Swiss National Bank Muscle Keeps EUR/CHF Off Lows but Recovery Prospects Uncertain

- Written by: James Skinner

Image © Adobe Stock

- GBP/CHF spot rate at time of writing: 1.1831

- Bank transfer rate (indicative guide): 1.1417-1.1500

- FX specialist providers (indicative guide): 1.1654-1.1725

- More information on FX specialist rates here

The Swiss Franc remained the best performing major currency of 2020 on Friday even as it underperformed on an intraday basis, although Swiss National Bank (SNB) intervention is likely to keep the Euro-to-Franc rate above the year’s lows, according to Capital Economics and Commerzbank.

Switzerland’s safe-haven Franc ebbed against all major currencies other than the safe-haven Yen and a swooning Australian Dollar as stock markets rose amid an apparent recovery of investor appetite for risk assets.

But rising stock markets may not be enough on their own to keep the all important Euro-to-Franc rate from new lows, meaning further intervention could be necessary to stave off pressure on already-subpar inflation, prevent a cheapening of economy-eating imports and impairment of export competitiveness.

This might be especially the case if governments continue responding to a second coronavirus wave with restrictions on activity among businesses and households, which are undermining continental recovery prospects.

“While Health Minister Alain Berset said that he “considered the matter to be under control”, the direction of travel elsewhere on the continent points to tighter curbs before long,” says David Oxley at Capital Economics. “Associated risk-off environment in financial markets is causing headaches for the SNB too."

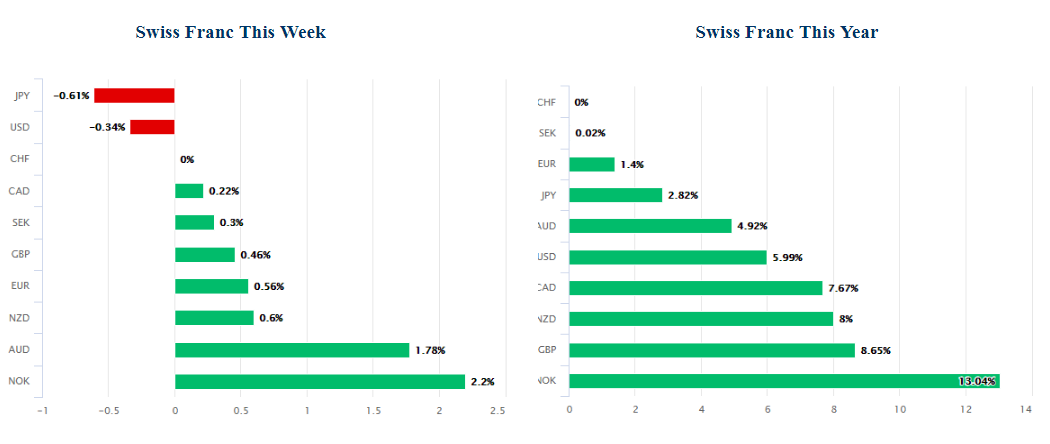

Above: Swiss Franc performances against major currencies this week and this year. Source: Pound Sterling Live.

Europe’s single currency fell to a three-month low against the Franc amid losses that washed over stock markets earlier this week, taking it briefly beneath the 1.07 handle and threatening a test of the technically-important 200-day moving-average at 1.0675 before returning confidence lifted the exchange rate Friday.

"The SNB would not hesitate to intervene in the FX market again if it deemed it necessary," Oxley says. "Looking ahead, the franc will continue to be prone to bouts of upward pressure during periods of risk-off investor sentiment. However, if appetite for risk improves next year, as we expect, this should give the SNB some breathing space, at least against the single currency."

EUR/CHF remains some way off the 1.05 level that’s viewed by the market as a de facto trigger for the heavy artillery of the SNB. However, the danger is that deteriorating investor sentiment toward Europe, if-not the global economy, leads the exchange rate back to that May low and necessitates a fresh intervention from Switzerland’s central bank.

Capital Economics forecasts EUR/CHF will recover to 1.10 by the end of 2021, from 1.07 Friday.

“With the second corona wave EUR-CHF remains under pressure. However, the SNB should succeed in preventing the exchange rate from plummeting. We even expect that the Swiss monetary watchdogs will succeed in keeping EUR-CHF well above the 1.05 level” says Ulrich Leuchtmann, head of FX strategy at Commerzbank. "Does this mean that the issue of "CHF appreciation pressure" is off the table? In our opinion, no. Two factors stand in the way of this: the second wave of corona that is currently sweeping Europe, and the ECB's monetary policy. Only when the corona pandemic subsides (according to our experts' estimates in H2 2021) will EUR-CHF have some potential for recovery."

After having cut its main interest rate far below zero the bank has for years opted to use transactions in the foreign exchange market to "stabilise economic activity" and counter downward pressure on inflation, which is often the result of exchange rate strength rather than ebbing momentum in the economy.

This, combined with sound economic and monetary fundamentals, have burnished the Swiss Franc with a safe-haven appeal and left the SNB with a reputation for intervention more so than with any other central bank.

“As net exporters, both currency areas are suffering similarly from the slump in world trade and would benefit similarly if it were to pick up again (contrary to our expectations),” Leuchtmann says. “In the long term, however, the exchange rate has only moderate potential for recovery.”

Above: Euro-to-Franc rate shown at daily intervals with 200-day moving-average in black.

Few if-any in the market doubt its ability or resolve to prevent the Franc from rising too far, given that it can create new money from little more than thin air and then sell it in exchange for rival currencies. But also, and equally, few if-any expect the Franc to weaken by much either.

Thomas Jordan, chairman of the executive board at the SNB, defended the bank’s practice in a speech to the Progress Foundation in Zurich last week, where he also dismissed fears about irreversible damage to the currency.

As controller of both domestic money supply and substantial foreign exchange reserves, Jordan argued the SNB always has the option of selling any newly acquired foreign currency stock back to the market in exchange for Swiss Franc’s that can then be cancelled.

“There is nothing to suggest that the long-term consequences of the corona recession for the real economy in Switzerland are significantly different from those in the euro zone,” Leuchtmann says. “In other words: As things stand today, there are no strong arguments from the fundamental side for significant EUR-CHF revaluations.”

Commerzbank’s Leuchtmann also sees the Euro reclaiming 1.10 in around the same time, although he and the Commerzbank team have warned that recovery potential beyond there is likely to be limited. He forecasts a 1.10-to-1.12 long-term range but says short-term risks are to the downside.

Meanwhile, technical analysts at the Germany-headquartered global commercial bank have got eyes on the 200-day moving average at 1.0678, while having also warned of limited upside potential for at least the next one-to-three weeks. They too however, also say EUR/CHF is unlikely to sustain a move below 1.05.

“We look for losses back to the 1.0678 200 day ma and this guards the 1.0607 10th July low,” says Karen Jones, Commerzbank’s head of technical analysis for currencies, commodities and bonds. “Extensive resistance now spans from 1.0712 to 1.0860 and is likely to act as an effective ceiling for the market.”

Above: Euro-to-Franc rate shown at weekly intervals with 200-week moving-average in black.