"Overheating" Housing Market Forecast to Cool Sharply in 2022

- Written by: Gary Howes

Image © Adobe Images

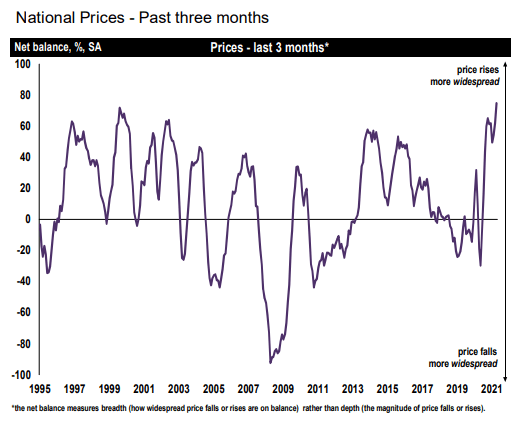

A much-watched survey of UK house prices shows a sharp rise in prices underway as demand outstrips supply and leads one economist we follow to say the market is now overheating, although a sharp cooling down is expected next year.

The RICS UK Residential Market Survey showed demand growth increasingly outstripping supply and accelerating house price inflation.

Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics says the market is now "overheating" but his calculations suggest the market should cool again in 2022.

The survey’s headline measure of house price growth rose again over the month, with a net balance of +75% of respondents noting an increase in prices during April.

This is up from a reading of +62% back in March and has now become successively more elevated in each of the last three reports.

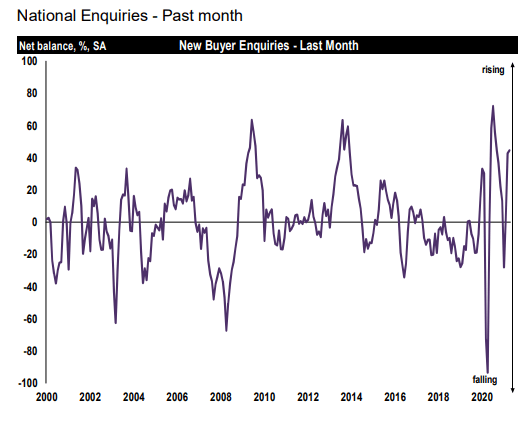

RICS says buyer demand remains firm across the market, while the flow of properties being listed for sale has lost impetus of late.

Tombs notes the average estate agent now has only 40 homes on their books, well below the average of 55 in the 2010s.

He also notes the relatively high level of the enquiries balance is echoed by Google Trends data, which show that, in the four weeks ending May 9, visits to one of the three main property websites were 30% above their average level in the same weeks of 2017-to-2019.

Looking ahead, RICS say respondents to their survey expect the frothy market to remain a feature of the next three months, before cooling down.

Tombs says the return of the threshold for stamp duty land tax to £125K, from £500K at present, will increase the cost of purchasing the average home by 1% and most of that tax hike will be capitalised into house prices.

He adds that the combination of higher mortgage rates and higher house prices has lifted the proportion of buyers’ incomes absorbed by mortgage repayments.

"A clear downside risk to the outlook for house prices is that future buyers are not prepared to devote such a large such of their incomes to housing as recent buyers once the pandemic is in the rear-view mirror," says Tombs.

Pantheon Macroeconomics also expect new housing supply to pick up in response to this year's jump in prices, which should ease supply constraints somewhat.

They forecast house prices to rise at a slower rate than incomes next year, and have pencilled in a slowdown in year-over-year growth to 0.5%, from 7.5% this year.

The RICS survey meanwhile shows renters face further pressures with near-term rental growth expectations rising sharply, returning a net balance of +55% in April, compared to a reading of +15% over the previous quarter.

Over the next twelve months, respondents envisage rents rising by 3% on average across the UK.