Pound Expected to Retreat Further Against the Euro, PM May's Speech to Offer no Relief

- Written by: Gary Howes

David Sneddon, Managing Director of Global Strategy Technical Analysis at Credit Suisse gives his latest projections for the Pound to Euro exchange rate.

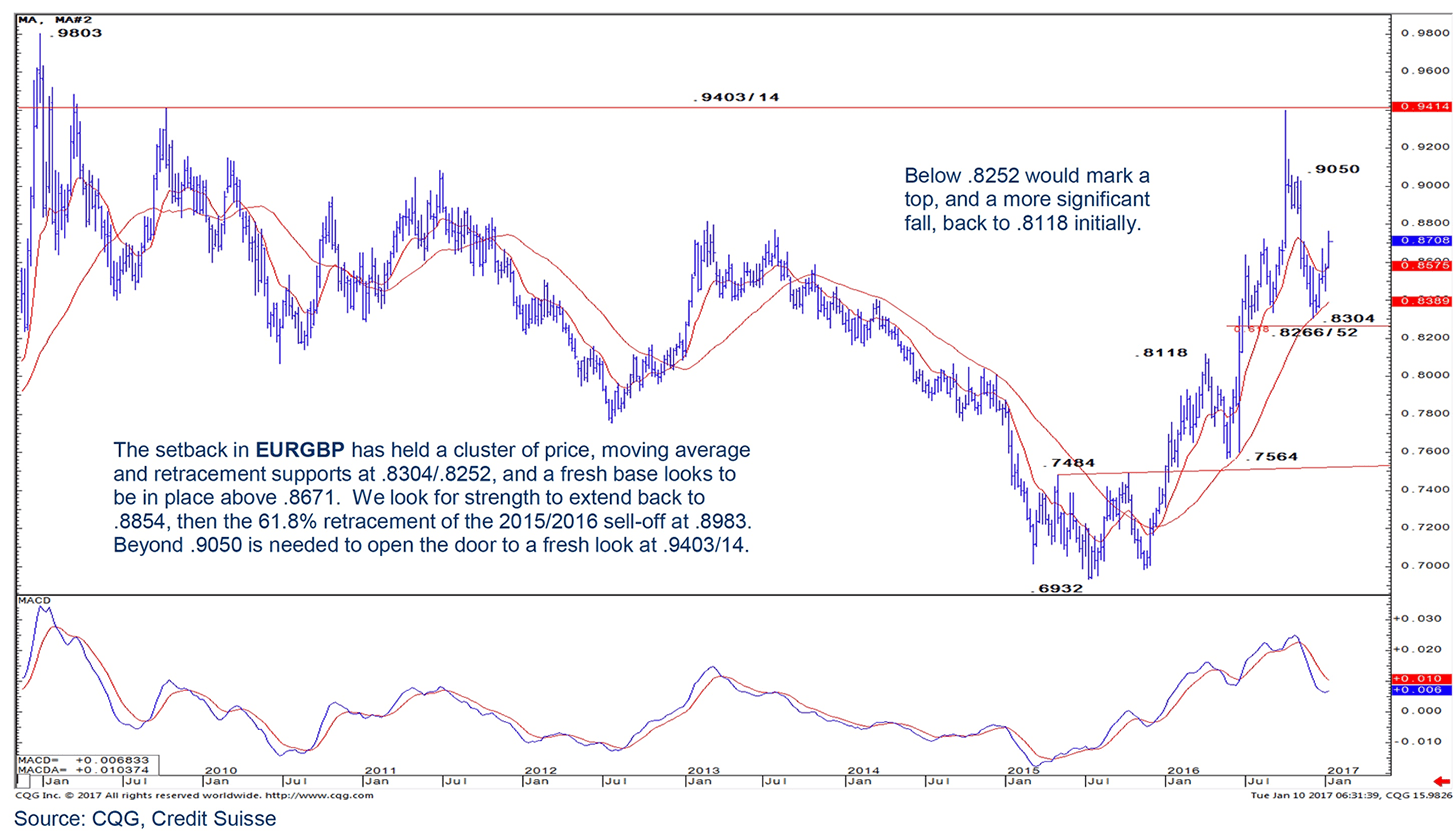

The analyst has looked at price action through the December 2016 through January 2017 period and believes the Euro has now established a fresh base against Sterling after holding a cluster of key supports.

The Euro fell against the Pound through from November into December as the single currency was one of the bigger losers of Donald Trump's victory in the US Presidential elections.

This period of weakness has however now come to an end.

"The setback in EUR/GBP has held a cluster of price, moving average and retracement supports at 0.8304/0.8252, and a fresh base looks to be in place above 0.8671," says Sneddon.

Credit Suisse look for Euro strength to extend back to £0.8854, then the 61.8% retracement of the 2015/2016 sell-off at £0.8983.

A break of £0.9050 is needed to open the door to a fresh look at £0.9403/14 says Sneddon:

A translation for those looking at this pair from the other way around, i.e. a GBP into EUR conversion:

Resistance to any further Pound Sterling strength is seen at €1.20/1.2118 while a fresh high is established at €1.1532. Credit Suisse look for fresh weakness to extend back to €1.1294, then the 61.8% retracement of the 2015/2016 rally at €1.1132.

A break of €1.1050 is needed to open the door to a fresh look at €1.0635/22.

For the investment bank's view on the outlook facing GBP/USD, please see here.

Outlook: PM May's Speech Unlikely to Aid the Pound

The Pound has suffered another bumpy ride this week, as concerns about the economic impact of a hard-Brexit have returned.

Pound Sterling began the week on a shaky footing, following a Sky News interview in which Theresa May strongly implied that the UK would cease to be a member of the Single Market after it leaves the EU.

"The Pound’s decline was only halted following Donald Trump’s poorly-received press conference which, emphasised the fact that markets appear to have previously focused more on the “good elements of Trump’s plan, such as the fiscal stimulus, rather than some of the “bad” bits such as trade wars and the building of a wall between Mexico and the United States," says Paul Hollingsworth at Capital Economics.

But the rally in sterling proved short-lived, with Theresa May’s announcement that she would give a speech next week laying out the Brexit plans in more detail generating a drop in the pound.

"It is doubtful that we will gain much new information from Mrs. May’s speech. It has looked likely for a while that the UK will leave the single market," says Hollingsworth.

And this week press reports suggested that the Government is preparing to lose the Supreme Court case, meaning that it still has to get a Brexit bill through parliament in order to trigger Article 50.

"But even if the UK is not a member of the EU single market, there are still a myriad of possible arrangements, with WTO rules only at the “harder” end of the scale, and a series of bi-lateral deal coupled with limited controls over migration and some budgetary contributions at the “softer” end. We doubt that the speech will cast much light over the exact composition of any new arrangement," says Hollingsworth.

However, other factors could also keep the Pound low according to Capital Economics.

Relative interest rate expectations between the US and the UK point to further weakness in cable in the near term.

By contrast, the Pound has performed a bit better against the Euro, and lingering political uncertainty in the

euro area could mean that this trend persists.