Fade Trump / Buy China Printing Press

Analyst Ben Powell and his team at UBS have come to an interesting conclusion when it comes to the reflation trade that characterised the latter half of 2016.

Most agree that it is the electoral victory of Donald Trump that is responsible.

Not necessarily says Powell who believes following the money trail leads to some interesting conclusions regarding China.

So could it be in China where the fortunes of stock markets - which trade at record highs - and the complex interplay of global currencies rest?

If so then we should be watching the sustainability of China’s rapidly expanding debt.

Incremental Total Social Financing (TSF) was RMB 3.74 Trillion in January. The TSF includes off-balance sheet forms of financing that exist outside the conventional bank lending system, such as initial public offers, loans from trust companies and bond sales. It can also hint at trends in the vast shadow banking sector.

"Think about that for a second… that is USD 545bn of new lending – in a single month," says Powell in a note to clients dated February 17. "Even in China, this is a large number, around 5% of GDP."

Indeed it was the biggest single month of TSF growth ever.

"Given this backdrop, it perhaps isn’t surprising that iron ore prices are up 60% in 5 months," says Powell.

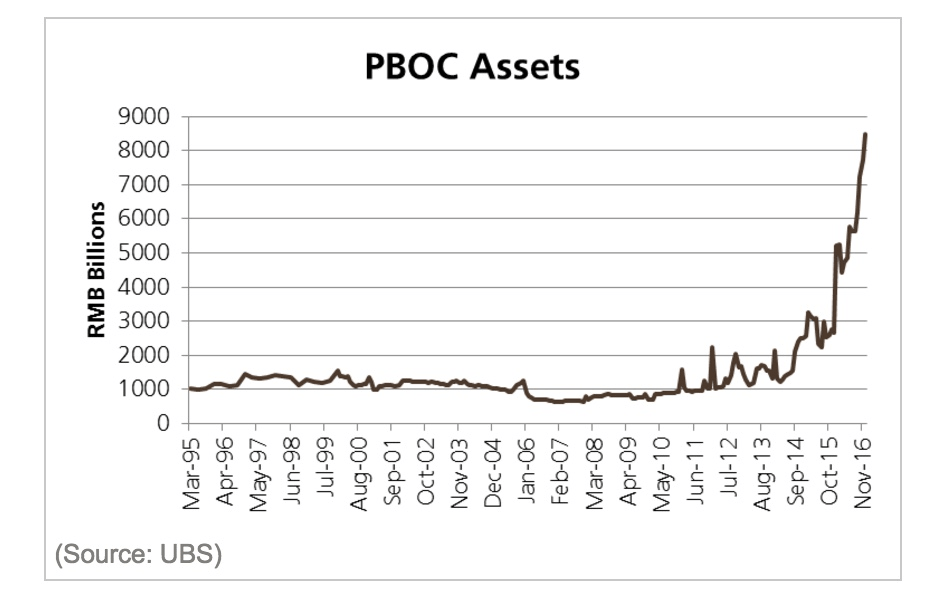

PBoC Quantitative Easing

The above shows that the People's Bank of China (PBoC) has been accumulating assets and therefore expanding the money supply to the economy.

"In 2014/15, it appears something changed, and a decision was made. Since then around a Trillion dollars of money has been printed and sent in the direction of the Chinese commercial banking sector," says Powell.

What changed? Powell suggests the following:

Firstly the context. By 2015 QE had moved from the lunatic fringe to global mainstream orthodoxy.

Secondly, in China the SHIBOR spikes of 2013 perhaps led the authorities to decide that the market was failing to fund banks at socially harmonious rates of interest. So the PBoC got the call.

What does this all mean for investors?

Stay bullish on China argues Powell who reckons the prospect of a bubble burst is still unlikely:

"At the global level I think it means that the world has misdiagnosed the reflation trade causes almost entirely. It has very little to do with the new US President. The reflation trade started to work in July of 2016. I would accept that the election of President Trump acted as a sentiment accelerant. But Trump wasn’t causal. The cause was the Chinese printing press.

"In FX I think the simple thought is the right thought. AUD still looks cheap to me versus the positive terms of trade shock Australia has enjoyed in the past several months. I can't see any real need to complicate this. I would continue to buy AUDSGD which has worked year to date, and I think continues to work.

"Fade Trump / Buy China printing press."