"Economy is Halfway Towards a Recession", but Bank of England will Keep Hiking: Capital Economics

- Written by: Gary Howes

Image © Adobe Stock

The UK economy is close to a recession, but this won't halt the Bank of England raising interest rates says Capital Economics.

The research consultancy says in a new research note, "following the 0.1% m/m fall in GDP in March , we now think the economy is halfway towards a recession".

Despite the slowing economy Capital Economics maintain a view the Bank of England will raise rates to a terminal level of 3.0%, far higher than the majority of economic forecasters are expecting.

The message from Capital Economics is clear: the Bank will keep raising interest rates, even into a recession.

Of course the underlying incentive for such a series of hikes would be to fight inflation which the Bank itself now believes could surge to 10% later in the year.

If UK GDP was flat in April, May and June, then it would be 0.1% lower in the second quarter relative to Q1. Capital Economics are forecasting a 0.2% quarter-on-quarter fall in UK economic growth in the second quarter, and no change in the third quarter.

They are therefore not forecasting a technical recession.

But, "with the biggest hit to households’ real incomes from higher inflation likely to come in Q2 and Q3, the risks to our GDP forecasts are on the downside. A recession is now very possible," says Dales.

Neither is the Bank of England forecasting a recession in 2022 but they do now expect growth to fall sharply when compared to their previous forecasts.

The Bank also said at the time of its May Monetary Policy Report interest rates will probably rise further above 1.0% despite the weak outlook for activity.

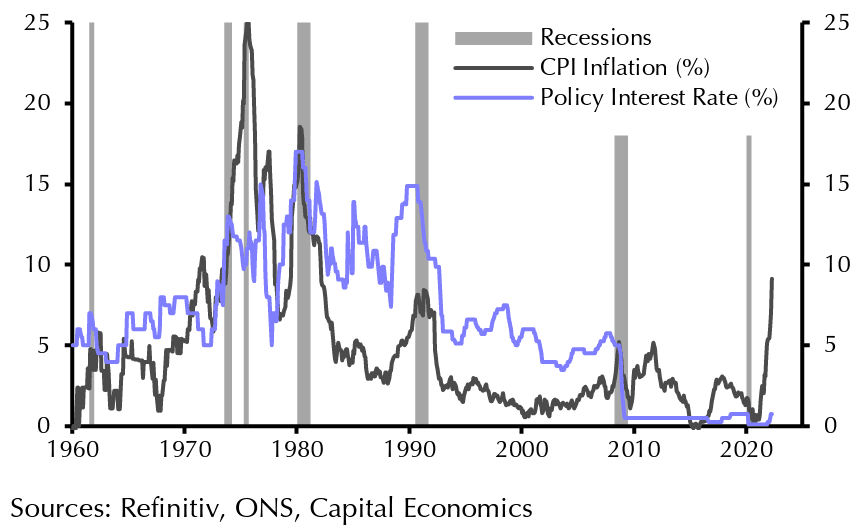

"Since its inception in 1997, the MPC has never raised interest rates during a recession. But that’s mainly because low inflation has meant it has never had to," says Dales. (The last time rates were raised during a recession was in 1975 as CPI inflation surged to 25%).

"If the MPC is going to raise rates during a recession, now is the time it’s likely to happen," adds Dales.

The Office for National Statistics last week announced the UK economy shrank in March and economists warn all signs point to further underwhelming growth over coming months, which could prompt the Bank of England to end its rate hiking cycle as a result.

UK GDP read at -0.1% in the month to March, which disappointed a market looking for a flat reading.

The economy nevertheless grew strongly in the first quarter as a whole as the UK consumer shrugged off fears over Covid and embraced pre-pandemic behaviours.

UK GDP grew 0.8% quarter-on-quarter in the first quarter of the year, but this was also below what analysts were looking for (1.0%) and would also contribute to the Pound's dour performance on Thursday.

GDP grew 8.7% year-on-year in the first quarter, which was also below the consensus expectation for 9.0% growth.