British GBP/EUR Rate: Forecasts for a Critical Week Show Downside Risks are Fading

The week ahead promises to be critical for the pound to euro exchange rate (GBP/EUR) as key developments on the charts meet a slew of economic data releases out of both the UK and Eurozone.

The pound to euro rate is today trading at 1.2482, a shade off Friday's close at 1.2487. It was a poor start to the new month with the exchange rate falling from an opening level at 1.2629 amidst a broad-based euro rally.

The move lower has made developments on the GBP to EUR charts interesting as the rate has broken below the previous 15-month bottom at 1.2579 established on March 24.

The question is whether this constitutes a breakout below the lows of the range which has been forming since the pair bottomed on February 25.

For confirmation a move below 1.2500 would be necessary to assure a probable breakout, with the expectation thereafter that the pair would fall to a target at 1.2360.

However, because it is April now the monthly pivots have recalculated and the S1 is now situated not far below the range lows at 1.2452.

Monthly pivots are a product of the previous months’ high, low, close and open and traders use them as focal points where prices often change direction.

The S1 monthly pivot is likely to be a tough obstacle to overcome as traders tend to cluster buy orders along it in anticipation the pair will bounce once it touches the level.

Therefore with the pivot so close, we are bearish, but cautiously so as there is a heightened risk the down-move will fail to reach its target.

Latest Pound/Euro Exchange Rates

| Live: 1.1519▲ + 0.28%12 Month Best:1.2133 |

*Your Bank's Retail Rate

| 1.1127 - 1.1173 |

**Independent Specialist | 1.1358 - 1.1404 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.

Downside Pressures Could Ease Suggest Commerzbank

We remain attuned to the fact that the recent decline in sterling-euro may become over-extended.

Indeed, the GBP to EUR has now more or less plunged towards the target held by Commerzbank at 1.2453 / 1.2399 suggesting this leg of the move lower may be coming to an end.

Commerzbank’s technical analyst Karen Jones cited this level as a target as it is the measurement lower from the peak 1.3348 - 1.4415.

Friday’s low came very close to here (1.2470).

Commerzbank now look for the down-move to start to struggle shortly - the 2008-2016 support line is located just below here at 1.2252 so downside scope is now considered to be limited.

Key resistance to any up-moves remains the four month downtrend line and 55 day moving average at 1.2807 / 1.2703 and these maintain downside pressure.

Why is the Pound Falling Again the Euro Again?

The main reasons the pair is falling, is recent strength in the euro due to investors now not expecting the European Central Bank (ECB) to use more easing to stimulate the euro-zone economy.

Central banks use monetary easing to lower borrowing costs for businesses and households in the hope that this will encourage them to borrow and spend more.

The ECB has already launched several easing programmes, most recently in December and March. Whilst previously investors were divided in whether they expected even more easing a consensus seems to have emerged that the ECB won’t.

Add to this mixed messages from the Federal Reserve about their monetary policy and the result is the dollar falling out of favour and the euro gaining:

“Fading expectations for Fed rate hikes and the notion that the ECB may be done cutting rates could see the impact of a divergent policy outlook between the U.S. and the euro zone fade,” say Commonwealth Foreign Exchange.

Another possible factor could be fears about the impact of Brexit on foreign investment after recent Current Account data for Q4 showed a the widest deficit since records began in 1955, which was caused by a fall in demand for UK government debt from foreign investors.

The reason for the sudden fall given by commentators has been investor uncertainty over the result of the EU referendum and potential fallout thereafter.

What to Watch in the Week Ahead

March Meeting ECB Minutes to be key - expected to be released on Thursday April 7.

The March ECB minutes could shed light on the big question currently facing currency markets which is: will the ECB increase stimulus?

According to BofA it will be closely scrutinised:

“Next week's focus is likely to centre around the March ECB minutes. We expect the accounts to not only offer further detail into the decisions taken last month, but also to provide an insight into what path the ECB may follow should they have to act again.”

Given the euro is currently appreciating as a result of expectations that the ECB will follow Draghi’s exhortation not to cut rates any lower, the minutes will further clarify the issue.

Other Data in the week ahead:

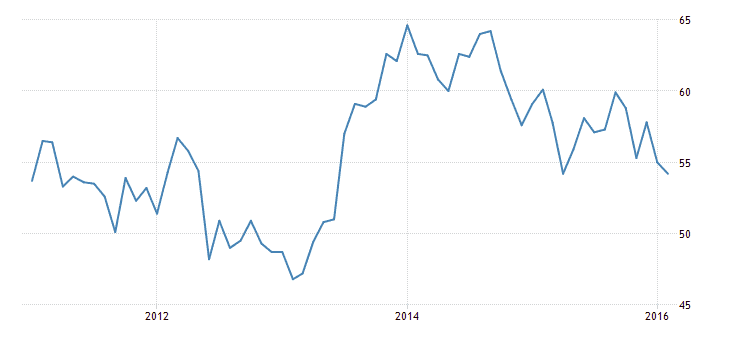

Monday sees the release of Construction PMI, which is expected to decline further to 54.0 from 54.2 in February. This would be in line with the general down-trend, and would also constitute a more than 18-month low for the metric.

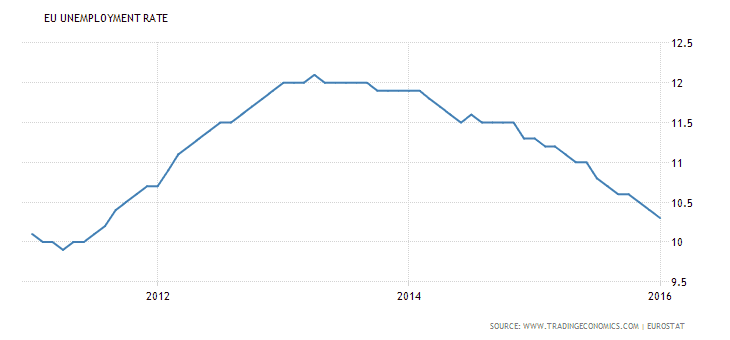

On the same day we have the Unemployment rate from the Euro-zone which is forecast to remain at its current level of 10.3. Euro-zone unemployment has been in a down-trend since peaking at 12.1% in May 2013.

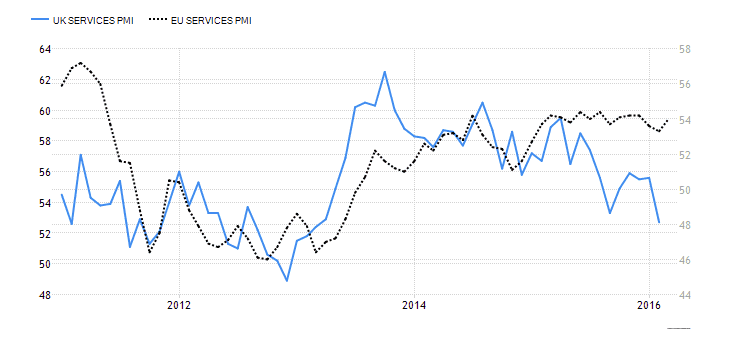

Eurozone Services and Composite PMI are then released on Tuesday April 5. Services PMI is forecast to 54.0 from current 18-month lows at 52.7.

Euro Area Services PMI is also scheduled for release on Tuesday, and is expected to remain unchanged at 54.0.

On Wednesday the UK's Services PMI is released; with the service sector accounting for in excess of 80% of UK economic output it goes without saying this is the highlight of the data calendar.

Analysts are forecasting a reading of 52.7, any disappointment on this will likely hurt sterling.

Note that the Eurozone's Service PMI has been outperforming the UK's Services PMI by a widening differential after the two tracked each other quite closely:

The above graphic is an interesting illustration that serves to illustrate why the euro has been outperforming the pound of late as it shows the Eurozone is actually performing admirably.

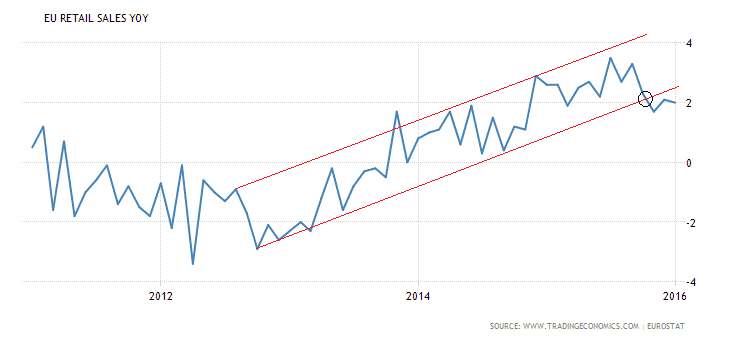

Euro Area Retail Sales on an annualised basis, it is expected to rise by 2.6% from a previous 2.0%

However, annualised Eurozone Retail Sales featured in the chart below shows a steadily up-trending channel which is showing signs of starting to breakdown. This may not bode well for the Retail Sales release next Tuesday, or for releases going forward as it suggests the metric’s steady recovery may be about to slow.

Euro Area Retail Sales for February (mom) is forecast to show a slowdown to 0.1% from the previous 0.4% rise in January.

Finally, Friday sees the release of UK Industrial and Manufacturing Production which are forecast to both show fairly deep declines of 0.1% from 0.3% previously and -0.2% from 0.7% previously mom in February respectively.

The Trade Balance is also released on Friday, and is expected to show a deficit of -10.2bn in February compared to -10.29 in January.