UK Public Finances and Investment Returns Improve but Economy Still Headed for Softer Year

- Written by: James Skinner

© IRStone, Adobe Stock

- Borrowing in 2018 the lowest in 16 years, but OBR forecast in doubt.

- Q3 GDP rebound confirmed at 0.6% but 2018 slowdown a certainty.

- Current account deficit widens in third-quarter, remains threat to GBP.

The public finances improved notably in November but the economy is still on course to slow again for the 2018 year, according to multiple economists.

The Office for National Statistics (ONS) said UK government borrowing was £7.2 billion in November, down £0.9 billion from the same period one year ago and the lowest November borrowing figure for some 14 years.

Borrowing for the 2018 year-to-date was £32.8 billion, down £13.6 billion from one year ago and the lowest year-to-November number for 16 years, largely due to stronger tax receipts at the Treasury.

National debt came in at £1,795.1 billion, up by £59.3 billion since November 2017 and equal to 83.9% of GDP. But the ONS also says the debt-to-GDP ration is unchanged from November 2017.

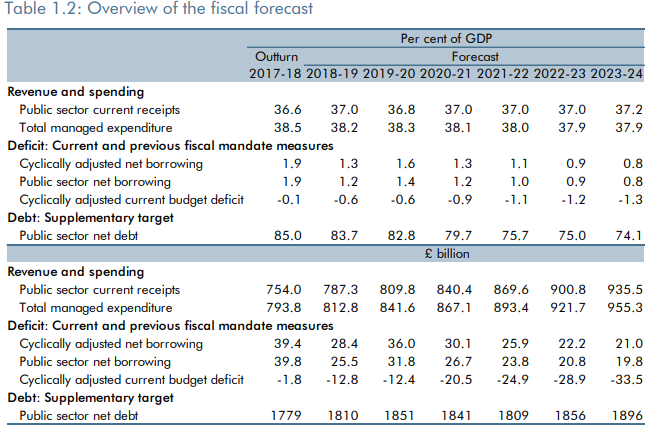

The Office for Budget Responsibility (OB)R said back in November that borrowing would be around £25.5 billion this year, and the national debt would likely be around 83.7% of GDP for 2018 overall.

It forecast borrowing would decline steadily over the coming years, although that's because the economy is expected to grow faster than the debt. Debt will still grow over coming year, not fall.

"Excluding tobacco duties, total [tax] receipts rose by a healthy 5.4%, above the 4.6% average rate so far this year. Accordingly, we must concede that the public finances aren’t flagging up the slowdown indicated by the latest monthly GDP data and business surveys," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Above: Office for Budget Responsibility forecasts for the public finances.

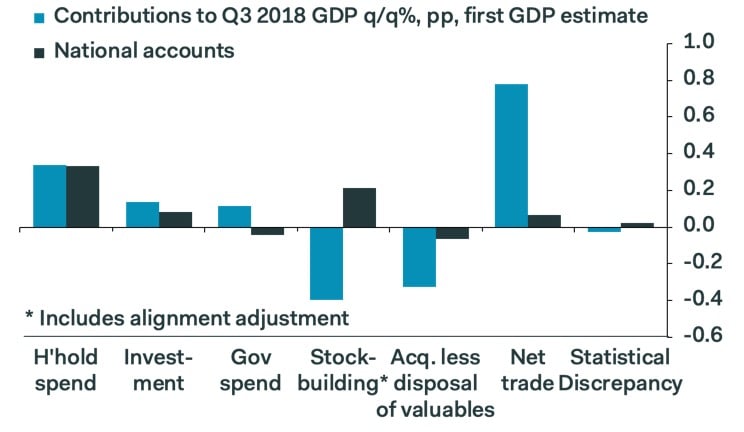

The ONS also confirmed that the economy grew by 0.6% during the three months to the end of September, with the services sector having led the way.

Household consumption was also strong during the period and the ONS' earlier estimate of the third-quarter decline in business investment was revised lower by a touch.

"GDP growth in Q3 included the bounce back from the weakness generated in Q2 by the severe weather. The softness of retail sales and the activity PMIs in more recent months suggests that growth will return to the rates of 0.3-0.4% q/q seen for much of the previous year," says Paul Dales, chief UK economist at Capital Economics.

However, after a dire first quarter that was induced by poor weather in February and followed by an uninspiring second quarter, official data suggests the economy is still set to slow this year.

Consensus among economists is pointing to GDP growth of a paltry 1.3% for 2018. With the economy up 1.1% for the year at the beginning of the final quarter, that conensus could yet prove too pessimistic, although a repeat of 2017's 1.7% expansion would still be a tall order.

"The recent deterioration in business and consumer surveys, together with timely official data, suggests that Q3’s strong growth rate hasn't been sustained in Q4; we look for a mere 0.2% increase," says Pantheon's Tombs.

Above: Pantheon Macroeconomics graph showing contributions to Q3 growth.

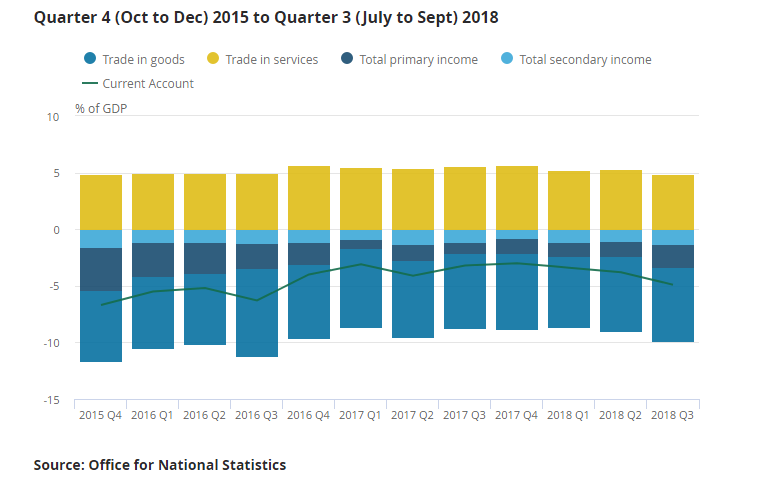

Finally, and on the downside, the UK current account deficit widened to -£26.5 billion during the third-quarter, up from -£20 billion previously and far higher than the -£21.7 billion deficit anticipated by the market.

Current accounts measure changes in the amount of money flowing into and out of an economy as well as movements in borrowing from the rest of the world.

"A current (and capital) account deficit places the UK as a net borrower with the rest of the world," the ONS says. "The UK must attract net financial inflows to finance its current (and capital) account deficit, which can be achieved through either disposing of overseas assets to overseas investors, or accruing liabilities with the rest of the world."

Currency markets care about the data as it paints a telling picture of international demand for a currency and provides insight into the extent to which a nation is exposed to the changing sentiments of investors.

All main components of the current account balance worsened during the recent quarter, although the greatest contribution to the deterioration coming through the primary income balance.

The primary income deficit widened by £3.6 billion to -£11.1 billion after an increase in profits earned by foreign investors holding UK assets saw the nation's liability to the rest of the world rise.

Rising returns could be a good omen for future investment flows into the UK, which would be positive for growth in turn, but they are a net-negative for the current account balance.

Profits earned by UK investors in other countries were unable to offset the increase going the other way, leading to a deterioration of the primary balance.

"The U.K. is heading into a political crisis with a large external deficit and a huge stock of debt, equal to 522% of GDP, that is owed to overseas residents. In the event of a no-deal Brexit, sterling would fall a long way before it found a floor," says Pantheon's Tombs.

Above: ONS graph showing changes in balances of current account components.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here