Pound / Euro Holds 1.19, 1.20 Possible if Germany Increases Restrictions

- Written by: Gary Howes

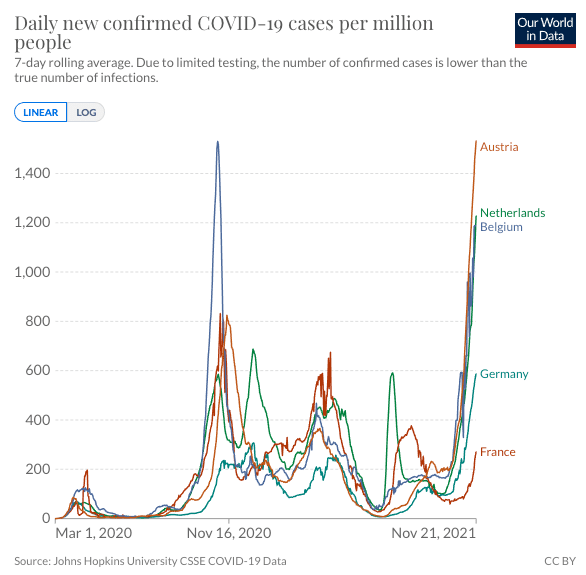

- EUR sentiment hit by new Covid wave

- Allows GBP/EUR to hold 1.19 region

- But hit to EUR tipped to be brief

Above: File image of Jens Spahn (left). Photographer: Etienne Ansotte. European Union. Source: EC - Audiovisual Service.

The Pound to Euro exchange rate firms around the 1.19 level and looks set to edge towards the big round number of 1.20 over the course of coming days, aided by positive technical momentum and deteriorating sentiment towards the Eurozone.

The Euro has lost a percent of its value to Pound Sterling over the course of the past week amidst the reintroduction of Covid restrictions that are expected to suck the air out of the Eurozone's economic recovery.

"Renewed Covid restrictions across large swathes of the eurozone add another headwind to the eurozone recovery narrative," says Jeremy Stretch, a strategist at CIBC Capital Markets.

For the single currency the impact of current restrictions look relatively limited but bigger moves could be likely if Germany implements tighter curbs over coming days.

"Austria accounts for just 3.1% of the eurozone’s GDP, limiting the resulting growth impact on the eurozone recovery. Harsh and broad-based lockdowns in Germany, which

accounts for nearly 30% of eurozone GDP, would be a different matter," says David Kohl, an economist at Julius Baer.

- GBP/EUR rates at publication:

Spot: 1.1911 - High street bank rates (indicative band): 1.1594-1.1677

- Payment specialist rates (indicative band): 1.1800-1.1850

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Cases are rising in Germany, hospitalisations are up and health Minister Jens Spahn said on Monday citizens will be "vaccinated, cured or dead" by the end of the winter.

"Should macro expectations continue to be compromised by Covid concerns we can expect EUR downside to remain in play," says Stretch.

Germany's response thus far has been to push for higher vaccination rates while tightening curbs on unvaccinated citizens.

But Lothar Wieler, the influential director of the Robert Koch Institute (RKI), Germany's disease control agency, said the need for further curbs on all citizens were now required.

"We are going to have a really terrible Christmas if we don't take countermeasures now," he said, calling for a rapid increase in vaccinations and the closure of bars and clubs, an end to large-scale events.

German Foreign Minister Heiko Maas said on Friday that shutting down the country in a full lockdown was not an option, which suggests the a worst-case scenario could be avoided for Euro exchange rates.

"However, the state of emergency characterised by the RKI heath institute suggests a U-turn cannot be ruled out by the authorities if ICU wards continue to fill up," says Kenneth Broux, a strategist at Société Générale.

The number of Covid-19 patients requiring intensive care increased by 170 in the past 24 hours to 3,845, according to the online registry of the German Interdisciplinary Association for Intensive Care and Emergency Medicine (DIVI).

“The COVID-19 situation is very worrying and not under control at the moment. We are very concerned,” said DIVI President Gernot Marx at a press conference.

He also stressed that additional measures could be required to curb the fourth wave by December.

Austria

Austria has gone back into a national lockdown as of Monday (November 22), becoming the first EU country to take such a measure in the face of the resurgence.

The lockdown will last at least 10 days but could extend to 20, officials said.

"Harsh contingency measure like in Austria will weigh on economic growth, mainly by depressing private consumption," says Kohl.

People 12 years and older are banned from going outside except for essential activities such as work, attending classes, grocery shopping, or for a walk.

Belgium

Renewed restrictions are centred around a requirement to wear masks in all social settings, but the economy will be dented by the new requirement that employees are to work from home for at least four days a week.

Netherlands

The caretaker government implemented a partial lockdown on November 13 that is due to run for at least three weeks, forcing bars and restaurants to close at 8 pm.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

But economists at Swiss bank Julius Baer say the current round of restrictions in the Eurozone are likely to have a more limited impact on the economy than previous episodes and only 0.1–0.2 percentage points will be knocked off their existing growth forecasts.

Indeed, looking ahead they find the outlook for the Eurozone is positive and now forecast growth of 5.0% in 2022:

"The longer-term growth outlook remains constructive for the eurozone, as there is still pent-up demand. Current contingency measures are depressing today’s demand to the benefit of tomorrow’s demand."

Kohl says private household savings are "excessive" in the eurozone, ensuring solid spending potential once restrictions are lifted.

The window for Euro weakness could therefore be limited to just the coming weeks as sentiment could snap back and account for latent recovery potential once it appears the spike in cases has peaked.

The Euro would be an obvious conduit for a recovery trade in foreign exchange markets.

"The economic recovery has further potential once contingency measures slow the infection dynamics," says Kohl.