Federal Reserve Interest Rate Risk Bodes Ill for Global Economic Outlook

- Written by: James Skinner

Image © Adobe Stock

Federal Reserve policy tightening is already making a mark on economies and currencies around the world but minutes of June’s meeting suggested this week that its impact could grow when making clear that interest rates may yet rise beyond the “modestly restrictive” level currently in the Fed’s crosshairs.

Remarks made by Chairman Jerome Powell had already implied in last month’s press conference that there is some chance of the Fed becoming even more hawkish and aggressive in its attempt to bring U.S. inflation down to the 2% target, from more than 8% on one measure in May.

But minutes of June’s meeting made unequivocally clear on Wednesday that there isn’t really any level the bank wouldn’t go to in its quest and given that its policy tightening has already taken a toll on economies - and currencies - around the world, that is also grim news for global growth outlook.

“Participants remarked that developments associated with Russia’s invasion of Ukraine, the COVID-related lockdowns in China, and other factors restraining supply conditions would affect the inflation outlook and that it would likely take some time for inflation to move down to the Committee’s 2 percent objective,” the final paragraph of the meeting record stated.

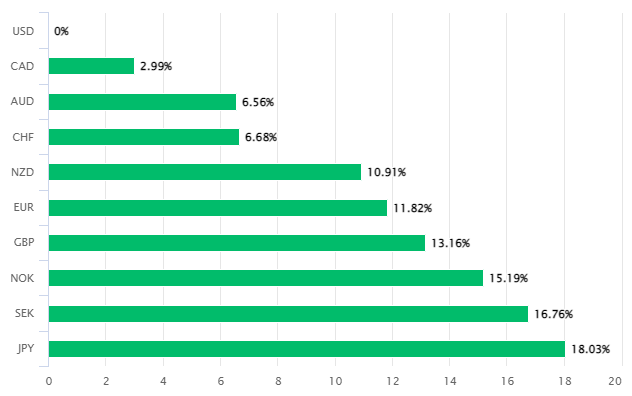

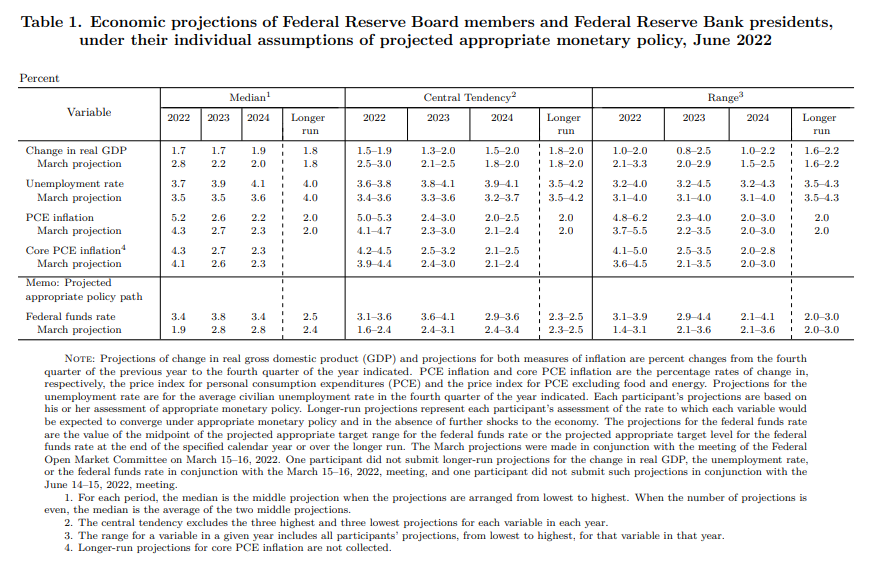

Above: Averages of Federal Open Market Committee members’ economic forecasts from June 2022.

Above: Averages of Federal Open Market Committee members’ economic forecasts from June 2022.

“Participants also judged that maintaining a strong labor market during the process of bringing inflation down to 2 percent would depend on many factors affecting demand and supply. Participants recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis,” it added.

The final paragraphs of the minutes confirmed that pursuing the 2% inflation target is the Fed’s overriding focus at present while implying strongly that if bringing down inflation requires the bank to drive the economy into a hole and the jobs market into a rut, then that’s what it will do.

This unfortunate economic reality was explained with even more clarity earlier on in the record of a June meeting where Federal Open Market Committee members decided in favour of the largest U.S. interest rate rise since 1994, which lifted the top end of the Fed Funds rate range to 1.75%.

“Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist,” was one such warning.

“At the current juncture, with inflation remaining well above the Committee’s objective, participants remarked that moving to a restrictive stance of policy was required to meet the Committee’s legislative mandate to promote maximum employment and price stability. In addition, such a stance would be appropriate from a risk management perspective because it would put the Committee in a better position to implement more restrictive policy if inflation came in higher than expected,” another paragraph later elaborated.

Above: U.S. Dollar Index shown at monthly intervals.

Above: U.S. Dollar Index shown at monthly intervals.

Chairman Jerome Powell said in June that a modestly restrictive level of interest rates would involve lifting the Fed Funds range to somewhere between 3% and 3.5% this year, and that a such a move could be followed by a further increase to more than 4% next year.

That was after FOMC members downgraded their forecasts for economic growth and lifted projections for inflation and unemployment back in June, and as they otherwise stuck with a view that was loosely summarised by the following words from Chairman Powell during last month’s press conference.

“The American economy is very strong and well positioned to handle tighter monetary policy,” he said.

June’s minutes suggested that view could change, however, in addition to making clear that a faltering economy wouldn’t necessarily alter the Fed’s course due to the role that supply side factors like commodities and international supply chains are playing in driving the ongoing inflation.

“Participants judged that uncertainty about economic growth over the next couple of years was elevated. In that context, a couple of them noted that GDP and gross domestic income had been giving conflicting signals recently regarding the pace of economic growth, making it challenging to determine the economy’s underlying momentum,” the meeting record stated.

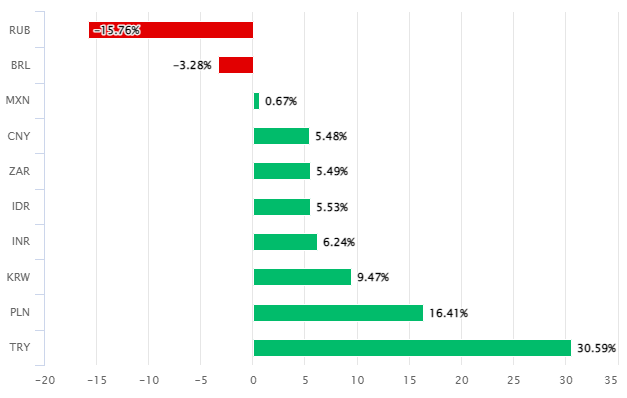

Above: U.S. Dollar performances against G20 currencies in 2022. Click each image for closer inspection.

“Most participants assessed that the risks to the outlook for economic growth were skewed to the downside. Downside risks included the possibility that a further tightening in financial conditions would have a larger negative effect on economic activity than anticipated as well as the possibilities that the Russian invasion of Ukraine and the COVID-related lockdowns in China would have larger-than-expected effects on economic growth,” it added.

Meanwhile, and in any case, many other economies around the world are also at least as susceptible to tightening Fed policy as the U.S. is itself.

This is in part because of the influence of the U.S. Dollar, which often rises with U.S. bond yields and can as a result pressure other central banks into following suit with their own interest rates in order to avoid importing extra inflation through the depreciation of their currencies.

"Participants noted that, with the federal funds rate expected to be near or above estimates of its longer-run level later this year, the Committee would then be well positioned to determine the appropriate pace of further policy firming and the extent to which economic developments warranted policy adjustments. They also remarked that the pace of rate increases and the extent of future policy tightening would depend on the incoming data and the evolving outlook for the economy," another relevant paragraph did state.

"Many participants noted that the Committee’s credibility with regard to bringing inflation back to the 2 percent objective, together with previous communications, had been helpful in shifting market expectations of future policy and had already contributed to a notable tightening of financial conditions that would likely help reduce inflation pressures by restraining aggregate demand. Participants recognized that ongoing policy firming would be appropriate if economic conditions evolved as expected," it added.