Pound / Canadian Dollar Recovery Puts December Highs in Sight

- Written by: James Skinner

- GBP/CAD recovery places December highs in sight

- Loonie’s retreat lifts USD/CAD near to 2021’s highs

- GBP steadier after UK inflation surprises on upside

- CA inflation stalls in Nov, biding BoC time on rates

Image © Bank of Canada

The Pound to Canadian Dollar exchange rate has reversed sharply off its 2021 lows this week following a widespread retreat by the Loonie and amid renewed stability in Sterling, although some analysts say GBP/CAD needs to get above 1.71 in order to really draw a line under recent weakness.

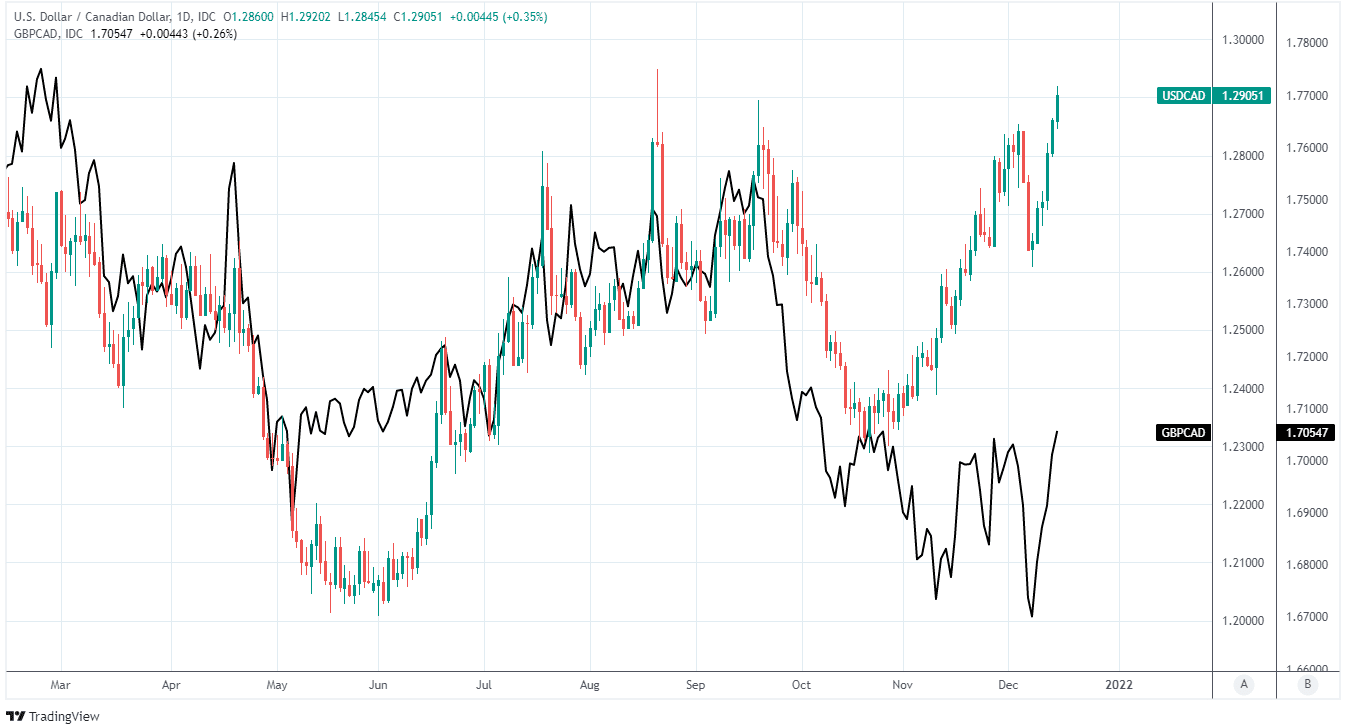

Canada’s Dollar was the biggest faller among major currencies in midweek price action that saw USD/CAD making a beeline for 2021 highs around 1.2950 for the first time in months, which helped GBP/CAD to sustain this week’s recovery above 1.70.

Gains for USD/CAD and GBP/CAD extended to more than two percent for the week by Wednesday after official data suggested Canadian inflation pressures may be more tame than elsewhere, with the annual rate holding steady at an elevated 4.7% last month.

“The fact that inflation remained stable in Canada is a bit of a relief relative to the concerning acceleration seen in the US in November,” says Royce Mendes, an economist at CIBC Capital Markets.

While Canadian inflation was only 0.2% higher for November and unchanged in annual terms, Wednesday’s data from the UK showed the consumer price index rising from 4.2% to 5.1%, a level not seen since 2011 and the years after the Sterling depreciation induced by the financial crisis.

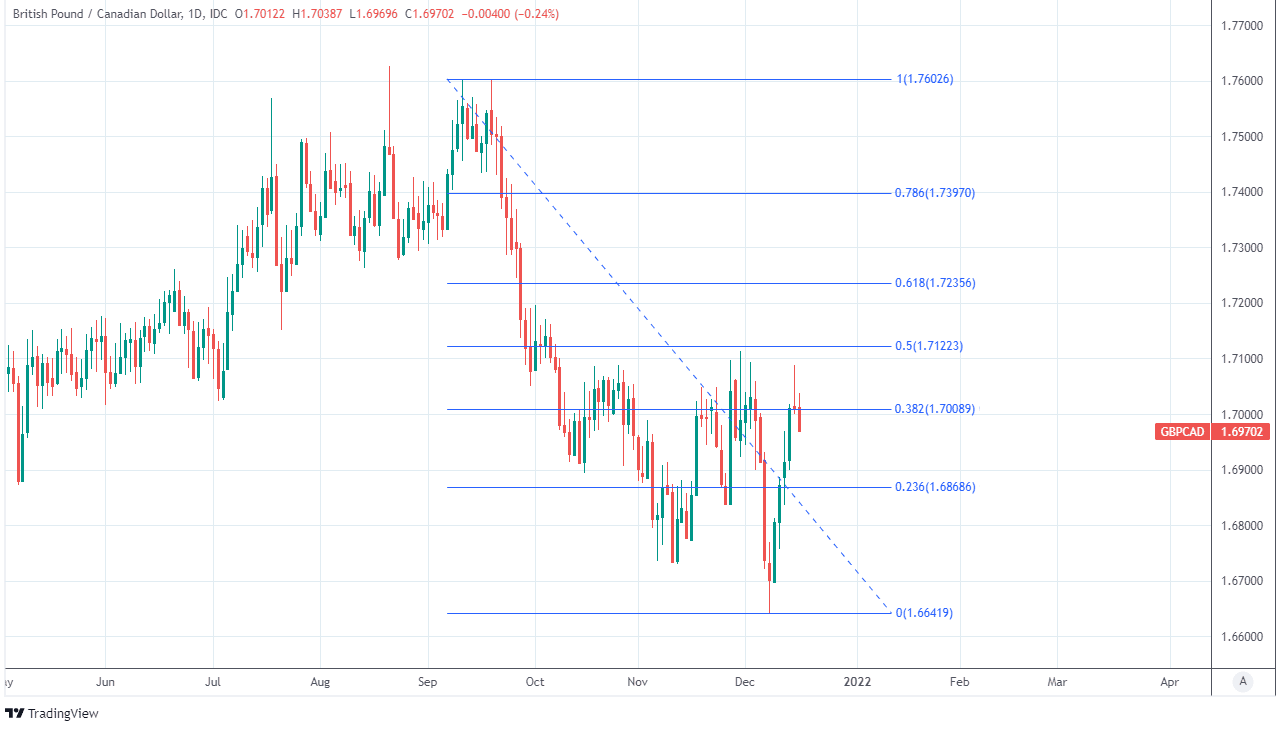

Above: GBP/CAD shown at daily interval, lifting off from 55-day moving-average with Fibonacci retracements of September decline indicating likely areas of technical resistance.

- Reference rates at publication:

GBP to CAD spot: 1.6982 - High street bank rates (indicative): 1.6388 - 1.6500

- Payment specialist rates (indicative: 1.6830 - 1.6897

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The slower build up of inflation pressures in Canada potentially vindicates the patient approach taken by the Bank of Canada in November’s policy announcement, while escalating UK inflation pressures could potentially enhance the sense of urgency at the Bank of England.

“The CAD just can’t hold a bid. Weaker crude, cautious risk appetite ahead of the Fed, and the narrowing in US/Canada spreads are combining to drive the CAD a little lower still,” says Shaun Osborne, chief FX strategist at Scotiabank.

UK and Canadian inflation still originates from supply chain disruptions that have proven longer-lived and more persistent than many expected, although last month’s move above 5% in the UK came sooner than had been anticipated by BoE policymakers.

The above kind of difference is one reason the market expects the BoE to raise Bank Rate sooner than it sees the BoC lifting its cash rate, albeit that market pricing suggests there’s unlikely to be more than a mere couple of months between them.

“The pound’s bounce from the 1.67/1.68 zone could well extend. But that 1.71 resistance zone needs to be taken out sooner rather than later if the GBP is to progress,” Osborne and colleagues said in Scotiabank’s latest review of GBP/CAD’s charts.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Recent data and this week’s price action has seen Sterling show greater resilience against the U.S. Dollar others, helping in the process to sustain the Pound-to-Canadian Dollar rate’s rebound, which had taken it back to within arm’s reach of December’s highs by Thursday.

But despite Sterling’s role, the main driver of the Pound-Canadian Dollar recovery has been the sustained retreat by the Loonie, which lifted USD/CAD to a 2021 gain along the way.

Only the oil and equity linked Norwegian Krone was able to match the losses seen by the Canadian Dollar this week, and despite their large scale GBP/CAD still hadn’t been able to get near to the 1.71 handle referenced by Scotiabank.

“Near-term price action appears overbought, but note that 2-year US/CA spreads have been plummeting of late as well (with CAD yields outperforming) suggesting that factors also support near-term CAD weakness. We remain short CAD both versus the USD (via a 1.32 strike over the coming months) and on the crosses (versus AUD),” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

GBP/CAD closely reflects the relative performances of GBP/USD and USD/CAD, and could potentially find itself bottoming out following an early December sell-off over the coming days although it would be susceptible to corrective declines in USD/CAD.

Above: USD/CAD shown at daily intervals alongside GBP/CAD.