Forex.com.

The call comes as the EURGBP exchange rate flirts with further downside having briefly dipped below 0.8585/50 support this week.

The implications of a Frexit are however much more serious than Brexit owing to France's membership of the Eurozone; leaving the currency union would shake markets to the core as we have noted recently.

“Even after the defeat handed out to Geert Wilders in the Dutch election, it is far from certain that Le Pen will fail,” says Dr Jörg Krämer at Commerzbank in Frankfurt. “Her voter base is highly motivated, and it is also unclear whether conservative voters would really vote for former socialist Macron in the run-off.”

In the near-term, the Euro exchange rate complex would likely come under pressure even were polls to show that Le Pen were making fresh progress.

“Given this uncertainty, the Euro could come under pressure in the coming weeks and months,” says Razaqzada.

That said, for now odds of a Le Pen win are receding, Oddschecker now expects a 24% chance of victory for Marine Le Pen in the French Presidential election in May.

Nevertheless, a 24% chance is still a chance and a number of analysts believes the EUR/GBP may start to ease as speculators potentially reduce their record net short positions in GBP and increase their bearish bets on EUR.

“However the long-term outlook on GBP remains uncertain, so we are only expecting – at this stage – a moderate GBP recovery relative to EUR,” says Razaqzada.

Food for Thought: Germany Could be the Next Threat to the Pound

Also drawing on the Eurozone political risk factor is Kathleen Brooks at City Index who says Germany could be a potential headache for Sterling.

“Risks are now centring on Germany and the prospect of Merkel losing in September’s election and Social Democrat Martin Schulz winning. If this happens then it could de-rail the Brexit negotiations and make it harder for the UK to get a sweet deal,” says Brooks in a note to clients.

This is certainly one risk factor to watch over coming weeks and we can say with confidence markets are not appreciating this issue in the slightest.