Pessimistic Markets Price Sterling and Interest Rates for a 2018 Bank of Interest Rate Rise

The Bank of England (BofE) is tipped to raise interest rates in 2018 by the money markets. But inflation is forecast to be uncomfortably high by the time 2018 comes around.

In the wake of the Bank of England’s latest inflation forecasts and communications on policy the interest rate markets are pricing in the first interest rate in years to occur in early 2018.

The UK currency has turned softer accordingly.

The pound’s value correlates to interest rate market pricing, and therefore if you are considering whether the pound is correctly priced you should also be considering whether interest rates are correctly priced.

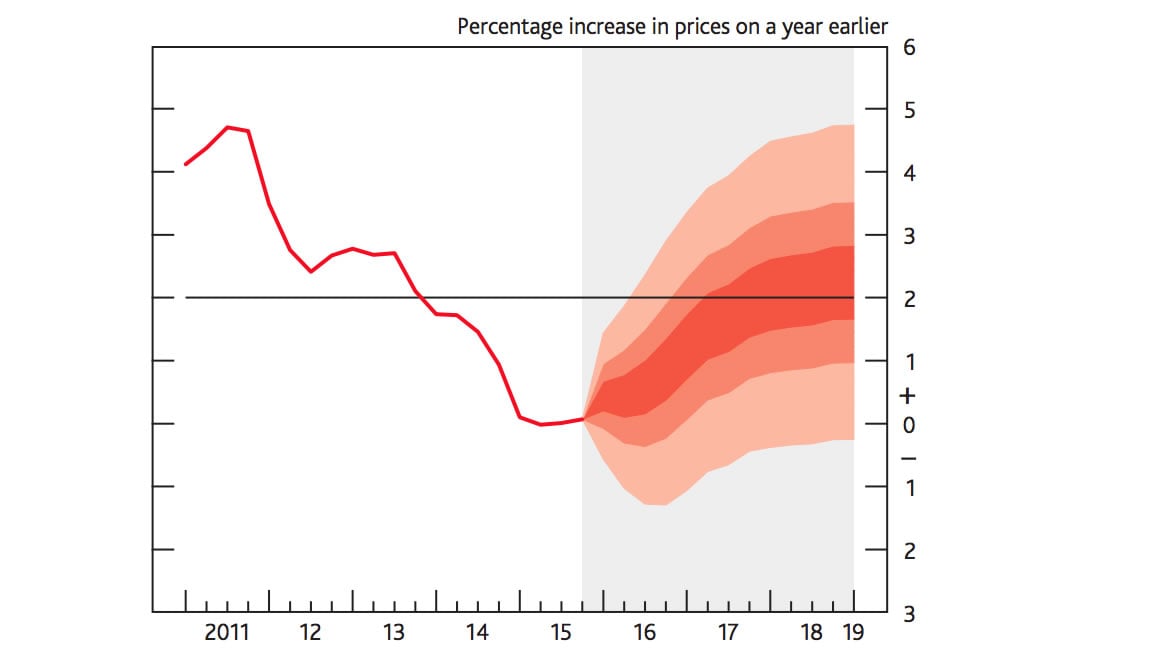

Saying the markets are wrong is hardly wise, but consider this - the Bank’s own forecasts put inflation at 2.25% in late 2018 / early 2019, well above the 2% target.

The BofE revised down its near-term inflation forecasts as it factored in the further fall in energy prices seen, with forecasts for Q4 2016 CPI over 30bp lower than back in November.

It appears that these downgrades are impacting longer-term expectations on interest rate policy in the money markets to an unjustifiable degree.

Indeed, the impact of energy price falls are seen fading further out and the Bank kept its forecasts for 2018 Q1 close to unchanged from November’s QIR.

“This gave the report a more hawkish aspect, with inflation continuing to rise to 2.25% by 2019 Q1,” notes Sebastien Cross, Rates Strategist, at Bank of America’s Merrill Lynch unit in London.

If markets are pricing in the first rate rise to occur just as inflation is breaching the 2% target, then they are wrong.

“Inflation at the Year 3 point (19Q1) is now forecasted to reach 2.25%, a record high for MPC forecasts, and a clear signal that markets might be over-doing it in their Bank Rate expectations (which feed into the MPC’s model),” notes James Rossiter I Vice President & Senior Global Strategist at TD Securities.

The Bank will have to raise rates as inflation starts accelerating, therefore, near-term inflation action remains key.

We believe the Bank will be incredibly responsive to any sudden upticks in inflation. Oil will be key to this story.

If OPEC agrees to production cuts to prompt an upward move in oil prices expect global inflation to start ticking higher.

That rate rise could occur a lot quicker than markets are expecting and this has interesting implications of how the GBP will perform over coming months.