Coronavirus vs. SARS: Predicting the Economic Impact of the 2019-nCov Outbreak

- 2019-nCov impact likely to be contained

- But more mobile Chinese population is key risk

- Chinese retail, transport sectors most at risk industries

Image © Adobe Images

The impact of the 2019-nCov virus (coronavirus) is to be short-lived say economists, but an increasingly mobile Chinese population risks the disease spreading over coming weeks.

While China is better prepared for viral outbreaks following the experiences of the 2003 SARS episode, global markets are still prone to take fright when faced with such 'unknowns' - evidenced by the losses seen in the first half of this week.

Stock markets and commodity prices turned sharply lower as it became clear the 2019 novel coronavirus, or 2019-nCoV, was spreading between humans and the numbers of infections had jumped significantly.

"We have no way of assessing the potential for this story to drive a further mark down in risky assets from here, we can only highlight that the story can get far worse," says John Hardy, chief FX strategist at Saxo Bank. "It took a number of months for the SARS virus outbreak – a similar coronavirus – outbreak to die down back in late 2002 and well into 2003."

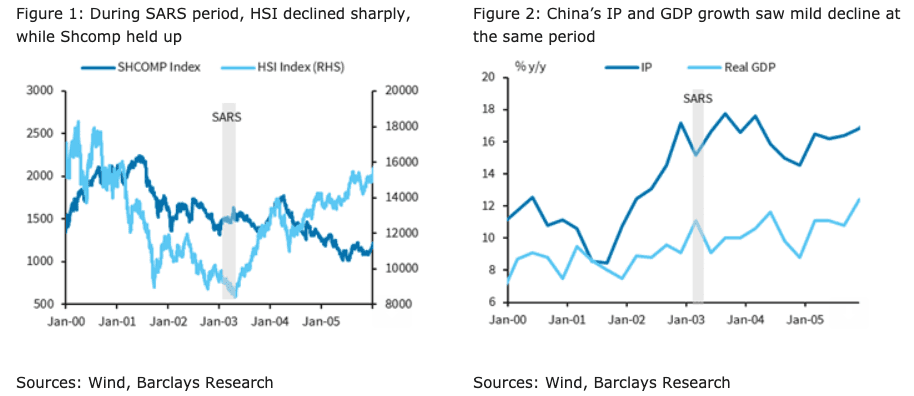

Comparisons have understandably been made with 2003's SARS outbreak as economists try to gauge the likely impact of 2019-nCoV. SARS had a discernible impact on the Chinese and other Asian economies and the fear amongst traders and investors is that the world's second-largest economy could be facing a new headwind, which would in turn have implications for global trade and growth.

From a medical perspective, the 2019-nCoV strain appears to be less deadly than SARS thus far, and markets have since recovered losses, although the Shanghai exchange continues to lag its Asian peers at the time of writing on Tuesday. However, 2019-nCoV is by no means over, "these pathogens have their own ways and so risk off remains the general mood among most market participants, especially whilst the number of reported infections has been growing exponentially," says Elwin de Groot, Head of Macro Strategy at Rabobank.

The SARS outbreak peaked about 3-4 months after the first case was reported in November 2002, and was mostly contained after 6-7 months.

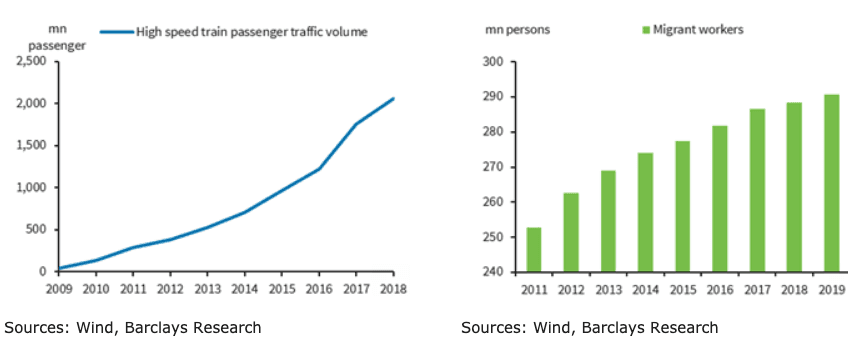

"Assuming a similar trajectory, the outbreak of the 2019-nCov may not peak until March-April. However, we are mindful of the potential for the outbreak to accelerate at a faster pace during the Lunar New Year travel season, with official estimates putting the number of trips being made at around 3 billion," says Jian Chang, an economist with Barclays in Hong Kong.

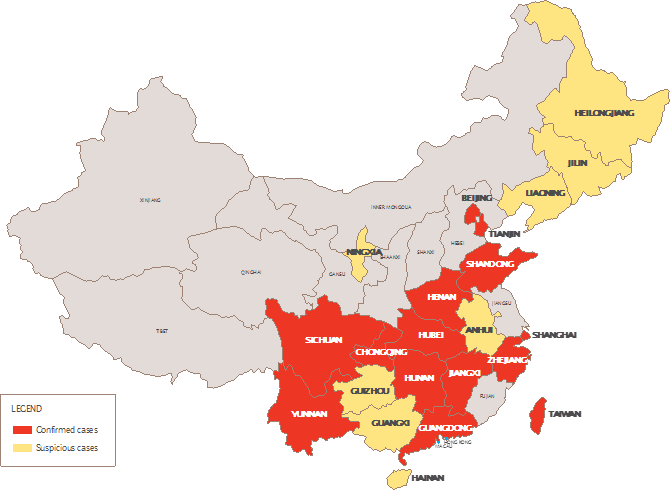

2019-nCoV has originated in the Wuhan region of China and at the time of writing, nine people are reported dead among the 440 people who are said to have contracted the corona virus.

Tuesday saw the first case reported in the United States by a man who had visited Wuhan. Chinese authorities are now stepping up efforts to limit the spread of the virus ahead of the travelling season around the Lunar New Year holiday.

In 2002-2003 the SARS outbreak was mainly concentrated in Beijing, Guangdong, and Hong Kong, however it is noted that today the Chinese population is notably more mobile thanks to 18 years of economic growth and infrastructure investment in China.

Chang says thanks to developments in transportation infrastructure, including high-speed rail and airlines, rising car ownership, and a larger number of migrants, authorities could face greater challenges when it comes to controlling inter-city and international travel.

From an economic and global financial perspective, how China reacts is key.

"We think the government could step up targeted credit and fiscal support, should the spread significantly intensities," says Chang.

Markets will be looking for guidance from China to not only contain the virus, but to offer measures to stimulate the economy should the 2019-nCov outbreak become more persistent.

Barclays say there are reasons to believe the economic impact of the 2019-nCov will be smaller than that of SARS, but the sectors to keep an eye on are largely retail and transport.

Their analysis notes China’s retail-sales growth was hit hardest in May 2003, reaching a low of 4.3% (April: 7.7%, Q1 average: 9.3%), but promptly rebounded to 8.3% in June 2003 and an average of 9.7% in Q3.

Passenger transportation began to contract year-on-year from April 2003, and fell by 42% and 22% in May and June 2003, respectively, before returning to growth from that September.

"However, relative to the SARS outbreak, we think the shock to retail sales this time may not be as large, given online sales are more prevalent nowadays and this would not be significantly affected versus bricks and mortar shops," says Chang.

"Travel and tourism related sectors remain most at risk, but it is often uncertainty that has most impact on markets," says Rabobank's de Groot.

Outside of China, Hong Kong's economy and financial performance was hit hardest by SARS, with the HSI index suffered a sizeable loss, falling by as much as 10% by end-April 2003 versus the start of the year.

Limited Economic Impact, for Now at Least

Despite the increased mobility of Chinese citizens, and the unfortunate timing of the outbreak which coincides with Chinese New Year, economists believe the economic impact of the virus should be less severe than the 2003 SARS outbreak.

"Looking back on previous virus outbreaks such as the SARS virus, one conclusion is that the negative reactions in the financial markets are usually quite short-lived. The mortality of the new virus, at least so far, seems to be considerably lower than for SARS (2% vs 10%)," says Elisabet Kopelman, Economist at SEB.

Chang says intensified temperature screening and improved inspection equipment across all types of transportation ports, coupled with more timely updates on infected regions, would enhance the effectiveness of infection identification and reduce the contagion risks.

"We think more timely and credible communication and preventive measures by the government this time around (as committed to by the China's health authority at a 22 January press conference; official link to updates on new cases) would help prevent more panic," says Chang.

Barclays economists don’t expect the effects of the 2019-nCoV outbreak to be of the same magnitude as SARS in view of better preventative measures taken by Hong Kong authorities and improved disease updates from the Chinese government.

"The China and Hong Kong stock markets traded poorly on Tuesday owing to rising concerns on the outbreak of the Wuhan coronavirus. The market suffered from a 15% drawdown during the SARS outbreak in 2002–2003. However, if the situation does not deteriorate akin to SARS, we are inclined to view the current correction as an opportunity to accumulate stocks," says Richard Tang, an equities analyst with Julius Baer.