UK Economy Grew 0.3% in June thanks to a Rejuvenated Services Sector

- Written by: Gary Howes

Image © Adobe Stock

The first of the new monthly estimates of GDP from the Office for National Statistics shows a mixed picture of the UK economy with modest growth driven by the services sector, partly offset by falling construction and industrial output.

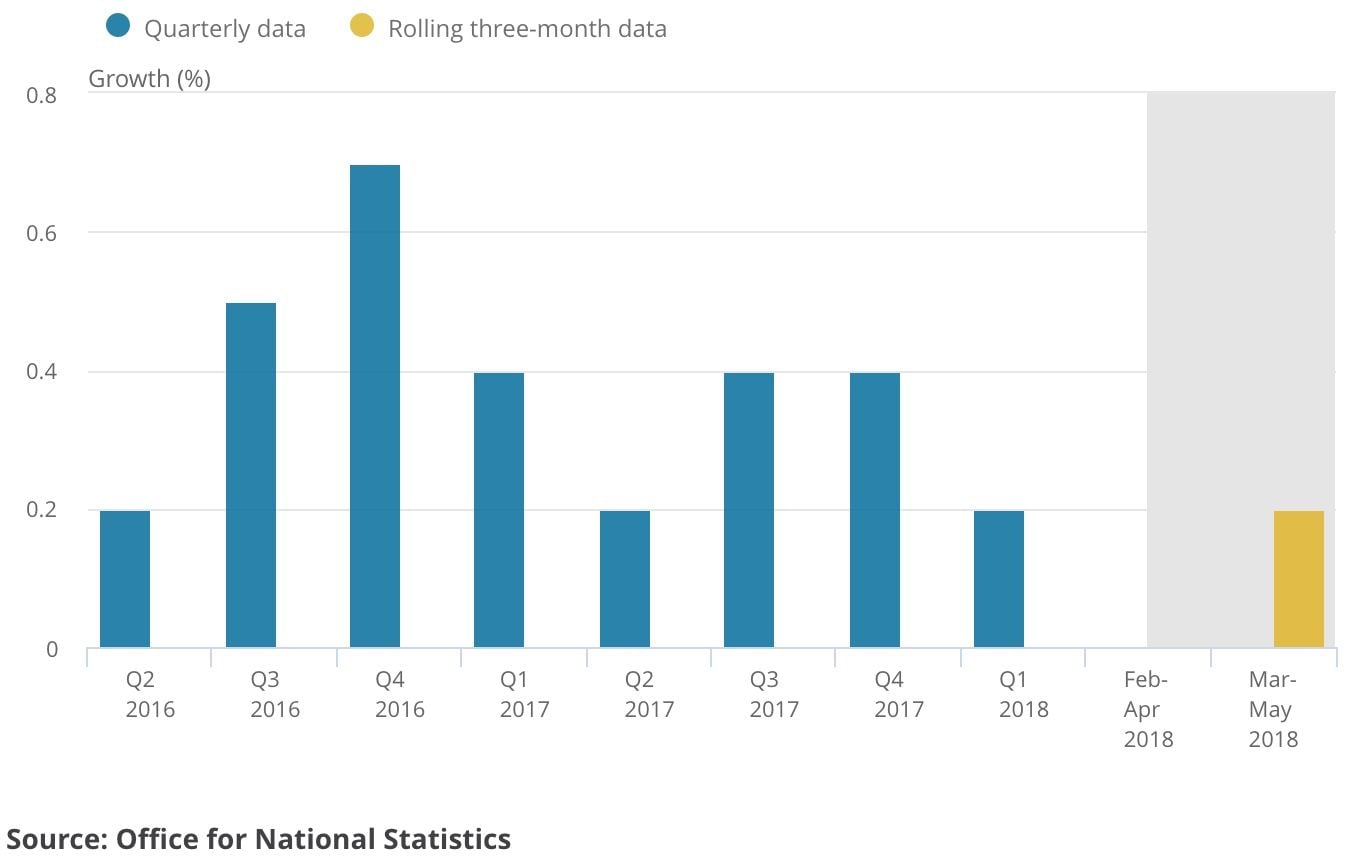

Monthly GDP grew 0.3% in May, in line with consensus forecasts, ensuring this particular number is likely to be neutral for the Pound. The GDP growth rate was flat in March, followed by a growth of 0.2% in April.

Looking at the rolling three-month-on-three-month measure, growth in the March to May period stood at 0.2% when compared with the previous December to February period.

Above: Rolling three-month-on-three-month growth shows a broadly negative trend.

"Services, in particular, grew robustly in May with retailers enjoying a double boost from the warm weather and the royal wedding. Construction also saw a return to growth after a weak couple of months," says Rob Kent-Smith, Head of National Accounts at the ONS.

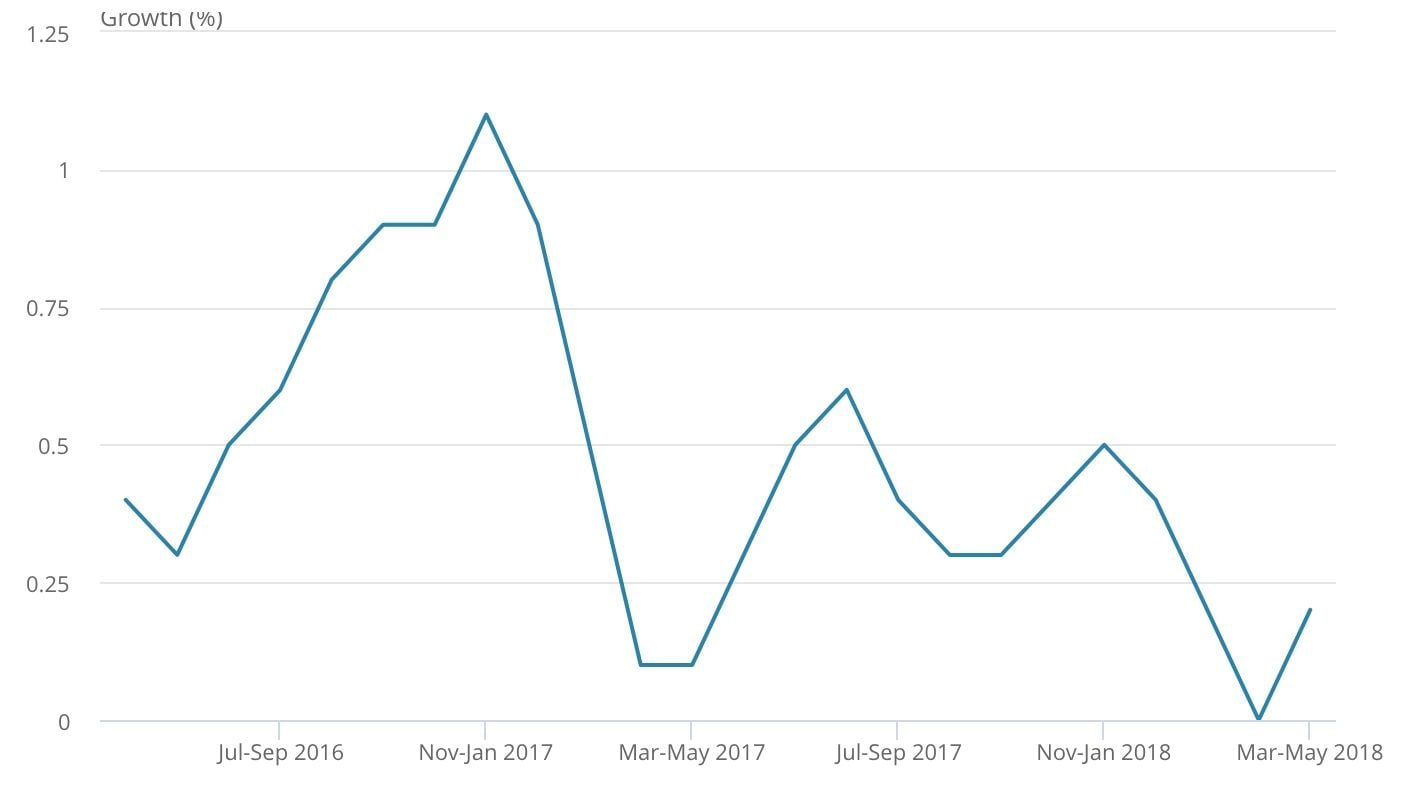

The services industries - which account for over 80% of the UK economy - experienced growth of 0.4% in the three months to May. Growth in consumer-facing industries (for example retail, hotels, restaurants) has been slowing over the past year. However, in the three months to May growth in these industries picked up, particularly in wholesale and retail trade.

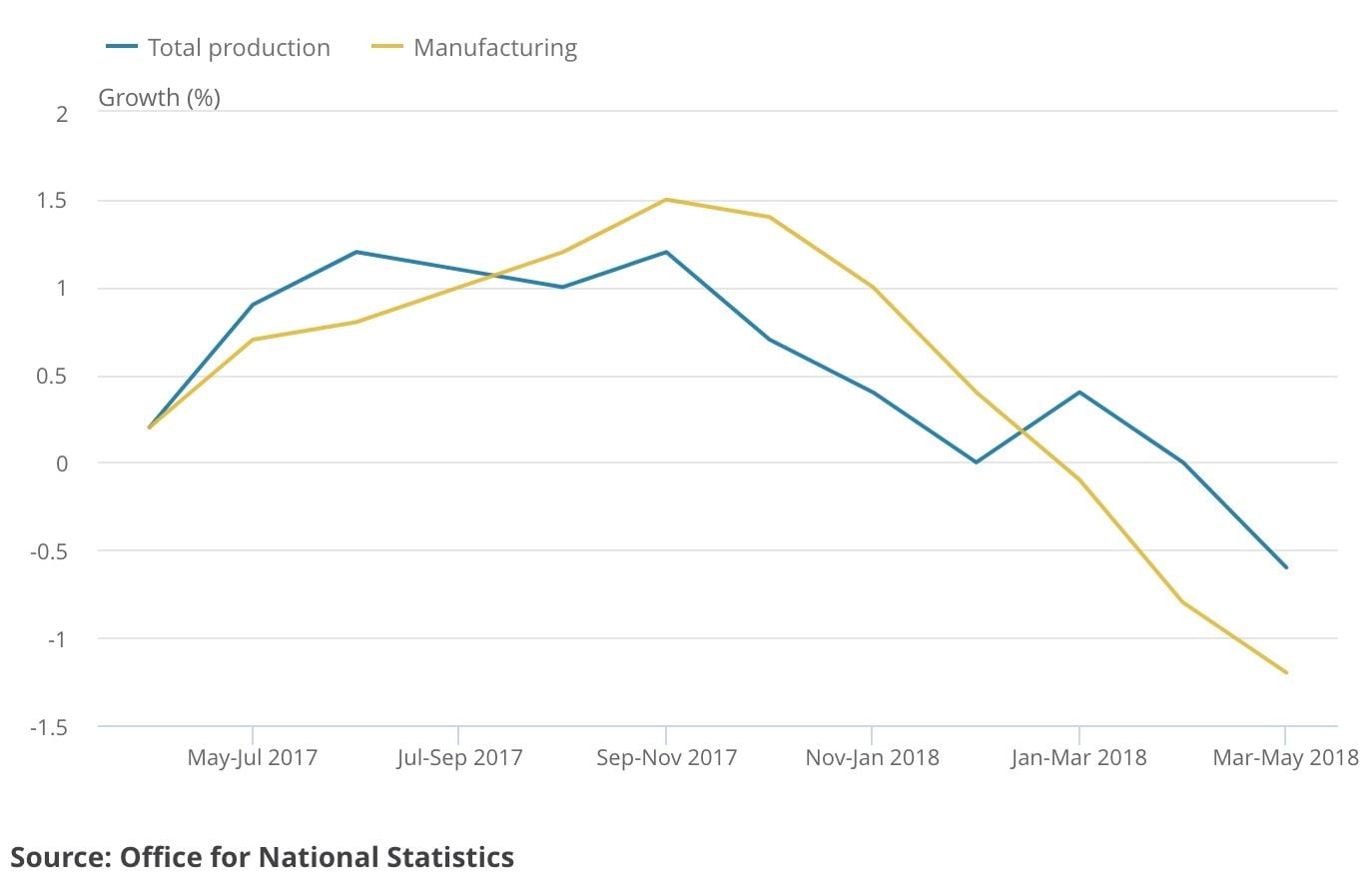

Of concern though is the apparent continued decline of the industrial and manufacturing segments of the economy with production shrinking by 0.6% in the three months to May.

The three months to May of negative 1.2% contributed negative 0.12 percentage points to headline GDP. This was the third consecutive fall in manufacturing, and was driven by weak exports say the ONS.

However, looking ahead, some economists expect the economy to pick up pace during the second half of the year. "Given the strong set of PMI surveys in June, this seems likely," says Andrew Wishart, UK Economist with Capital Economics.

Capital Economics reckon the data has done enough to convince the Bank of England's Monetary Policy Committee to raise interest rates by 0.25% at their August meeting.

"This is the last batch of GDP data the MPC will receive before its meeting on the 2nd of August. And while it was a little weaker than expected, note that another 0.3% monthly rise in GDP in June would leave quarterly GDP growth in Q2 at 0.4% – in line with the MPC’s forecast," says Wishart.

However, the tone struck by Morgan Stanley - the global investment banking giant - is distinctively downbeat.

Morgan Stanley say the Bank of England will raise rates in August but hit the pause button as high uncertainty stemming from Brexit negotiations is to hit investment and consumption, leading second-half growth to slow sharply.

According to analysts, the UK and EU won't reach agreement at October summit, forcing more UK concessions.

The output gap is being set to reopen as unemployment rise modestly thanks to the uncertainty and deferred investments.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here