Pound Sterling Looking Heavy against Euro as Markets Take Fright over new Beijing Lockdown

- GBP softer in sympathy with stock market pullback

- Markets ease on news of new lockdown in China

- But progress on covid-19 treatment to underpin sentiment

- GBP upside to be capped by months of trade negotiations between EU and UK

Image © Adobe Stock

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The British Pound has turned lower against the Euro heading into the mid-week session as global stock markets turn red amidst renewed fears of another covid-19 outbreak and as relief on the Brexit trade negotiation front lost its lustre.

The Pound-to-Euro exchange rate has shown an increased sensitivity to the movement in global investor appetite, tending to rise and fall alongside global stock markets, a relationship the appears to have become tighter since it became clear June would no longer be a 'make or break' month for Brexit trade negotiations.

The Pound rallied against its Eurozone rival early on Tuesday amidst a strong appreciation in world stock markets, but the steam was let out of the rally later in the U.S. session when investors turned shy on news Beijing was being placed in lockdown over a pocket of covid-19 infections.

"Rising US Covid cases and the Chinese move to shut Beijing schools has dented confidence after a day of gains," says Joshua Mahony, Senior Market Analyst at IG.

The Pound-to-Euro exchange rate had rallied to a high of 1.1219 ahead of the market pullback, and is quoted back below 1.12 at 1.1137 at the time of writing.

"A number of reasons may have injected a degree of caution in markets including concerns about rises in Covid-19 cases in Beijing and parts of the US, border skirmishes between China and India, and growing tensions on the Korean peninsula," says Hann-Ju Ho, Economist at Lloyds Bank Financial Markets.

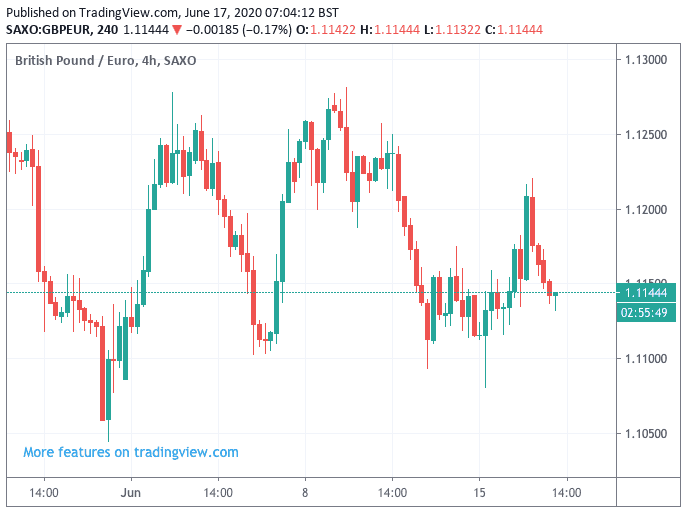

Above: GBP/EUR has been caught in a clear range during June

Looking ahead, how Sterling trades over the coming 24 hours and next few days is likely to rest with how investor sentiment evolves and we would not be surprised to see major swings either higher and lower as has become customary in the covid landscape.

The general trend is ultimately supportive however, with stocks and commodity prices moving on a view that the world is exiting lockdown and any outbreaks will likely be localised. It appears the rapid shutdown in Beijing will likely contain the virus and therefore minimise the need for the rest of the economy to go into shutdown once more and we would not be surprised to see this pattern repeated in China and other nations until a vaccine is found.

On the medical front, developments are also supportive: news of a breakthrough that could significantly lower the mortality rate of covid-19 will likely keep sentiment broadly supported. Oxford University researchers have found that Dexamethasone - a 60 year old steroid - reduced deaths by a third among patients on ventilators and by a fifth of those receiving oxygen only.

"This is the most important trial result for COVID-19 so far. Significant reduction in mortality in those requiring oxygen or ventilation from a widely available, safe and well known drug. Many thanks to those who took part and made it happen. It will save lives around the world," says Professor Chris Whitty, England's Chief Medical Officer.

The drug is already widely in use across the world as it is a generic, meaning it is cheap to produce and procure allowing it to be deployed much faster and have a greater impact on the virus than would be the case if a brand new drug was being rolled out.

"With nations around the world seeking to avoid another detrimental lockdown phase, today's Oxford-led breakthrough sparked optimism that fatality rates can be significantly reduced by using a cheap and widely available steroid treatment. With Dexamethasone cutting ventilator fatalities by a third, and deaths in oxygen patients by a fifth, there is genuine optimism that we could soon see a useful toolkit of treatments that could dramatically improve Covid-19 recovery rates," says Mahony.

With the steady progress being made against covid-19 it appears the risks of another substantial meltdown - as seen in March - is less likely, particularly as countries are likely to enact local shutdowns when pockets of infection emerge.

This should protect Sterling from any major losses against the Dollar and Euro and likely ensure the current phase of consolidation extends.

The British Pound meanwhile rallied earlier in the week amidst reports of fresh momentum being injected into trade talks between the EU and UK.

The UK and EU took a step closer to securing a trade deal following a high level meeting between UK Prime Minister Johnson and senior EU officials, with Johnson saying the prospects for an accord are "very good."

Bloomberg reported that people with "knowledge of the conversation" from both sides said the intervention by the leaders has injected fresh momentum into the deadlocked negotiations.

The Pound underperformed its peers during May amidst growing anxieties that talks would break down in June. It appears that markets had misread the situation to a degree, placing greater emphasis on the month-end deadline for an extension to be agreed than was warranted.

There was an expectation that this week's European Council meeting of EU leaders would prove to be decisive on agreeing a future trade deal, but it has since emerged that Brexit trade negotiations are not even on the agenda of Friday's EU Council meeting.

That June is no longer critical to negotiations has provided Sterling with some element of support, but we remain of the view that any strength in the Pound will ultimately remain short-lived in duration as the issue of Brexit has only been kicked into the future.

The EU and UK are due to enter a phase of intense negotiations during July, with leaders expected to unlock a deal in the autumn when market anxiety will start to build once more and likely pressure Sterling.

We would not be surprised if a final breakthrough only comes in December, meaning there is potential for months of Sterling underperformance ahead.