Australian Dollar: Slow Vaccine Rollout to Blame for Weakness says Westpac

- Written by: Gary Howes

- Australia highlights risks of slow vaccine rollout

- AUD likely remains capped for sometime yet

- Melbourne lockdown extended

Above: Vaccination centre signage, Australia. Image © Rafael Ben-Ari, Adobe Images

- GBP/AUD reference rates at publication:

- Spot: 1.8885

- Bank transfer rates (indicative guide): 1.8190-1.8322

- Money transfer specialist rates (indicative): 1.8680-1.8718

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Australian Dollar will remain capped for "some time yet", burdened by a slow vaccine rollout says an analyst at one of Australia's largest banks.

Richard Franulovich, Head of FX Strategy at Westpac, says in a research briefing note that few economies underscore the risks of a slow vaccine roll out during the Delta variant spread more concretely than Australia.

"The RBA may be talking about a quick rebound in Australia’s economy just as soon as coronavirus is contained but the Australian Dollar seems to have been punished for Australia’s slow vaccination rollout, a situation that won’t improve quickly," says Franulovich.

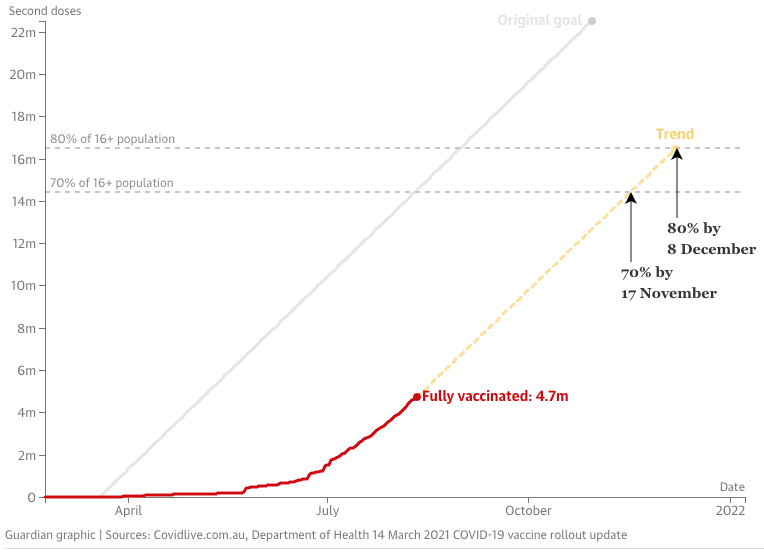

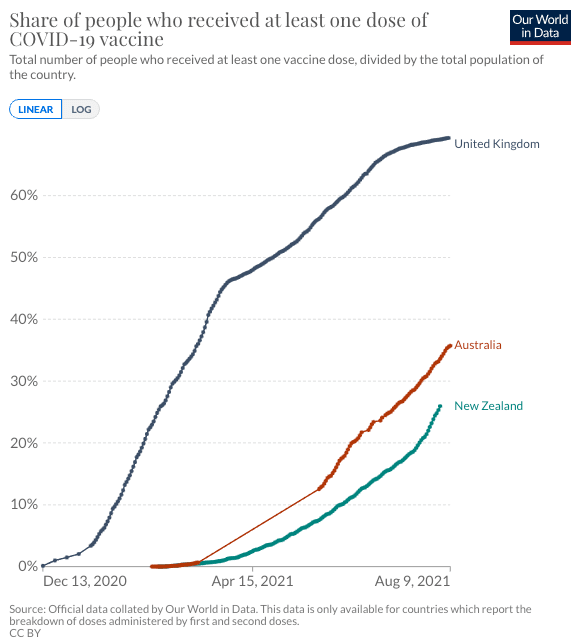

With 36% of the population having received a single dose of a Covid vaccine there remains a significant gap to close before the country can exit a stop-start lockdown policy aimed at eliminating Covid-19 within the community.

Until then, billions of Aussie Dollars will likely be lost to lockdowns, curbing global investor enthusiasm for Australian assets.

It was announced Wednesday that Australia's second-biggest city Melbourne will stay locked down for a second week after reporting 20 new Covid-19 cases, it had been due to exit its 6th lockdown on Thursday.

Above: Vaccination progression in UK, Australia and New Zealand

New South Wales on Wednesday announced it had recorded a further 344 new cases of Covid-19, with authorities saying at least 65 people were infectious in the community.

The New South Wales lockdown is to run until at least the end of August but authorities will want to see cases turn lower over coming days if this is to be achieved by month-end.

The Australian Dollar has meanwhile been one of the under-performers in the G10 currency space, having fallen against the majority of its peers over the course of the past month with analysts citing a slowdown in Chinese economic growth and the domestic Covid situation.

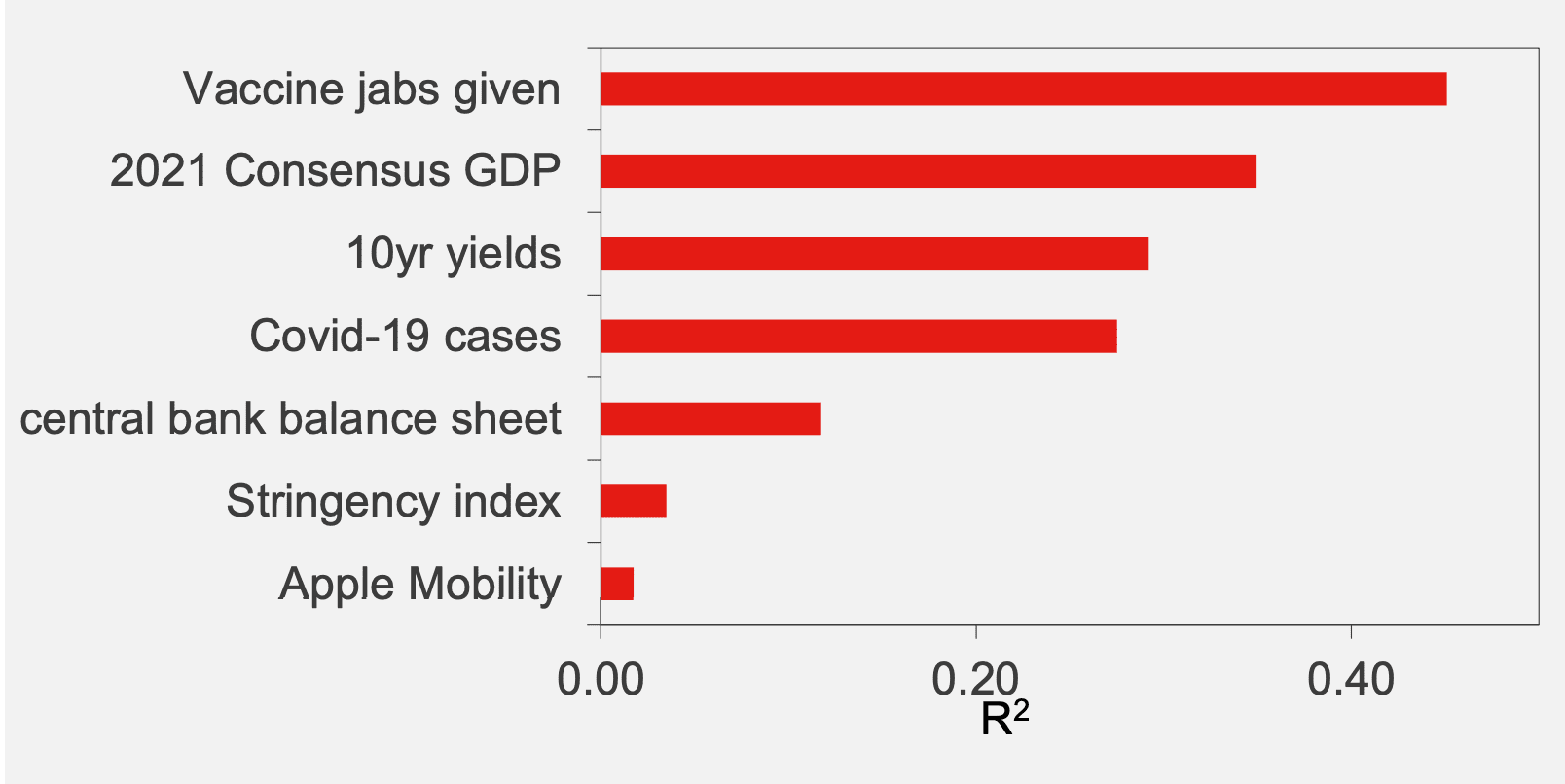

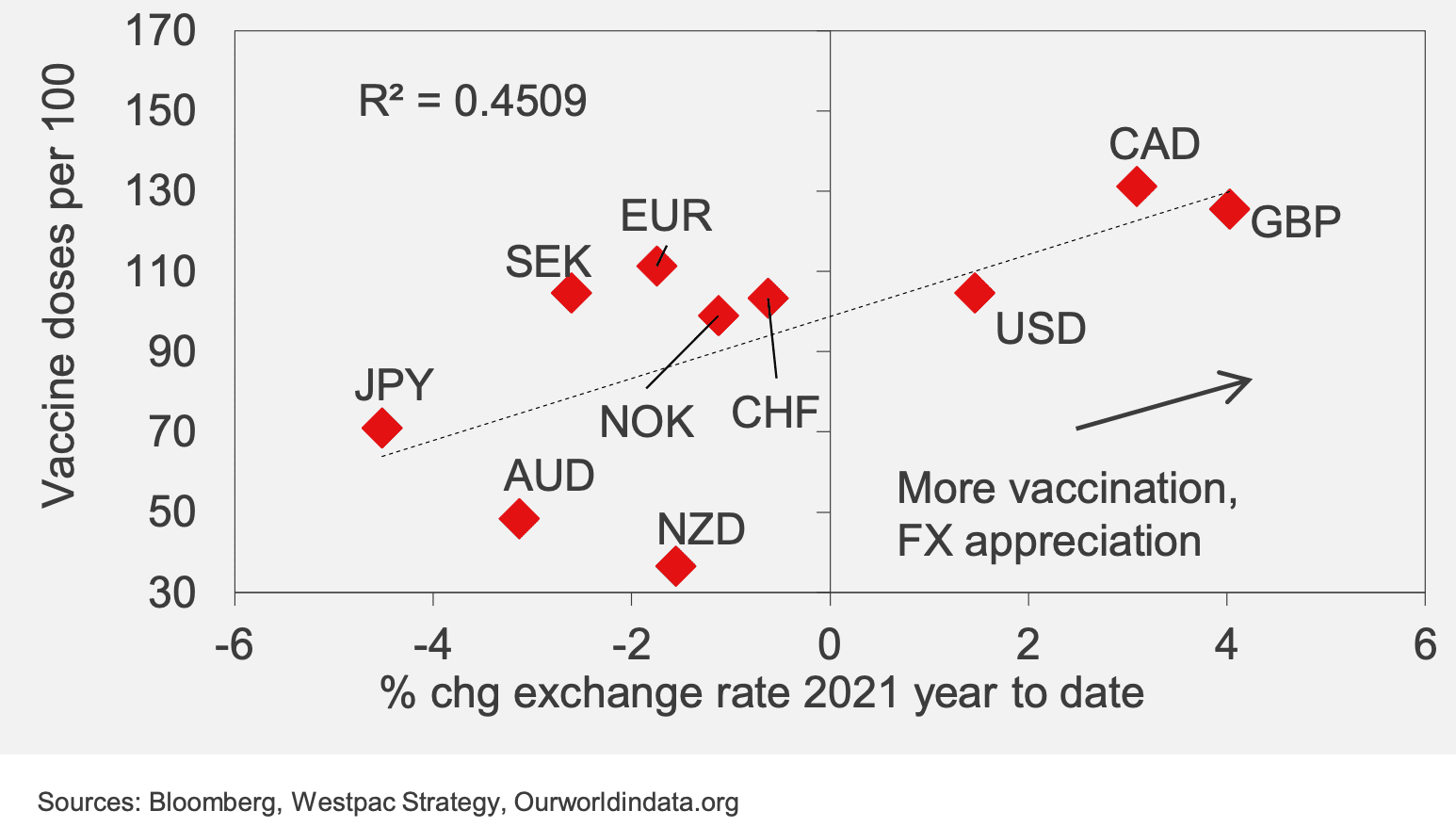

Westpac's analysis of vaccination rates relative to currency performance suggests the better performing currencies over recent months are those associated with advanced vaccine rollouts.

"As a general rule, currencies have generally appreciated for those economies where yields and growth expectations have risen the most, where vaccination rates have been higher and where central banks have dialled back balance sheet support, and vice versa. That is not entirely surprising. Vaccination rates, growth outlooks, yields and central bank policy trends have after all been feeding off each other all year.

Above: What matters for currencies? Westpac's G10 FX vs key Covid, policy and rebound metrics. Image courtesy of Westpac.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Few economies underscore the risks of a slow vaccine roll out during the Delta variant spread more concretely than Australia. There’s hope that a more

aggressive vaccine rollout in coming months will break the stop-go cycle for the economy, but until then AUD likely remains capped for sometime yet," says Franulovich.

Westpac's research finds vaccination rates have been the single most reliable metric for G10 currency performance so far this year.

"Vaccination profiles say more about the sustainability of future rebound potential and the scope for policy support withdrawal than any other factor in our sample, so it stands to good reason that vaccination trends have been a better gauge for currencies," explains Franulovich.

Above: Vaccination and currencies. Image courtesy of Westpac.

"GBP, USD and CAD outperformance this year lines up almost perfectly with their stronger vaccine rollouts, while at the other end of the spectrum, AUD and JPY underperformance matches their glacial vaccine rollout profile," says Franulovich.

Australia's National Cabinet remains committed to targeting "near-zero community infections", but to finally end the pattern of lockdowns they believe full vaccination status should reach approximately 70% of adults (or 56% of the total population).

"However, while vaccinations have lifted sharply recently (to ~200k /day), due to supply constraints, the ‘magic number’ for re-opening still can’t be reached before Oct-21," says George Tharenou, Economist at UBS.

Image courtesy of The Guardian

UBS estimate Australia's third quarter national GDP to slump by around 2.5% Quarter-on-Quarter, assuming Sydney is in lockdown for all of the third quarter and some snap lockdowns occur elsewhere. They estimate the economic cost of NSW’s lockdown is in excess of A$1BN+ a week, with a cumulative national GDP hit totalling around A$25BN.

UBS see material risk the RBA’s economic forecasts set in July are disappointed, and at their September meeting, if lockdowns are extended, there is a risk they delay tapering.

In addition to the downside risks posed by the domestic Covid-19 outbreak, the Australian Dollar is said to be one of the most vulnerable of the world's major currencies to a Covid-driven slowdown in Chinese economic growth.

A slowdown in China's economic expansion is amongst a number of concerns pinging on investors' radars as we move through the third quarter, given authorities have started imposing fresh restrictions on movement in a number of economically significant regions owing to the spread of the Delta variant.

"There’s no doubt that Australia and New Zealand will be the G10 countries most hurt if China's growth does slow. Those two are extremely dependent on China for their export markets," says Marshall Gittler, Head of Investment Research at BDSwiss Holding Ltd.

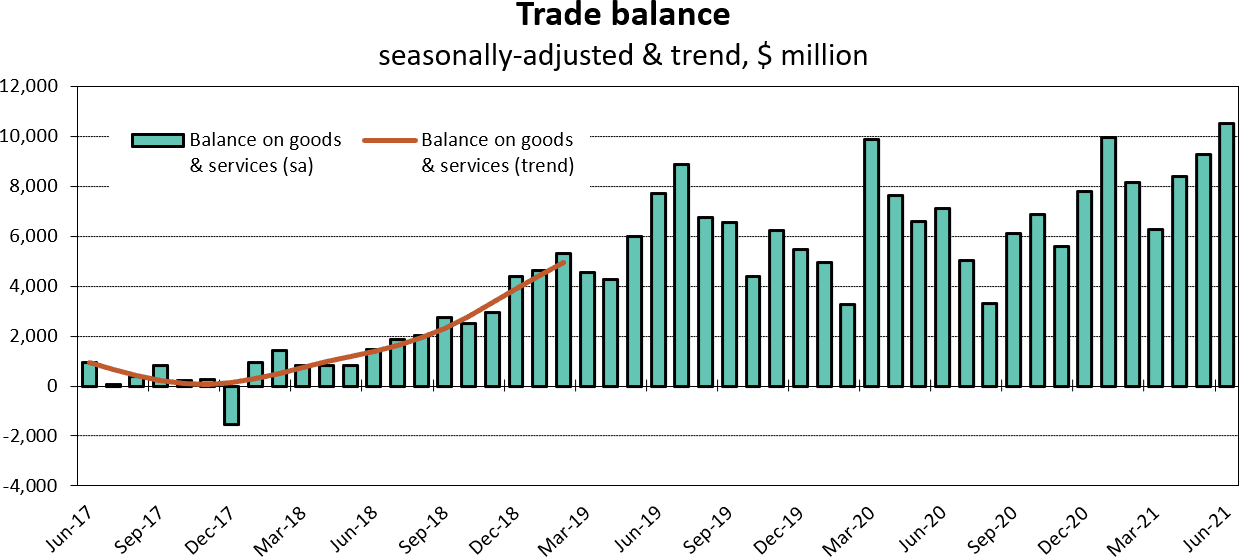

Australia reported a record trade surplus with China in June, driven by higher iron ore export receipts, confirming the centrality of China's economy to Australia's foreign exchange earnings.

China accounted for 39% of Australia's total exports of A$42.23bn ($32.77bn) according to May's official trade data, well above Australia's second-largest trading partner Japan that accounted for almost 10%.

Although Covid-19 is proving a substantial headwind to Australia's trade dynamics, and Australian Dollar appreciation, an all-out routing of the currency is nevertheless unlikely shows Westpac's research.

Westpac don't expect the slowdown in China caused by the Delta outbreak to be serious enough to dent demand for Australia's exports of raw materials.

Australia’s run of positive trade surpluses now stands at 42 months, with June seeing a record high at A$10MN.

This strong fundamental position owes itself to the export strength - primarily in raw commodities - that has persisted through the U.S.-China trade war and the Covid pandemic.

Sean Callow, Senior Currency Strategist at Westpac in Sydney, says the impact of the trade surplus should become more potent for the Australian Dollar in late August and September as mining company dividend conversion comes into closer focus.

"Before then, however, it is hard to be enthusiastic about the Australian Dollar," says Callow. "The glimmer of hope on Covid containment is more a Q4 than Q3 prospect," says Callow.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}