Analysts: UK Inflation Forecast to hit 3%

- Written by: Gary Howes

Analysts are in agreement - inflation should reach 3% by the time 2017 is out.

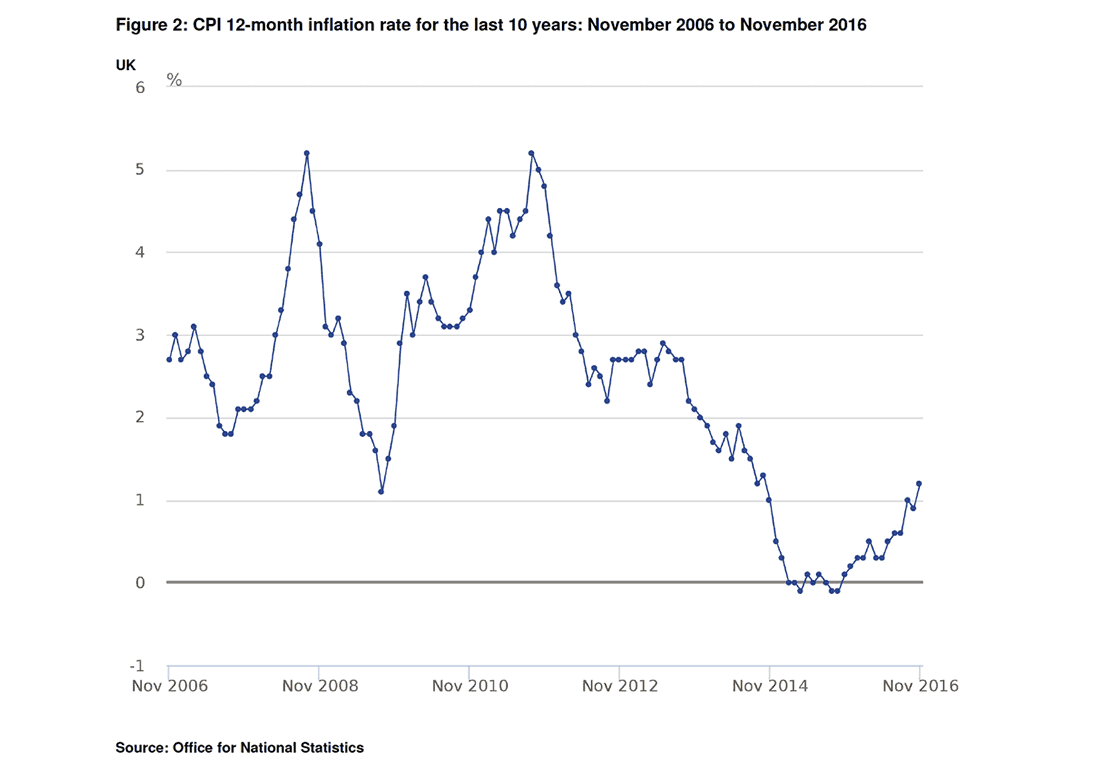

The UK’s November’s inflation print came in stronger than expected, with the annual CPI figure coming in at 1.2%, 0.1% higher than the consensus.

The 2-year high in the CPI rate was largely caused by Pound Sterling’s weakness and fast-rising oil prices now that the OPEC cartel has successfully colluded to push prices higher.

In short, the UK consumer is facing a pincer movement on prices and economists are in agreement that we are going to easily overshoot the 2% target set out by the Bank of England.

"There is more inflation coming through the pipeline. The prices of UK manufactures are already 2.3% up on a year ago and the cost of raw materials, energy and other inputs into the manufacturing process are nearly 13% higher than a year ago,” says Andrew Sentance, senior economic adviser at PwC.

Sentance says we should expect inflation to rise to close to 3% by the end of next year, which will squeeze consumer spending and slow economic growth.

“We are leaving behind the very favourable world of near-zero inflation which has benefited consumers over the past couple of years,” says Sentance.

The persistence of rising food prices, a subdued Sterling and bullish oil prices should continue pushing UK inflation higher in coming quarters.

Analysts at ING also see inflation racing towards 3% in 2H17.

“As wages are unlikely to keep with rising consumer prices, the hit to real wages will be very apparent through 2017,” says ING’s Petr Krpata.

The next question, particularly from a currency perspective, is how the Bank of England decides to react to the data.

Shilen Shah, Bond Strategist at Investec Wealth & Investment, says: “Given the upward pressure on inflation, the BoE’s move towards a more neutral policy stance is understandable given that it has indicated that its patience for inflation to overshoot the 2% CPI target is limited.”

However, ING’s Krpata believes that although the MPC previously introduced a two-way reaction function, “we expect the committee to look through the higher prices as activity data will remain subdued. Hence, any overshot in sterling higher triggered by false hopes of a potential tighter BoE policy should be faded.”

Indeed, inflation is now exactly where it was envisaged to be by the Bank in their November estimates.

"Today's data provide confirmation that the expected rise in inflation following sterling's post-referendum depreciation is back on track," says Michael Sawicki at Lloyds Bank.

Lloyds forecast inflation to hit 3.1% by December 2017.