Oil and Gas Shock Hits the Euro, but Losses Pared on Ceasefire Headlines

- Written by: Gary Howes

- Markets react to significant oil and gas surge

- Amidst fears West will sanction Russian energy directly

- But Germany says it won't stop gas and oil imports

- Hopes for a ceasefire see earlier moves reversed

Image © Adobe Images

A surge in oil and gas prices has prompted the Euro to fall to multi-year lows as traders bet the shock will prompt the European Central Bank to step away from raising interest rates in 2022, although headlines suggesting Russia could halt operations if its conditions were met saw initial moves pared..

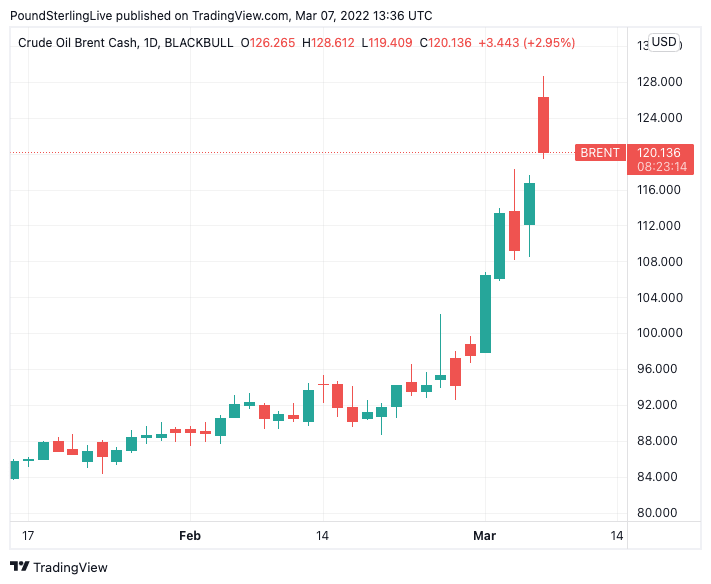

Oil prices surged to $139 a barrel, the highest level for almost 14 years, and wholesale gas prices for next-day delivery more than doubled at the start of the new week amidst fears Western countries were considering a ban on Russian energy imports.

European natural gas prices reached an all-time high when the benchmark TTF quoted above €345 per MWh.

The outsized moves came after the U.S. was reported to be in "active discussions" with the EU over a possible ban on Russian energy.

"News that the G7 is looking at coordinated sanctions against Russian exports, especially oil, sent oil and other commodity prices soaring in Asia," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"The new week has started with a bang, with stocks tumbling and crude oil soaring at the Asian open overnight as traders woke up to weekend news that the US and its allies are discussing a coordinated embargo on Russian crude supplies, while trying to prevent a global supply shock," says Fawad Razaqzada, Market Analyst at Think Markets.

- Reference rates at publication:

GBP to EUR: 1.2093 - High street bank rates (indicative): 1.1770 - 1.1854

- Payment specialist rates (indicative): 1.1984 - 1.2033

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

For currency markets there was a binary move in favour of those countries that belong to energy exporting countries while net importers were hit.

"The conflict in Ukraine is clearly a negative EUR shock. In the short term, the EUR has room to trade lower on the stagflationary implications for the euro area but, in the medium term, the crisis should force structural integration supporting the euro," says a weekly currency research briefing note from Barclays.

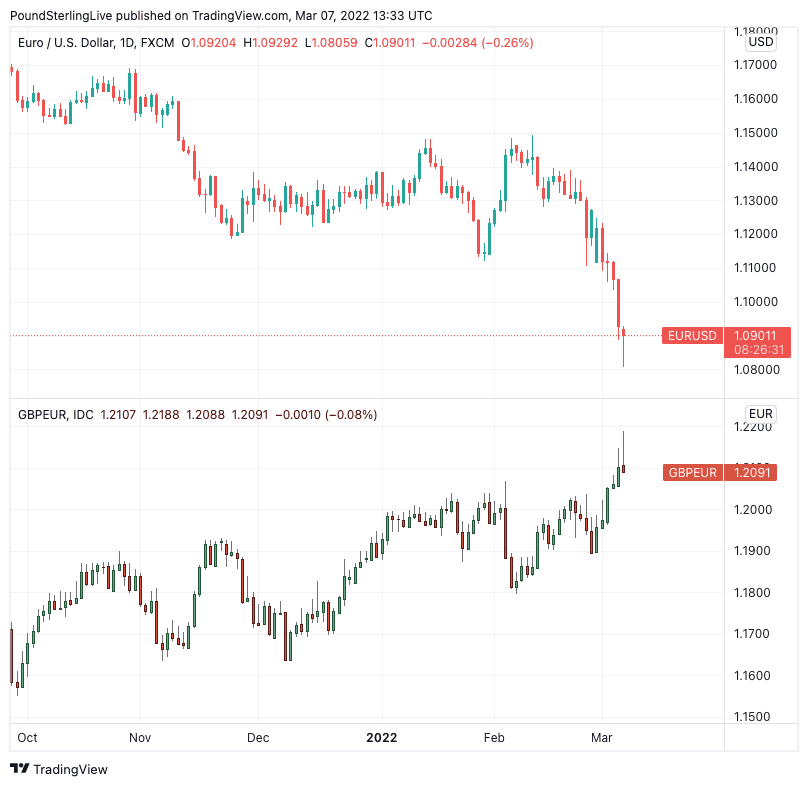

The Pound to Euro exchange rate rose to as high as 1.2188 on Monday, its highest level since July 2016. The Euro to Dollar exchange rate slumped to its lowest level since May 2020 at 1.0859.

Economists say the surging cost of oil and gas will hurt the Eurozone's economy particularly hard given its significant integration with Russia's energy industry.

"EURUSD: The negative relationship between the price of crude oil and the currency pair is strengthening, and we suspect FX investors will spend a solid portion of this week monitoring these two variables," says Stephen Gallo, Head of European FX Strategy at BMO Capital Markets.

"One of the most important factors hanging over EURUSD is the risk of an EU ban on all Russian imports including fossil fuels," adds Gallo.

Fears of a slowdown in Eurozone economic growth could meanwhile lead the European Central Bank (ECB) to reconsider the speed at which they 'normalise' monetary policy settings, which in turn caps Eurozone bond yields and weighs on the Euro.

The central bank meets on Thursday.

"Higher commodity prices are threatening to force central banks to slam on the monetary policy brakes faster than would otherwise be the case, which is hurting sentiment," says Marinov.

Above: Brent crude oil prices at daily intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Dmytro Kuleba, Ukraine’s foreign minister, stepped up pressure on the West to stop buying Russian oil which, he said, "smells of Ukrainian blood".

U.S. Secretary of State Antony Blinken told the NBC talk show Meet the Press: "We are now in very active discussions with our European partners about banning the import of Russian oil to our countries, while of course at the same time maintaining a steady global supply of oil."

And support in the U.S. for such measures comes from across the political divide:

"We have more than enough ability in this country to produce enough oil to make up for the percentage we buy from Russia," Marco Rubio, the Republican senator told ABC.

In the UK, Liz Truss, the Foreign Secretary, indicated that she would support ceilings on how much Russian oil and gas heads to G7 countries.

Ursula von der Leyen, the EU Commission President, meanwhile spoken of ramping up sanctions on Russia, but stopped short of advocating an outright ban on Russian oil.

"The goal is to isolate Russia and to make it impossible for Putin to finance his wars," she told CNN.

Oil and gas prices reversed from their highs as the day progressed, in part thanks to confirmation from Germany's Finance Minister Christian Lindner said his country is not currently planning to stop importing Russian oil, gas and coal.

A retreat from earlier highs in oil and gas allowed Euro exchange rate to retrace earlier losses.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Further impetus to the recovery came amidst headlines that Russia would immediately cease its military campaign if Ukraine agreed to a list of demands.

"Big step back from Russia and signal for dip-buying if true, but there is a sizeable risk that this is all a ruse," says Simon Harvey, Senior FX Market Analyst at Monex.

Russia said it is ready to halt military operations "in a moment" if Kyiv meets a list of conditions, Kremlin spokesman Dimitry Peskov said.

Amongst demands were that Ukraine cease military action, change its constitution to enshrine neutrality, acknowledge Crimea as Russian territory, and recognise the separatist republics of Donetsk and Lugansk as independent states.

This is a volatile and headline-driven market that is likely to see wild swings.

It is therefore too soon to call an end to the Euro's trend of weakness but those watching this market should be prepared to see outsized movements in either direction.

"We have also spoken about how they should recognise that Crimea is Russian territory and that they need to recognise that Donetsk and Lugansk are independent states. And that’s it. It will stop in a moment," said Peskov.

Realistically the recognition as Crimea and the Dombass regions as being could be met by Kyiv, but the effective veto of Ukraine joining the EU and NATO would prove more problematic.