"Brutal Period of Redundancies" Ahead: Economist Reactions to UK Employment Data

- Less out of employment than feared

- Fall in pay slows

- Vacancies increase

- Hours worked increase

- "prolonged labour market shock" likely says IES

Image © Adobe Stock

The UK reported better than expected headline employment figures on Tuesday, however economists remain overwhelmingly of the opinion that the labour market will deteriorate significantly into year-end.

Unemployment in the three months to July rose by 12K reports the ONS, which is far less than the 125K decline the market was looking for, ensuring the unemployment rate remains unchanged at 4.1%.

The Claimant Count Change for August - those applying for out of work benefits - rose 73.7K in August, which is less than the 100.0K the market was expecting. The Claimant Count reached 2.7 million in August 2020, an increase of 120.8% since March 2020.

The rate of decline in employee pay growth slowed in July following strong falls in the previous three months, with the Average Earnings Index, with bonuses included read at -1.0% in July, which is better than the -1.3% the market was expecting.

Vacancies continued to show increases in the latest period, driven by the smaller businesses, some of which are reporting taking on additional staff to meet coronavirus (COVID-19) guidelines, says the ONS.

"The labour market continued to show signs of recovery, supported by the phased easing of lockdown restrictions throughout the summer, which has boosted business activity and consumer demand. Total hours worked rose by almost 8% as people returned to work. Vacancies, an indicator of labour market tightness, rose by nearly one-third in the 3 months to August, than in the 3 months prior. The decline in annual pay is also showing signs of slowing," says Jing Teow, Senior UK Economist at PwC.

Despite improvements, there are other further data points to consider that suggest the labour market will struggle over coming months.

The number of employees on payroll is 695K lower than before the crisis which started in March 2020, while total hours worked is still nearly 20% lower than pre-crisis levels.

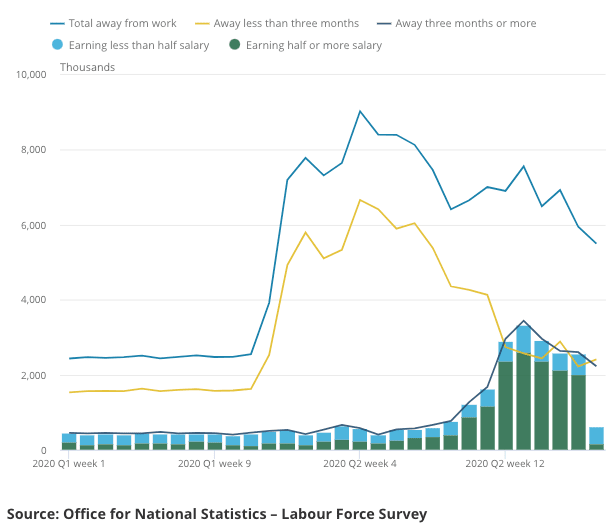

Around 5m workers are still temporarily away from work, and what happens to them following the ending of the government furlough support scheme is critical to how the labour market ends the year.

"While these signs of improvement are encouraging, we are not yet out of the woods," says Teow.

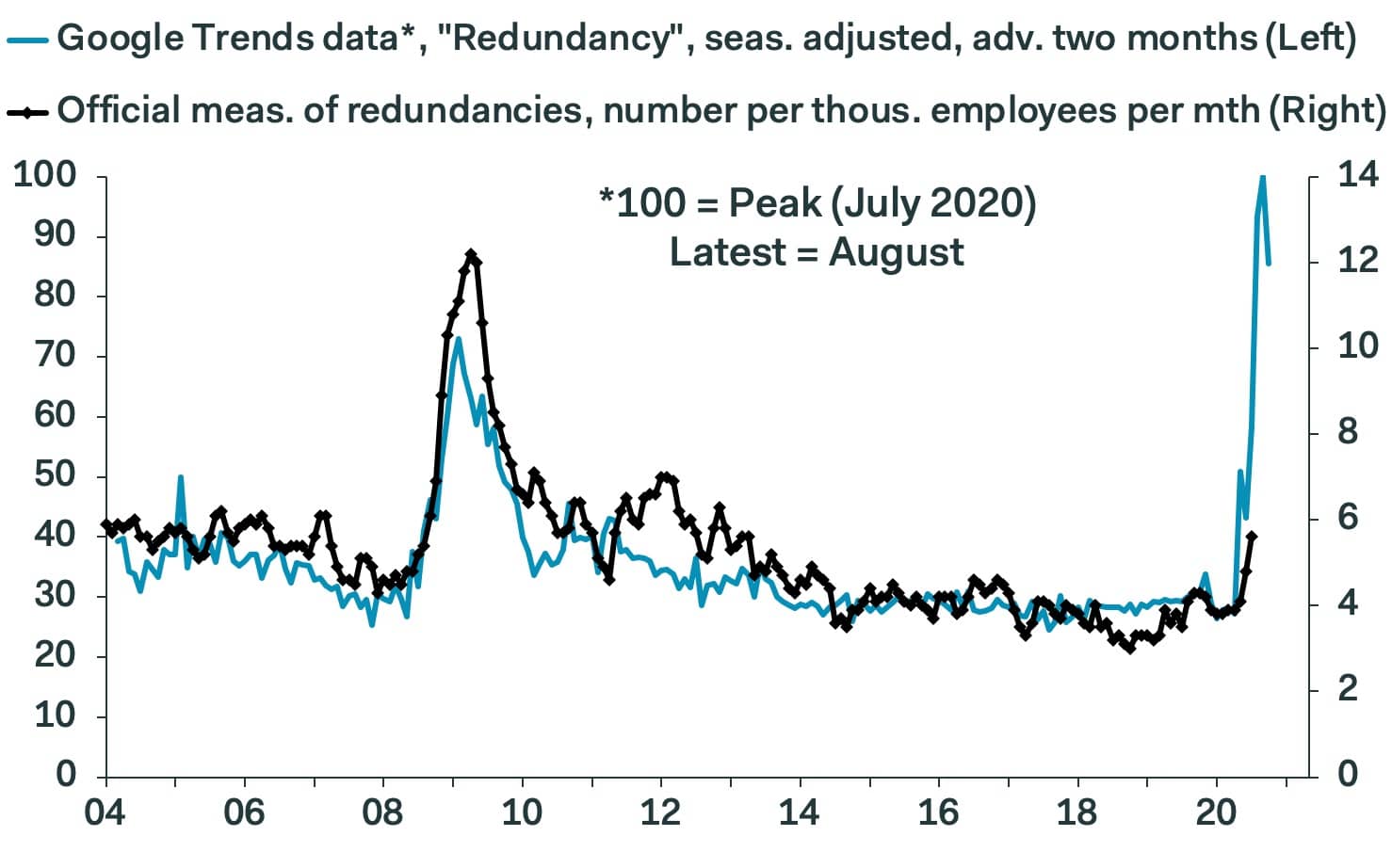

"We're still just at the start of what looks set to be a brutal period of redundancies," says Samuel Tombs Chief U.K. Economist at Pantheon Macroeconomics.

"On the one hand July saw at least two million people return to work from furlough and vacancies continue to slowly recover. But at the same time, redundancies have risen by nearly 50% in three months to their highest since 2012, while the number of young people in employment fell by more than at any point since 2009. Taken together, these figures show that the ending of lockdown has marked really just the beginning of what may be a prolonged labour market shock," says Tony Wilson, Director at the Institute for Employment Studies.

Wilson says if we want to avoid a rapid rise in unemployment over the next year or so "then it is clear that we will need more measures to support future jobs growth, as well as getting in place quickly the support announced in the Plan for Jobs this summer".