Manufacturing Downturn Extends, but Tentative Improvements Noted

Image © Adobe Stock

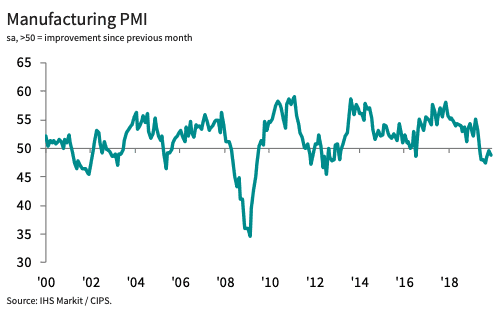

The IHS Markit Manufacturing PMI for November confirmed the slump being experienced by the sector extended, however the data came in on the stronger side of expectations.

The PMI read at 48.9 in November, an improvement on October's reading of 48.3, and ahead of market expectations for a similar reading of 48.3.

So while the data was better than economists had forecast, the reading below 50 was still consistent with the sector contracting; this is the sevent consecutive reading that puts the sector in contractionary territory.

"The UK manufacturing downturn continued in November, as businesses responded to the delay to Brexit and a fresh injection of uncertainty from the forthcoming general election," report IHS Markit, compilers of the PMI survey.

Output, new orders and employment all fell, while destocking activity resumed as firms depleted buffers built-up in advance of the postponed exit date.

Companies reported scaling back production in response to lower new order intakes. Efforts to reverse high stock holdings also contributed to the contraction, as did settling backlogs of work directly from inventories

New orders fell for the seventh month in a row during November, IHS Markit says this reflected tougher conditions in both domestic and overseas markets.

“A heavy sense of inevitability hung around the sector in November as it continued to suffer the effects of a lethal cocktail of Brexit uncertainty, slowing global growth and an impending General Election. These combined to stifle any chance of manufacturing crawling out of the contraction zone, where the sector was stuck for a seventh month in a row," says Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, who sponsor the report.

However, there is certainly a sense that the worst might now be behind the sector, highlighted by today's numbers coming in ahead of analyst expectations.

"Amid this volatility, we see tentative signs that underlying demand is recovering; both the new orders and output expectations balances increased to their highest levels since May, mirroring the slight recent improvement in the Eurozone’s manufacturing PMI," says Samuel Tombs, UK economist for Pantheon Macroeconomics. "But for now, firms are not confident enough about the business outlook to hire more workers; the employment balance remained marginally below 50 for the eighth consecutive month."

Tombs adds that while the sector might be seeing some improvements, 2020 should remain a challenging year.

"The manufacturing sector likely will miss out on any rally in economic activity driven by a reduction in political risks in the first half of next year, given the threat that manufacturers will have to export under WTO terms from the end of 2020. Overseas firms will be wary of sourcing components from U.K. suppliers, given the risk that the supply chain could fail in January 2021. So while we still look for GDP growth to recover next year, we doubt that the manufacturing sector will play a role," says Tombs.