UK Recessionary and Inflationary Impulse Wanes: PMI Data for December

- Written by: Gary Howes

UK inflationary pressures are cooling and the services sector appears to have avoided contraction in December, according to preliminary PMI data for December.

The S&P Global Services PMI read at 50.0 in December, which is better than the consensus expectation for 49.2 and an improvement on November's 48.8.

The data offers a timely snapshot of how the UK economy is evolving.

However, the Manufacturing PMI read at 44.7, which was below the expected 46.5 and represents a sharp contraction on November's 46.5 and confirms the sector remains under pressure.

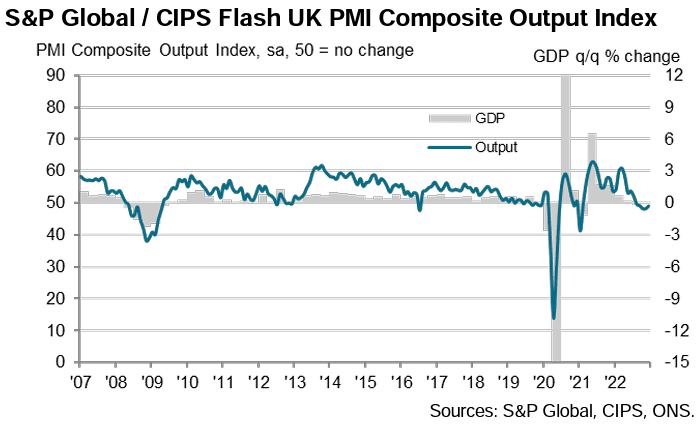

Rebalancing the data to give a better account of broader economic performance gives a Composite PMI reading of 49, which represents an improvement on November's 48.2 and means the economy would have shrunk only slightly in December.

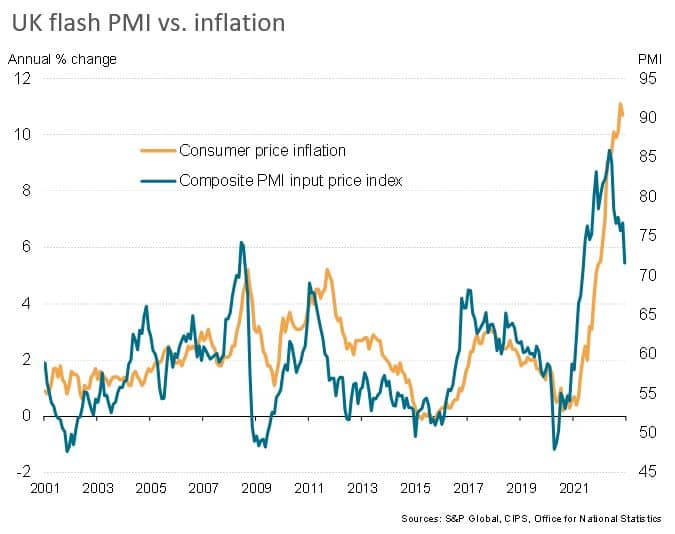

But the standout news contained in the flash December PMIs relates to inflation, "UK inflationary pressures have cooled sharply again, according to the flash PMI price gauge," says Chris Williamson, Chief Business Economist, S&P Global Markit Intelligence.

Image courtesy of S&P Global.

The rate of input cost inflation for firms remained substantial in December, despite the pace of increase softening noticeably to a 19-month low.

Prices charged meanwhile rose at the softest pace since August 2021, with a number of firms commenting on the need to remain as competitive as possible amid a weak demand environment.

"For now, the downturn looks to be relatively mild, and the easing in the rate of decline in December is encouraging news, as is the further marked cooling of inflationary pressures," says Williamson.

Optimism around the 12-month outlook for business activity picked up slightly to a four-month high in December, but remained subdued in the context of historical data.

The economic slowdown is meanwhile looking to impact on the labour market as the December data showed a renewed fall in employment across the UK private sector.

Though only marginal, says S&P Global, it marked the first reduction in headcounts since February 2021.

"Businesses are battening down the hatches, most notably by reducing headcounts," says Williamson.

The data falls a day after the Bank of England raised interest rates by 50 basis points and signalled further hikes will be necessary.

However, the slowdown in the labour market and inflationary pressures highlighted in the PMI report could all the Bank to consider ending its hiking cycle early in 2023.

"Both these developments should help to convince MPC members that they have almost done enough to ensure that the headline rate of CPI inflation eventually returns to the 2% target. We continue to expect the Committee to hike Bank Rate to 4.0% in February and then to stand pat thereafter," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.