Next Week's RBA Hike Unlikely to Boost Australian Dollar says Westpac

- Written by: Gary Howes

Image © Adobe Stock

The Reserve Bank of Australia dominates the Australian Dollar's near-term outlook with investors expecting a 50 basis point hike to be announced next Tuesday.

The move forms part of the RBA's monetary normalisation strategy that involves raising interest rates to counter growing domestic inflation and a need to ensure it doesn't fall behind the Federal Reserve.

The impact on the Australian Dollar of the hike could however be muted, according to analysts at Aussie lender Westpac.

In a weekly currency briefing Westpac says to expect further Australian Dollar underperformance as the RBA's rate hikes are ultimately unable to counter the strong downward drag of a global equity market selloff.

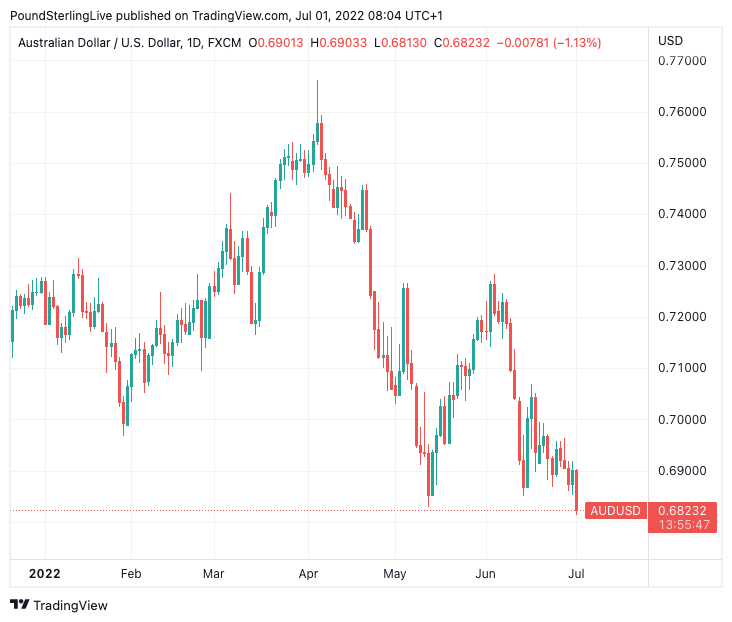

"Given the poor global mood, the 50bp hike we expect from the RBA next week probably won't be enough to prevent the Aussie from slipping to fresh 2-year lows," says Sean Callow, Sydney.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Outright risks to the Aussie Dollar come in the form of a smaller than expected 25 basis point hike, which would disappoint against consensus expectations for a more forceful 50 bp move.

Westpac expects 50bp in both July and August, with market pricing only a little short of this.

"The statement should include a positive view on the economy, unlike legitimate recession talk in the likes of the US and UK," says Callow.

This would be, all else equal, supportive of the Australian Dollar against the U.S. Dollar and Pound.

But, "near term, the poor equity and metals prices mood should see 0.6800 give way but back to 0.72 by September," says Callow.

Above: AUD/USD at daily intervals.

Global markets start July in a risk-off mood as an equity market bear rally continues.

The S&P 500 - often taken as a global benchmark for investor sentiment - fell a staggering 8.39% in June, its largest monthly drop since April's 8.8% fall.

In fact the decline of 2022 is now deeper than the pullback witnessed in early 2020 when Covid fears gripped the world.

The scale of the declines are however understandable given much of the rally of 2020 and 2021 was fuelled by injections of cheap money from the U.S. Federal Reserve and other global central banks.

With central banks tightening policy in light of surging inflation, further losses for equities can continue.

For the Australian Dollar, which is typically considered a pro-cyclical currency, this portends further weakness.

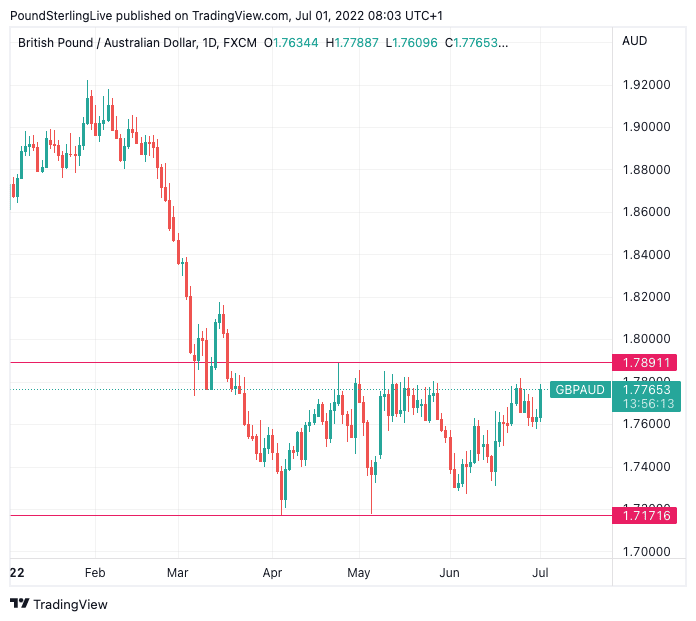

The developments come as the Pound to Australian Dollar exchange rate (GBP/AUD) pushes towards the top of the range it has held since the market's significant repricing following Russia's invasion of Ukraine:

Above: GBP/AUD at daily intervals.

Should the RBA decision and ongoing market decline result in broad based Aussie Dollar weakness the Pound could break higher out of this range and start retracing the post-invasion fall. (Set your FX rate alert here).