Australian Dollar: Westpac See Pound Falling Below 2.0 Despite Current Strength

The pound has enjoyed a positive start to the year against the Aussie dollar but one of Australia's leading currency analysts confirms momentum could still push the GBPAUD exchange rate lower.

The pound has got off to a flyer in 2016 with strong gains coming almost exclusively on the back of the Chinese-inspired woes besetting the commodity currencies.

Weakness is therefore more a function of the Australian dollar, as opposed to any pound strength.

Herein lies the problem for the GBP/AUD exchange rate - if sentiment towards the Australian unit were to improve, as it may well do, then recent weakness will be quickly forgotten.

The multi-month depreciation in the British pound to Australian dollar exchange rate would therefore resume.

For those hoping for a stronger GBP to AUD conversion, disappointment has been in abundant supply since the pair turned lower back in August 2015. Since the best exchange rate in years was achieved the GBPAUD has been stuck in a declining channel.

Back in August international payments were being achieved just above 2.20.

Now, we are looking at live rates of 2.0480 while banks are seen charging just below 2.00 for converting your pounds. All is not lost though as independent providers with smaller overheads are still seen offering above 2.01.

Forecasting More Losses for GBPAUD

Pound Sterling Live’s Joaquin Montfort wrote at the start of the year that despite some recent relief in GBPAUD over Chinese-inspired jitters, the Aussie could well reassert itself.

Westpac’s Sean Callow backs this view.

“AUD outperformance against the pound seems likely to continue multi-week, despite the near term challenge of breaking GBP/AUD 2.00,” says Callow in Sydney.

Callow concede’s that perhaps the biggest risk to any Australian dollar strength is China, and recent concerns over that country’s manufacturing sector could allow the GBP to AUD conversion a move back towards 2.07.

“Short term risks for AUD centre mostly on China’s sluggish industrial sector and nerves in its FX and equity markets. This could see GBP/AUD test the 200dma at 2.07.”

On balance though, Callow reckons the Aussie will be favoured by markets:

“But with AUD enjoying underlying demand from M&A, commercial property etc and iron ore prices finally looking more range-bound, we see scope as far as 1.93 multi-week.”

Long-Term, Pound Sterling Still Below Average

Longer-term though it could be argued that the British pound could enjoy more upside in its quest to find its longer-term equilibrium point.

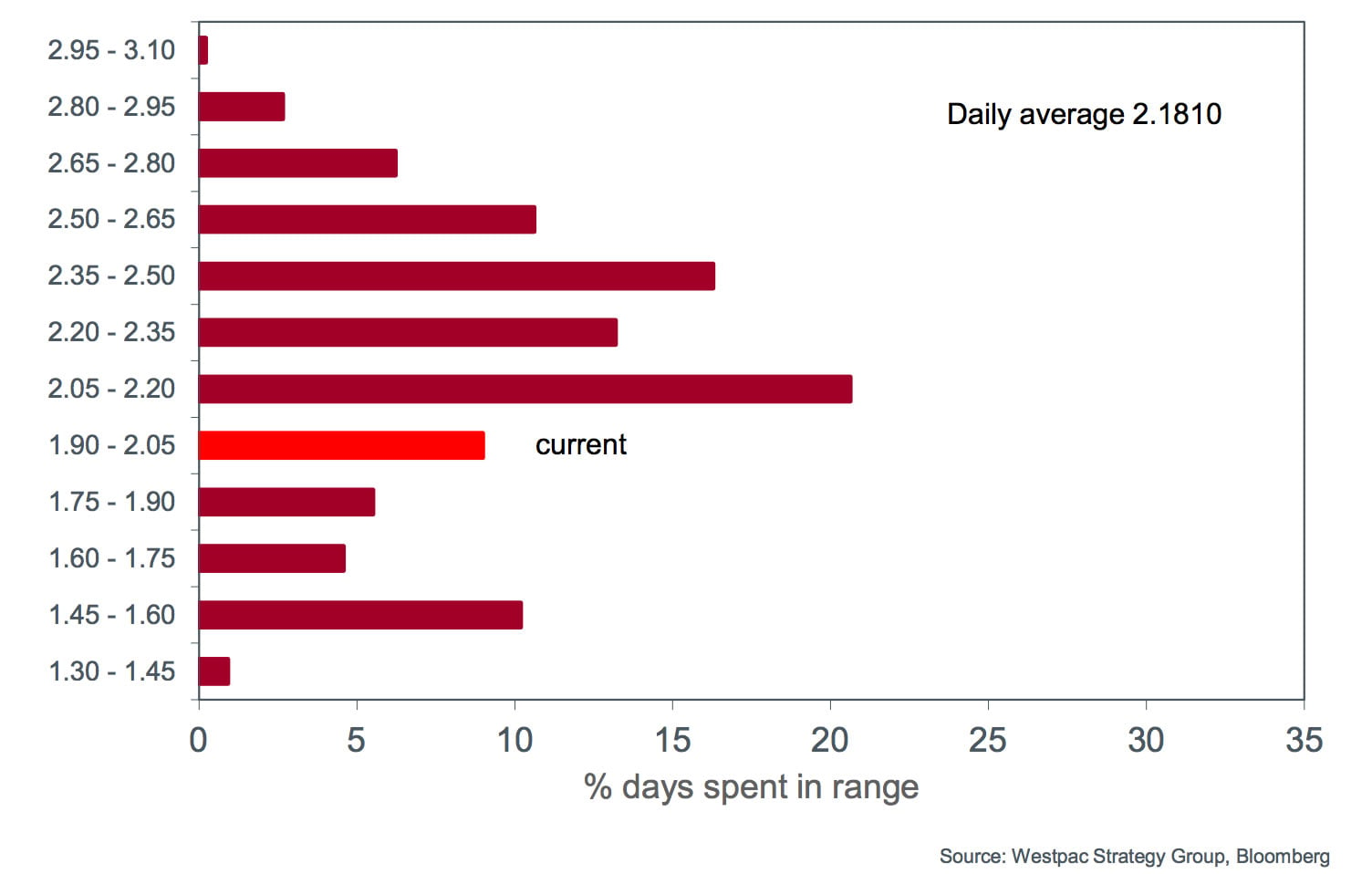

The favoured trading range for GBP/AUD is at 2.05-2.20; this level accounts for over 20% of days traded by the pair since the Australian currency was allowed to float freely in 1983.

The current 1.90-2.05 range accounts for about 10%.

Westpac do not see GBP/AUD moving into the favoured 2.05-2.20 range over coming weeks as soft UK inflation rates are likely to keep the start of the Bank of England tightening cycle sufficiently distant in market pricing to weigh on sterling.

In comparison a steady hand at the RBA is tipped to keep the Aussie in demand.

Studies of the difference between yields on UK and Australian sovereign debt also confirm a trend in favour of the Aussie.

“The spread has moved back towards AUD over the past 6 months as RBA easing expectations have faded while a lack of urgency for the Bank of England to tighten policy has weighed on UK yields out to 2 years,” says Callow.

Westpac expects rates to be kept on hold at 2% through 2016.

The main risk to the outlook seems to be from the terms of trade, particularly if export prices resume their fall but AUD does not.