Australian Dollar Softer on Unexpected Job Market Weakness

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar trades softer following the release of disappointing labour market data, the second disappointing release from the country this week.

The country reported a 40.9K decline in employment in July, a first fall since October 2021, where analysts were looking for an increase in 25K.

"AUD/USD inched lower to near 0.6920 following the mixed July labour market report," says Carol Kong, a strategist at Commonwealth Bank of Australia.

The Pound to Australian Dollar (GBP/AUD) meanwhile defended a near-1.0% gain made the day prior to trade at 1.7357; the pair is now nearly 2.0% higher this week.

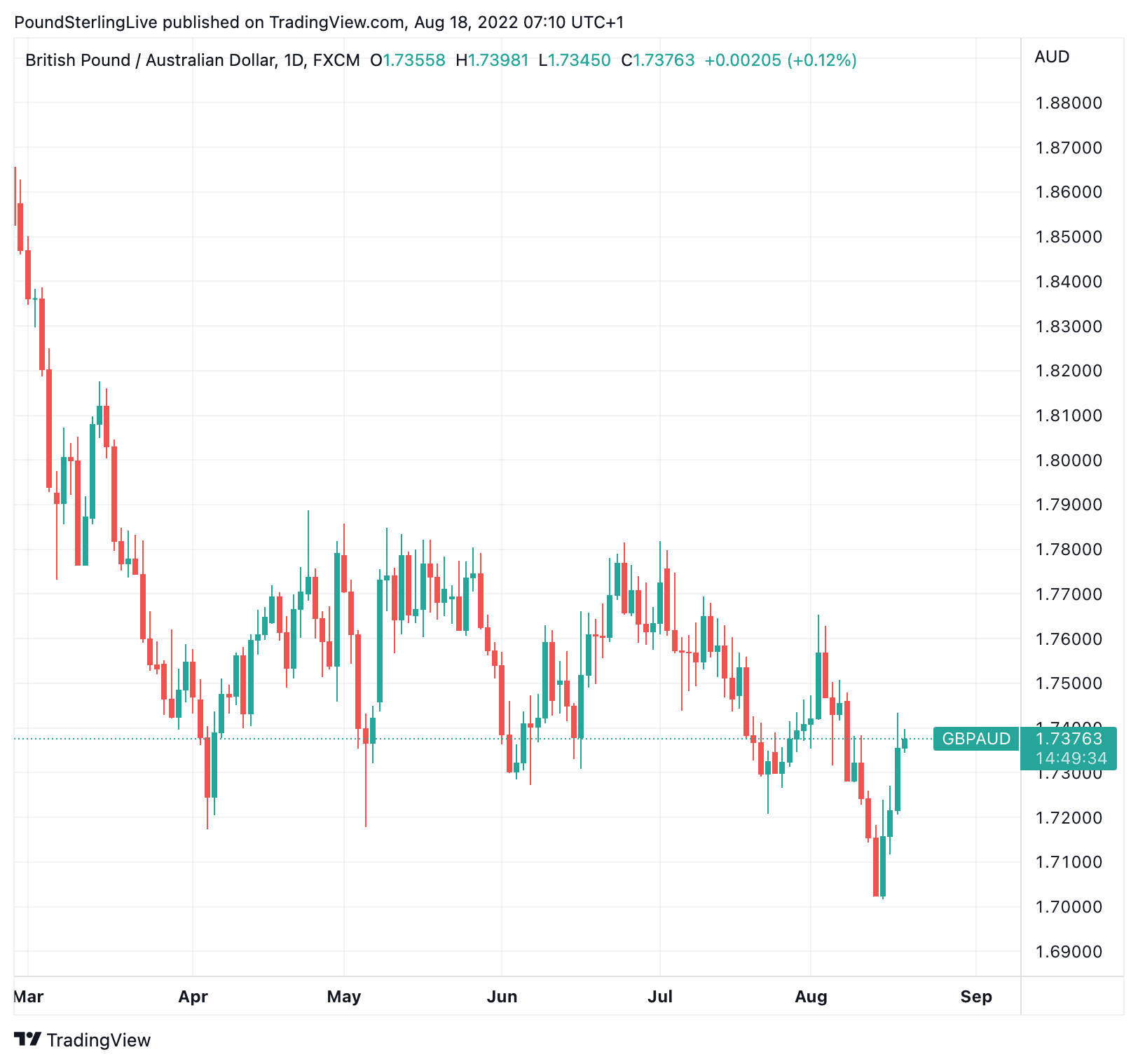

As the below chart shows the exchange rate had attempted to make a break below the recent consolidation zone, suggesting the potential for an extension of the February trend lower:

Above: GBP/AUD at daily intervals. Set your FX rate alert here.

GBP/AUD is now quoted at around 1.6892 on bank accounts for those looking to make international payments, while our data suggests private payment companies are offering around 1.7327.

The ABS also reported the Australian unemployment rate eased to 3.4% due to a sharp fall in the participation rate, which is itself a potentially concerning development that hints at an intensification of labour shortages.

"The downside surprise on employment adds weight to the case for the RBA to slow the pace of rate hikes at the next policy meeting in September. Our Australian economics team will firm up their call for the September meeting in due course," says Kong.

The ABS meanwhile reported a 86.6k decline in full-time employment and 46.0k rise in part-time employment for July.

The weakness in employment was also widespread across the nation with all states except for Western Australia and Tasmania reporting a fall in total employment.

This is the second disappointing domestic data release out of Australia this week, with the currency struggling mid-week following the release of some softer than expected wages data.

Although Australia reported its fastest rise in wages in almost eight years it remains less than half the headline inflation rate, creating a record 'real' wage fall.

The quarterly wage price index rose 0.7% in the second quarter, taking the annual increase to 2.6% year-on-year, the ABS said on Wednesday.

The market was looking for a rise of 2.7% year-on-year and 0.8% quarter-on-quarter.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes